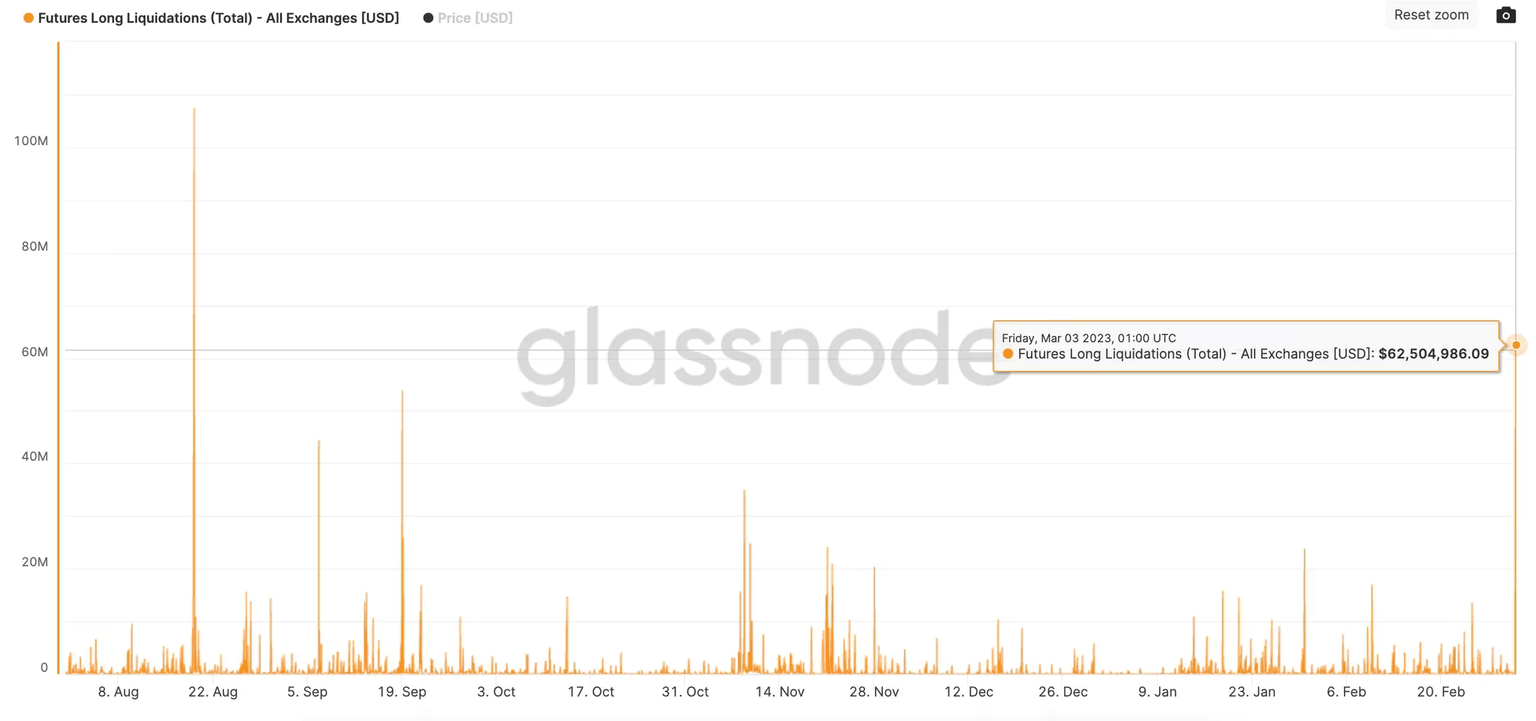

Bitcoin long liquidations hit highest level since August

Bitcoin's (BTC) early Friday slide, triggered by concerns about crypto-friendly bank Silvergate (SI), shook out bullish leverage from the futures market.

Exchanges liquidated longs or bullish bitcoin futures worth over $62 million during the Asian hours, the highest amount since August, according to data from Glassnode. Short liquidations worth just over $500,000 were also observed.

Liquidation happens when the market moves against a trader's bullish/bearish bet, leaving them with insufficient funds to keep the leveraged trade open.

The dominance of long liquidations shows the leverage was skewed on the bullish side, meaning most traders were positioned for a price rally.

Bitcoin, the leading cryptocurrency by market value, fell over 5% to $22,000, reaching the lowest since Feb. 14, CoinDesk data show.

Shares in Silvergate fell 50% on Thursday after the crypto-friendly lender said it's evaluating "its ability to continue as a going concern" and delayed filing its annual report with the Securities and Exchange Commission.

Bitcoin's late reaction to Silverage news perhaps stemmed from fears that the crisis at the bank known to facilitate fund transfers between exchanges and other market participants may worsen the liquidity crunch in the crypto market.

Most exchanges on Thursday announced a suspension of business tied with Silvergate.

Bitcoin's long liquidations surge as prices slide. (Glassnode)

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.