Bitcoin, major cryptos slide as markets digest hawkish Powell remarks

Bitcoin dipped under $30,000 in European hours on Wednesday, amid a retreat across traditional markets, as traders and analysts assessed the potential economic ramifications of U.S. Federal Reserve Chair Jerome Powell's pledge Tuesday to keep tightening pressure on financial conditions until inflation shows signs of weakening.

Bitcoin's slide over the past few days is setting it up to extend a seven-week losing streak, already the longest in a trading history that dates back to the early 2010s. The cryptocurrency has suffered from a downturn in broader markets, stricter crypto regulations, waning retail interest and systemic risks in the crypto sector.

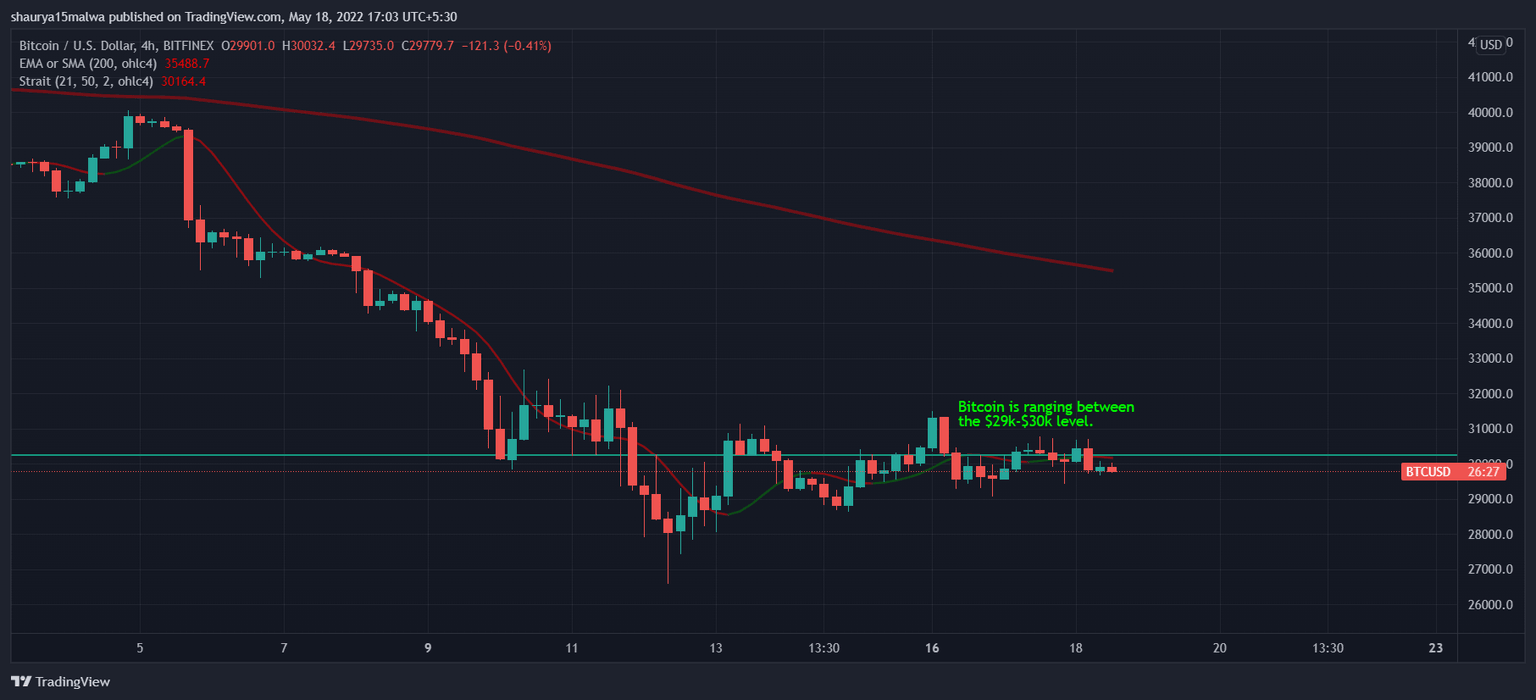

Bitcoin edged below $30,000 this morning as traders accessed Powell's hawkish comments yesterday. (TradingView)

Major cryptocurrencies followed bitcoin’s slide in the past 24 hours. Polkadot’s DOT lost as much as 6%, while avalanche (AVAX), bnb tokens (BNB), XRP, and ether lost 2.2%. Tron (TRX) was among the few in the green buoyed by positive sentiment around its ecosystem stablecoin USDD.

Powell said Tuesday that the agency remained committed to reducing inflation concerns and could use “aggressive” measures to ensure a strong economy.

"What we need to see is inflation coming down in a clear and convincing way and we're going to keep pushing until we see that," Powell said at a Wall Street Journal event. "Achieving price stability, restoring price stability, is an unconditional need. Something we have to do because really the economy doesn't work for workers or for businesses or for anybody without price stability.”

“It's the bedrock of the economy really,” Powell added. The Fed has previously vowed to keep inflation in check as it tightens balance sheets following nearly two years of unprecedented stimulus to help an ailing amid the-then ill-effects of the coronavirus pandemic.

Powell acknowledged controlling inflation might cause slower economic growth or higher unemployment, but added price hikes would be done in a manner that would prevent a recession.

However, if inflation still failed to go down, Powell said rates would be hiked until it does.

"We will go until we feel we are at a place where we can say, 'Yes, financial conditions are at an appropriate place, we see inflation coming down,” Powell said.

Why do higher rates affect markets?

Higher rates tend to negatively affect company earnings who borrow money to run their businesses. With rates on consumer loans such as mortgages also on the rise, households are additionally left with lower disposable incomes, which in turn causes a ripple effect in the broader economy.

Businesses are hence affected by both a higher cost to borrow money and lower consumer spending.

While such scenarios take months to play out, traders price in changes anticipating lower earnings, which leads to a drop in equity valuations. On Wednesday, for example, U.S. futures on S&P 500 dropped 0.4% while technology-heavy Nasdaq dropped 0.6%. European markets showed nominal movement as Germany’s DAX rose less than 0.1% while Stoxx 600 slid 0.1%.

Bitcoin has traded similar to a risky technology stock in the past months, with correlations reaching almost 1:1 with the S&P 500. Some market observers suggest a further correction could take place if current market conditions continue.

“Markets have been expecting the hikes for some time now and it looks like the expectations are already on the charts,” said Anton Gulin, regional director at crypto exchange AAX, in a Telegram message.“The movement of bitcoin and Nasdaq is rather correlated as well for a couple of months."

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.