Bitcoin: Longs need stops below 60000

Bitcoin new all time high at 67000 followed by a lower close is not the bullish signal we would expect!!! IN THEORY WE NOW HAVE A DOUBLE TOP SELL SIGNAL AS WE FAIL TO HOLD ABOVE THE PREVIOUS ALL TIME HIGH.

Ripple we wrote: longs first support at 10750/700 working on the bounce to 11400 & 11600 but we are struggling.

We certainly did struggle as prices reversed row support at 10700/750.

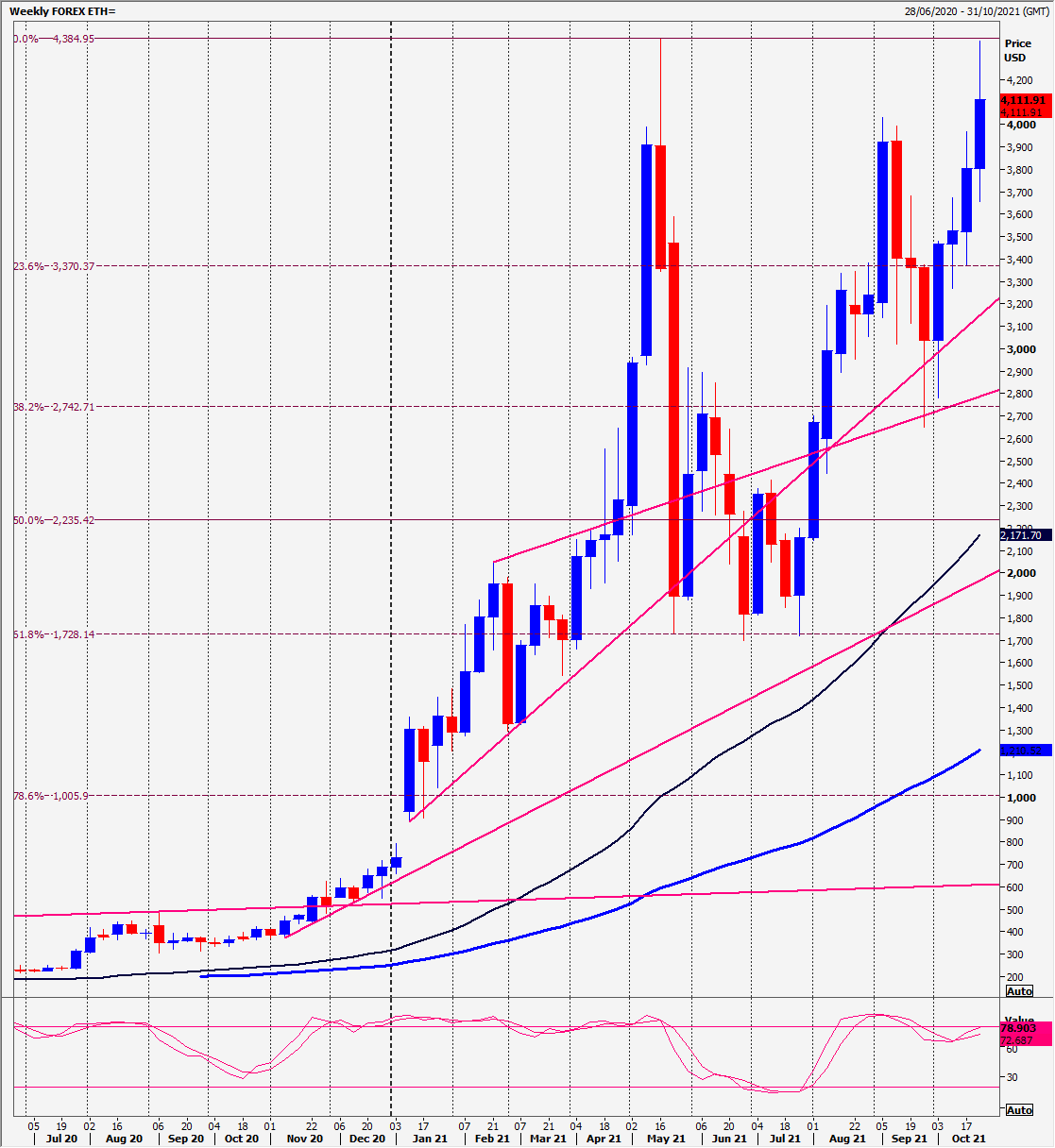

Ethereum made a high for the day exactly at the all time high at 4355/85. The resistance was clearly rejected with prices unchanged on the day as we collapsed to 4010. THIS LEAVES IMPORTANT DOUBLE TOP RISK IF WE DO NOT CLOSE THE WEEK ABOVE 4400.

Daily analysis

Bitcoin reaches 67000 for a new all time high but the euphoria did not last as we test first support at 63100/63000 as expected but over ran to 62000. Bulls must do better at second support at 60700/500. Longs need stops below 60000. A break below here targets 58000. This is the last line of defence for bulls. A break below here over the weekend is a longer term sell signal.

Ripple longs at first support at 10700/750 re-target 11000, 11400 & 11600. Expect strong resistance at 12020/12100. A break higher can target 11300/11400.

First support at 10700/750. Most important support of the week at 10250/10200. Holding here keeps bulls in control. A break below here is an important sell signal initially targeting less important 9700/9600. On a break below I would expected significant losses. Initially we should target 8600. This may hold on the first test & we could even see a decent bounce. However I would be a seller at resistance on this bounce, expecting the support to break eventually for another significant sell signal.

Ethereum we have a double top sell signal. Buying at support is now more risky but here are the levels if you want to try scalping a bounce. First support at 4000/3980. A break lower targets 3880 then then better support at 3770/30. A decent bounce from here is expected, perhaps as far as 3950. Longs need stops below 3670. A break lower is a sell signal targeting 3570/50 the strong support at 3380/40. Longs need stops below 3300.

Bulls must see a weekly close above the all time high at 4355/85 to eliminate the double top sell signal risk now.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk