Bitcoin longterm holders increase holdings as buyers who accumulated during bear market remain in profit

- Reflexivity Research data shows percentage of Bitcoin supply held by long-term holders is pushing to highest levels since late 2015.

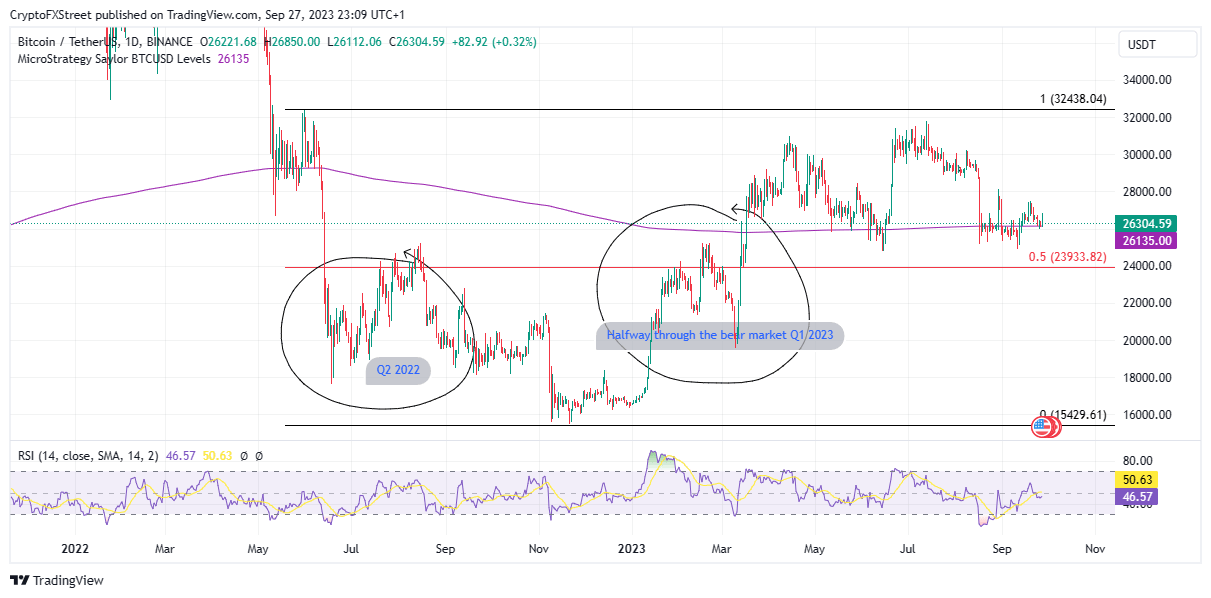

- Meanwhile, traders that bought Bitcoin during Q2 of 2022 and Q1 of 2023 are still up on their buys.

- MicroStrategy Saylor tracker supports the thesis, showing the profit potential of long-term holding.

Bitcoin (BTC) price has recorded reduced volatility over the last few weeks, an action that has been attributed to the absence of a catalyst to drive some impulse in the market. Meanwhile, the market onlookers’ eyes remain peeled to the US Securities and Exchange Commission (SEC) with hopes of approval in the longstanding Bitcoin Spot Exchange-Traded Fund (ETF) applications.

Also Read: Members of US FSC urge SEC Chair Gensler to immediately approve spot Bitcoin ETFs

Bitcoin long-term holders still accumulating

Bitcoin (BTC) long-term holders are still growing their portfolios, according to data from Reflexivity Research, an industry-leading digital asset investigator. Using data by Glassnode, the researcher shows that the percentage of Bitcoin supply held by long-term holders is pushing to its highest level since late 2015.

BTC long-term holders

In a recent report, MicroStrategy revealed that it acquired 5,445 additional BTC tokens between August 1 and September 24 at an aggregate value of $147.3 million.

MicroStrategy has acquired an additional 5,445 BTC for ~$147.3 million at an average price of $27,053 per #bitcoin. As of 9/24/23 @MicroStrategy hodls 158,245 $BTC acquired for ~$4.68 billion at an average price of $29,582 per bitcoin. $MSTR https://t.co/GbJtUoQfXv

— Michael Saylor⚡️ (@saylor) September 25, 2023

Meanwhile, Bitcoin profitable days indicate that in the end, holding has proven to be the working strategy, considering investors who acquired BTC during the second half (Q2) of 2022 and during the first half (Q1) of 2023 are still sitting on unrealized profit because Bitcoin price continues to hold above the equilibrium level of $23,933.

BTC/USDT 1-day chart

The $23,933 equilibrium level aligns with the 50% Fibonacci Retracement level using a market range measured from the range low of $15,429 to the range high of $32,438. Notably, the bear market began around May 2022 provoked by the collapse of the Terra Luna ecosystem, with its effects still tormenting the market to this day.

The equilibrium level at $23,933 marks the break-even price. As such, Bitcoin price holding above it at the current value of $26,304 shows that buyers who accumulated halfway through the bear market remain in profit. If we consider them long-term buyers, then they remain above their entry prices.

The MicroStrategy Saylor BTCUSD index supports this outlook with a purple band, showing the price levels of MicroStrategy's Bitcoin acquisitions based on their 8-K filings, total accumulated BTC, average USD price, and current gain. Based on these metrics, MicroStrategy’s entry’ points remain below the current Bitcoin price of $26,304, at $26,135.

Also Read: Bitcoin profitable days shows that in the long run holding is usually a solid strategy

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.