- Bitcoin price dipped further to the downside this week, another 15%,

- BTC price needs to provide a bullish weekly candle to set further upside.

- Upside potential could be limited by only 11% of gains as the downtrend is still in place.

Bitcoin (BTC) price was just inches away from slipping further away below as investors mulled over several economic, central bank and geopolitical issues. With that, BTC price dipped towards $32,650 and was just inches away from sliding in a perfect fade-in zone where bulls would be able to scope up large chunks of Bitcoin at historical discounts. But going into the close on Friday, the Nasdaq rallied sharply, and with that, Bitcoin price looks to be set for next week to at least test the downtrend barrier.

Bitcoin bulls could get optimistic, but the positive sentiment is thin

Bitcoin price was gaining much media attention at the beginning of this week as global markets were on the back foot. In general, cryptocurrencies were on the chopping block in a significant portfolio reshuffle. Price action in BTC dipped towards $32,650 and saw bulls turning the tide as Bitcoin price traded further into the trading week. Investors could shrug off the negative sentiment, and Bitcoin profited from that turn to erase some occurred losses.

BTC price will attempt to close above $38,073 going into Sunday evening, setting the stage for a return towards $40,000 and somewhere next week, $40,750 could be reached. With that, the red descending trend line from November will come into play and will need all stars aligned for bulls to break it. If market sentiment and bulls lack firm conviction, a failed test could offer a perfect bull trap and entry for bears to push price-action back to $32,650.

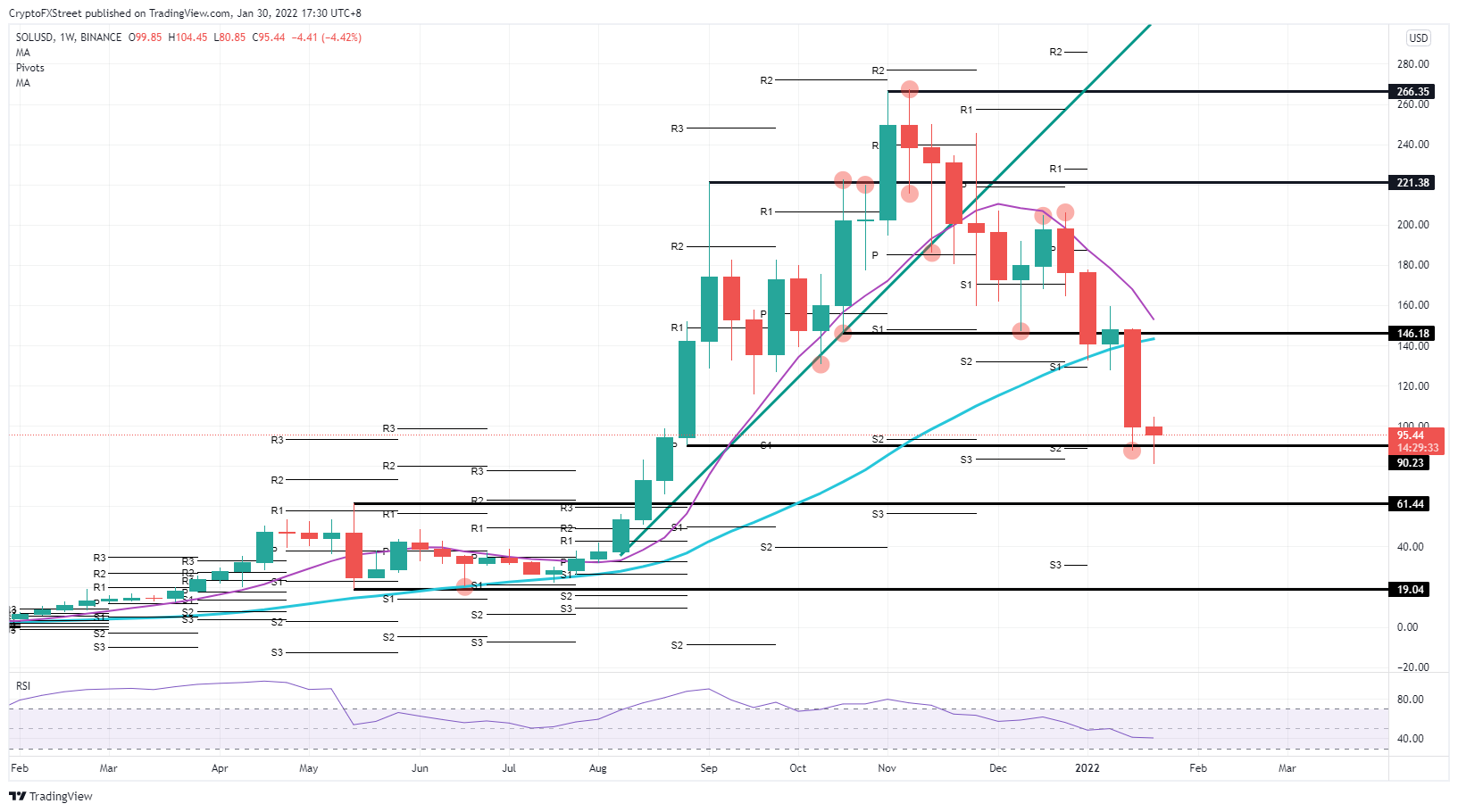

BTC/USD weekly chart

Global market data could keep investors mulling once again as the risk is arising that the global economy is set for rather stagflation than a reflation trade, where inflation will drag on growth and investors will look for safe havens and defensive stocks. That would spell negative news for Bitcoin as cryptocurrencies are more on the risk-end of the spectrum. With bulls pulling their funds, expect a return to $32,650 and danger of slipping further in the danger zone towards $32,050, trading in that fade-in zone as the last line of defense and window of entry for bulls, as bears will otherwise attempt to breach $30,000.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs.

Binance Coin price nears $600 breakout as CZ reacts to BNB listing on Kraken

Binance Coin price posted considerable gains on Thursday, fuelled by investor optimism tied to its upcoming listing on the U.S.-based crypto exchange Kraken.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Slovenia moves to impose 25% tax on crypto traders

Slovenia has become the latest European Union member state to crack down on untaxed crypto gains, unveiling a proposal to impose a 25% tax on personal profits from digital asset disposals starting in 2026.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.