Bitcoin (BTC $43,149) struggled to hold above $43,000 into Dec. 8 as an altcoin surge put Ether (ETH $2,349) in the spotlight.

BTC/USD 1-hour chart. Source: TradingView

ETH, SOL step up as Bitcoin takes liquidity

Data from Cointelegraph Markets Pro and TradingView showed ongoing BTC price consolidation as ETH/USD added up to 7.6% in around 24 hours.

Bitcoin, having tapped new 19-month highs of $44,490 earlier in the week, now troubled market participants as both ETH and Solana (SOL $71) stole attention.

$BTC Binance Spot

— Skew Δ (@52kskew) December 8, 2023

Bids sold into and filled it seems

Decent OI wipe here (Binance / Bybit Open Interest & Delta) https://t.co/DkWuLfD5gx pic.twitter.com/0CfnxCzL41

Eyeing Bitcoin’s share of the overall crypto market cap, popular analyst Matthew Hyland described recent progress as a potential “false breakout.”

Dominance hit 55.26% on Dec. 6, in line with the BTC price highs — the highest reading since April 2021.

“It would need to close above support to avoid; currently below,” Hyland wrote in part of commentary on X (formerly Twitter), referring to the key 54.35% mark.

At the time of writing, dominance stood below this at around 53.9%.

Bitcoin crypto market cap dominance 1-week chart. Source: TradingView

Some major altcoins took advantage of the situation, with ETH/USD hitting $2,392 before seeing a modest correction of its own on the day.

ETH/USD 1-week chart. Source: TradingView

SOL/USD hit $72.88 on Bitstamp, its highest since May 2022, as investors increased bullish bets on three figures entering the future.

SOL/USD 1-week chart. Source: TradingView

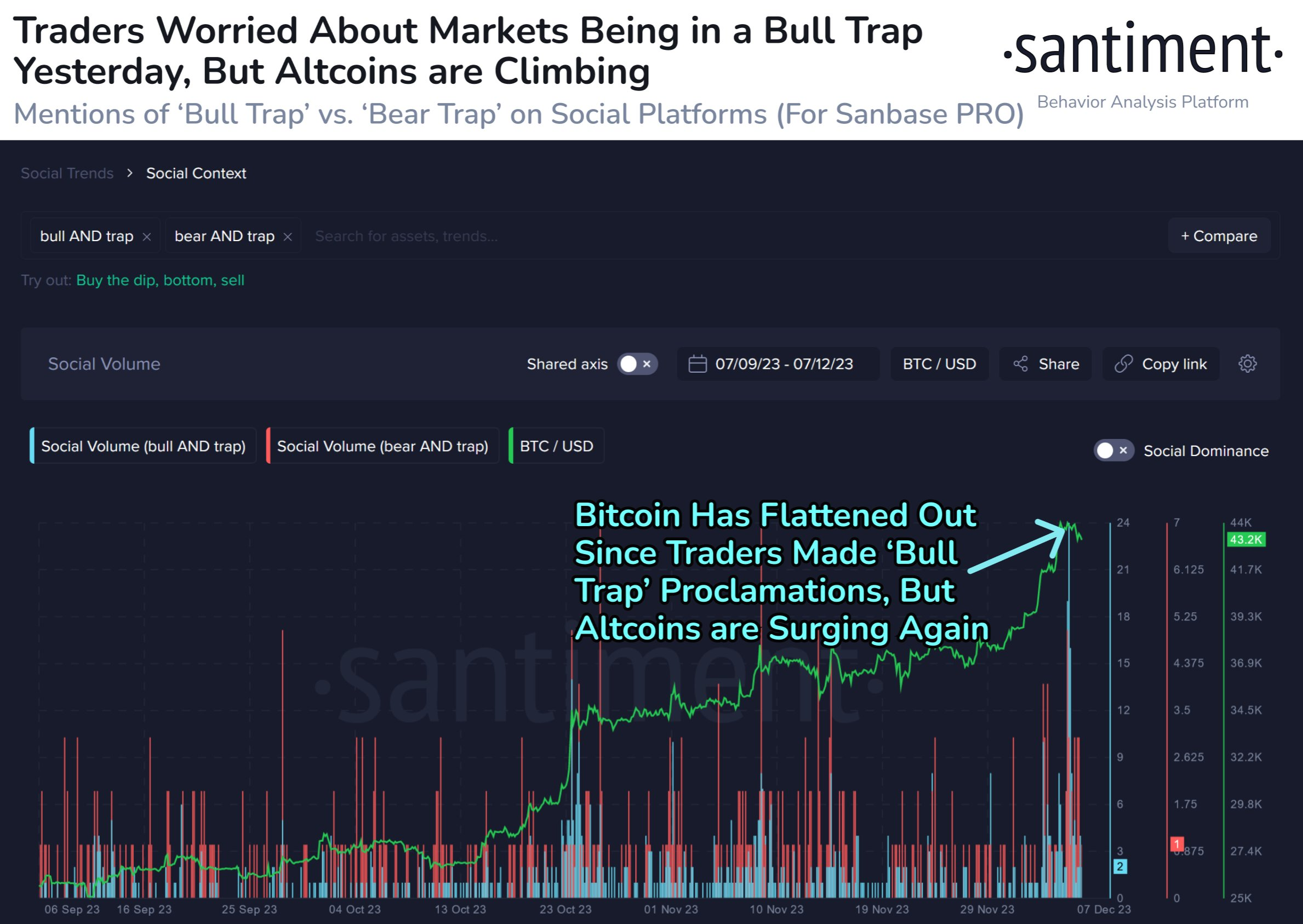

Commenting on the current status quo, research firm Santiment argued that fear, uncertainty and doubt, or FUD, surrounding an altcoin breakout could ultimately help Bitcoin.

“Traders are fearful that #crypto markets may be in a bull trap at the moment,” it reasoned on Dec. 7.

But while Bitcoin may have stopped its momentum for the time being, Ethereum and altcoins are blasting off once again. FUD could propel $BTC to $50K if it increases.

Crypto social media volume data. Source: Santiment/X

An accompanying chart showed data that covered social media activity for the phrases “bull trap” and “bear trap,” referring to current crypto price action.

Keeping the faith on more upside

Elsewhere, Bitcoin market participants saw encouraging signs in the current BTC price comedown.

Popular trader Credible Crypto, known for his optimistic perspective on Bitcoin in the current environment, argued that accumulation was ongoing before the “next leg up” for the largest cryptocurrency.

Those bids got filled, then we had another set of bids pop up after the initial bounce which also got filled (second green box) and now we have a third set of bids that just appeared below price.

— CrediBULL Crypto (@CredibleCrypto) December 8, 2023

Someone is clearly accumulating $BTC on this dip in anticipation of the next leg… https://t.co/jqc2ETyiTX pic.twitter.com/qnuo1ZRRgH

As Cointelegraph reported, however, some believe that a much larger correction is due, this having the potential to return the market to $30,000 or even closer to $20,000 before new all-time highs hit.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.