- Bitcoin consolidates the sell-off from near $ 12450 region.

- Massive resistance levels are stacked up around the 12k mark.

The weekend love for the dominant cryptocurrency, Bitcoin, appears to remain unabated, despite a brief aberration seen earlier today. However, traders witness a tug of war between the bulls and bears over the last hours, leaving the prices consolidating in a tight range between 11850- 11375 levels.

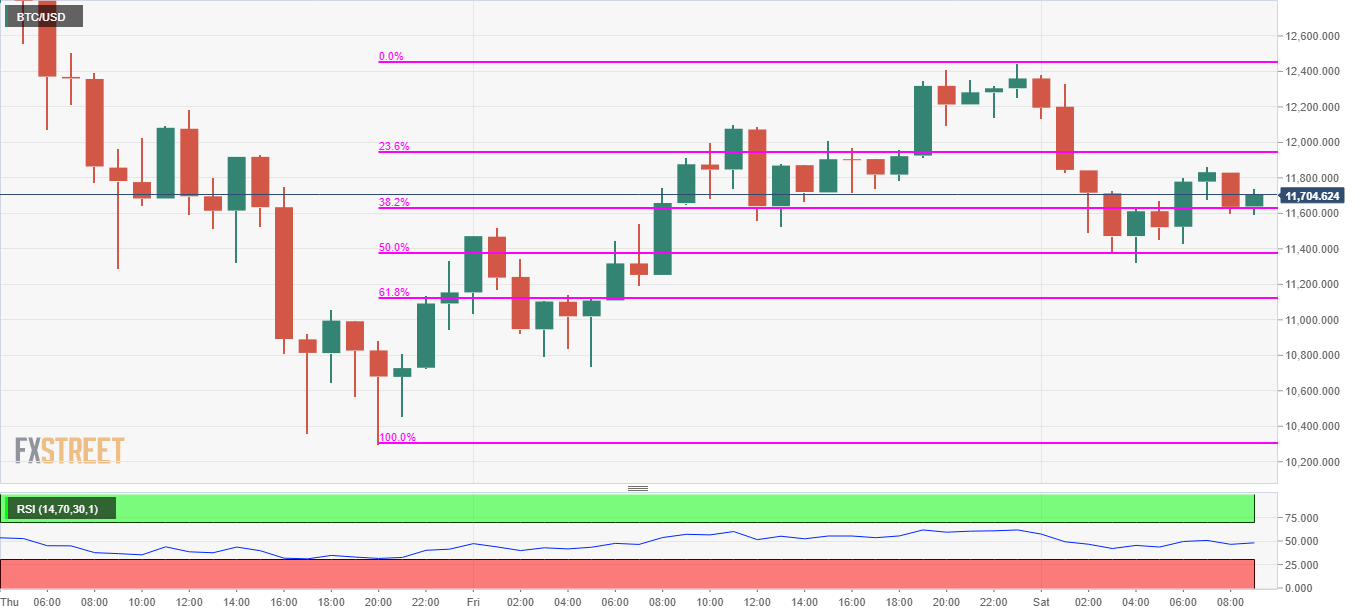

The bulls are seen trying hard to take on the recovery, but a bunch of stiff resistance is lined up around the 12000 levels. That area coincides with the 23.6% Fibonacci retracement (Fib) of Friday’s corrective upside on the hourly chart.

According to Tanya Abrosimova, Cryptocurrencies News Editor at FXStreet, “the recovery above $12,000 is regarded as a pre-condition needed to resume the movement within the long-term upside trend. As long as the price stays below the said barrier, we are in for range-bound trading. However, once it is cleared, the upside is likely to gain traction with the next focus on $12,600. This resistance is created by the upper boundary o 1-day Bollinger Band. The next critical barrier awaits us on approach to $13,000 followed by the recent high of $13,700.”

On the flip side, a break below the 50% Fib level near 11,375 is needed for the bears to regain complete control, opening floors for a retest of the 10,300 level. However, the prices appear to take a breather after a volatile week, with the Relative Strength Index holding steady just shy of the 50 mark.

To conclude, Bitcoin appears to wait for fresh catalyst for the next direction while the bulls continue to struggle below the 12,000 mark.

BTC/USD 1-hour chart

Levels to watch

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: ADA, AVAX, TON in profit as BTC stalls at $100K

Altcoin market updates: ADA, AVAX, TON emerge as top gainers While BTC has stagnated on Monday, traders are redirecting capital toward mid-cap assets, driving the likes of Cardano (ADA), Avalanche (AVAX) and Toncoin (TON) above key resistance levels.

Ripple's XRP aims for $1.96 as WisdomTree registers for an XRP ETF in the US

Toncoin Price Forecast: Crypto whales spotted buying $30M TON in 4 days, amid Gensler’s exit

Toncoin price opened trading at $6.2 on Monday, up 27% since Gary Gensler's exit confirmation on November 21. On-chain data trends suggest a $7 breakout could follow as whale investors have scaled up demand for TON considerably over the last 5 days.

MicroStrategy set to push Bitcoin to new highs after 55,500 BTC acquisition, should investors be concerned?

MicroStrategy revealed on Monday that it made another heavy Bitcoin purchase, acquiring 55,500 BTC for $5.4 billion at an average rate of $97,862 per coin.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.