Bitcoin likely to remain in red through the next quarter if history is any indication

- Bitcoin price ended its four-month positive return streak as May noted a negative return of 6.92%.

- Historical monthly return suggests that BTC is likely to remain in the red for the next quarter as well.

- Based on this data, investors can expect the bull run to restart in October 2023.

- With worsening macroeconomic conditions, this bearish outlook might just manifest.

Bitcoin (BTC) price produced a monthly close at $27,210, noting a -6.92% return for May. The last-minute slide in BTC put an end to the four-month bullish streak that kickstarted the 2023 rally.

Also Read: Bitcoin Weekly Forecast: BTC delays inevitable crash to $25,000

Bitcoin price and historical returns

Bitcoin (BTC) price faced intense selling pressure in May, which caused it to drop 8.75% from its local top of $29,820. As a result, the month returned a negative 6.92%, ending the four-month positive streak for BTC.

As hopes of a bull run diminish, more investors could join the selling spree, triggering a sell-off. Or, Bitcoin price could consolidate, making it boring for day traders and investors. Historical data is key when measured over a large enough timeframe and reflects investors’ sentiments, which often tend to be cyclical.

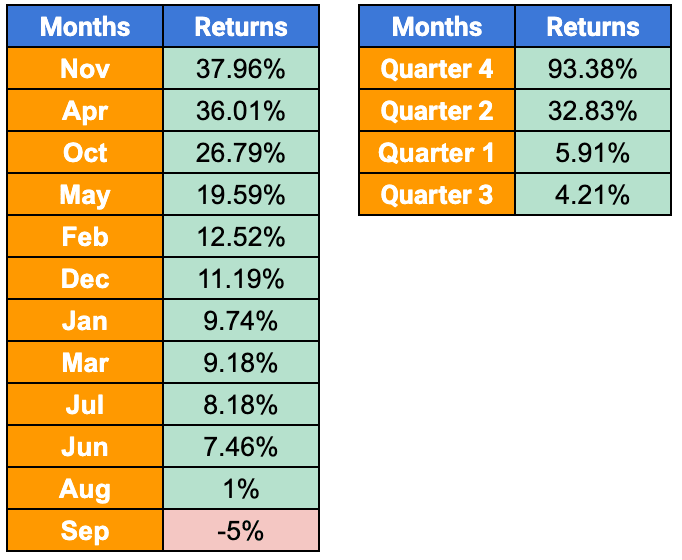

Over the last 14 years, the highest average return for Bitcoin price is roughly 38% in November. Following this is 36% in April and 26% in October. Likewise, quarters one and four display the best returns for Bitcoin price. A simple conclusion from this would be that the first and third quarters are typically the best time to invest in cryptocurrencies.

BTC average monthly and quarterly returns

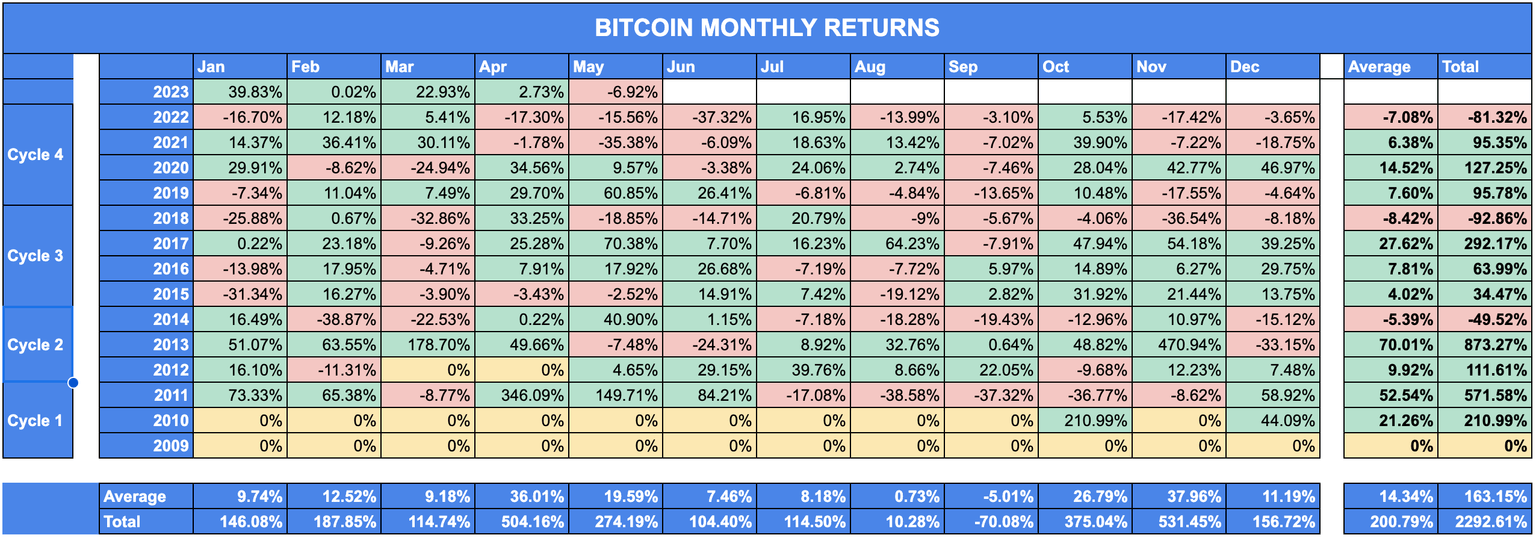

The monthly return table for Bitcoin price not only shows the big-picture outlook but also adds structure to the chaos of everyday volatility. As seen in the image below, the average return for BTC slumps after April all the way up to September. But in the last quarter, the average monthly return picks up steam.

A simple conclusion one can draw from this is that the next three months are likely going to be in the red or barely breaking even. The former seems more plausible when factoring in the worsening macroeconomic conditions.

BTC monthly returns

Read more: China coin narrative in play as Coinbase CEO warns of restrictive US crypto policies

Macroeconomic economic conditions worsen

In hindsight, Covid-19 seems to be the starting point of what is happening in the world. Due to the sudden halt in the economic machine, central banks across the world started worrying about an impending recession. To prevent a catastrophic breakdown of world economies, central banks decided to grease the economy by printing and distributing money to failing banks, businesses and people.

While money printing did the trick, it took a heavy toll on inflation. The year-over-year Consumer Price Index (CPI), or inflation in the United States, peaked at 9.1% in 2022. Similar ripple effects were seen in economies across the world that resorted to printing money out of thin air.

Central banks have been trying to curb the inflation. The US Federal Reserve has been curbing inflation by raising interest rates, which is reminiscent of the Great Recession of 2008 - 2009. Similar hikes in interest rates in 2008 caused the banks to fail, which had a domino effect causing the housing market bubble to pop. The panic was soon followed by a recession in not just the US but across the globe.

Likewise, the recent hikes by the Fed caused many popular US banks to close up shops, which caused panic among retail investors. Now, the latest in a long line of crisis is the US Debt Ceiling; the US House of Representatives has voted to remove the $31.4 trillion ceiling, which received bipartisan support.

Read more: S&P500 Futures grind higher, yields stabilize as US House of Representatives pass debt ceiling deal

Closing thoughts

Based on the historical data and macroeconomic conditions, the outlook for Bitcoin price does not look good. So, investors can expect the next three months to be so-so. But from a long-term investment perspective, Q3 is likely to provide plenty of opportunities to accumulate BTC and other altcoins before the 2023 bull rally kickstarts in Q4.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.