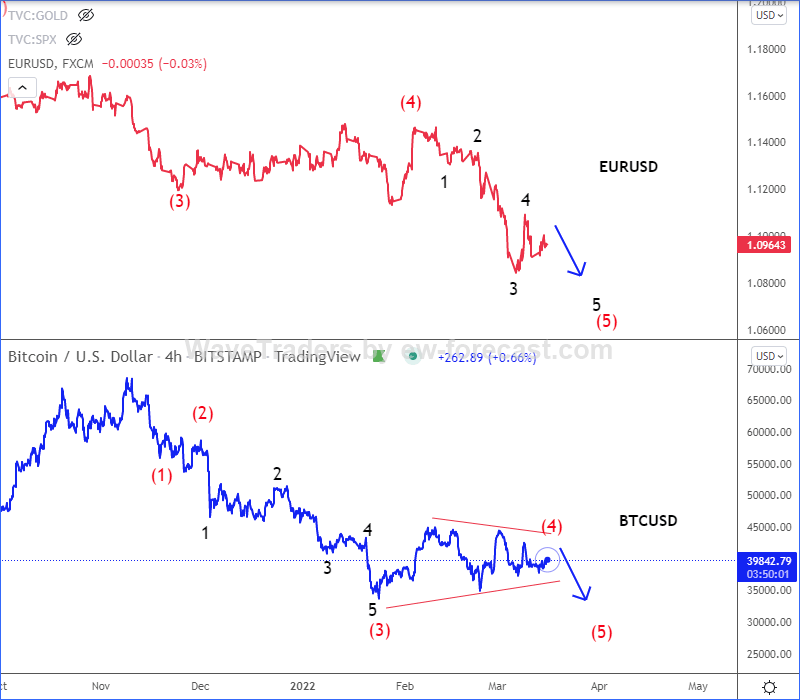

Bitcoin may retest lows following EUR/USD: Elliott Wave analysis

We have seen some intraday spike up in the Crypto market. There was no obvious catalyst for the move that’s native to the cryptocurrency industry, but the Asian stock markets began trading at around the same time. In any case, the massive volatility took its toll on the derivatives markets and the liquidations for the past 24 hours surpassed $200 million according to data from CoinGlass. Anyway, such intraday spikes we just see as a fake rise, so looking at the intraday chart, it still looks like a correction within a downtrend, so watch out for a bearish resumption ahead of the important FED meeting today.

EURUSD and BTCUSD are nicely connected and in positive correlation since November 2021. If we consider that EURUSD has room for more weakness within an extended wave (5) to complete wave 5 of (5), then BTCUSD could be easily headed lower out of potential bearish wave (4) triangle pattern into wave (5) towards June 2021 lows. All eyes on FED meeting later today.

EUR/USD vs BTC/USD Elliott Wave analysis

Check more of our analysis for currencies and cryptos in members-only area. Visit Wavetraders for details!

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.