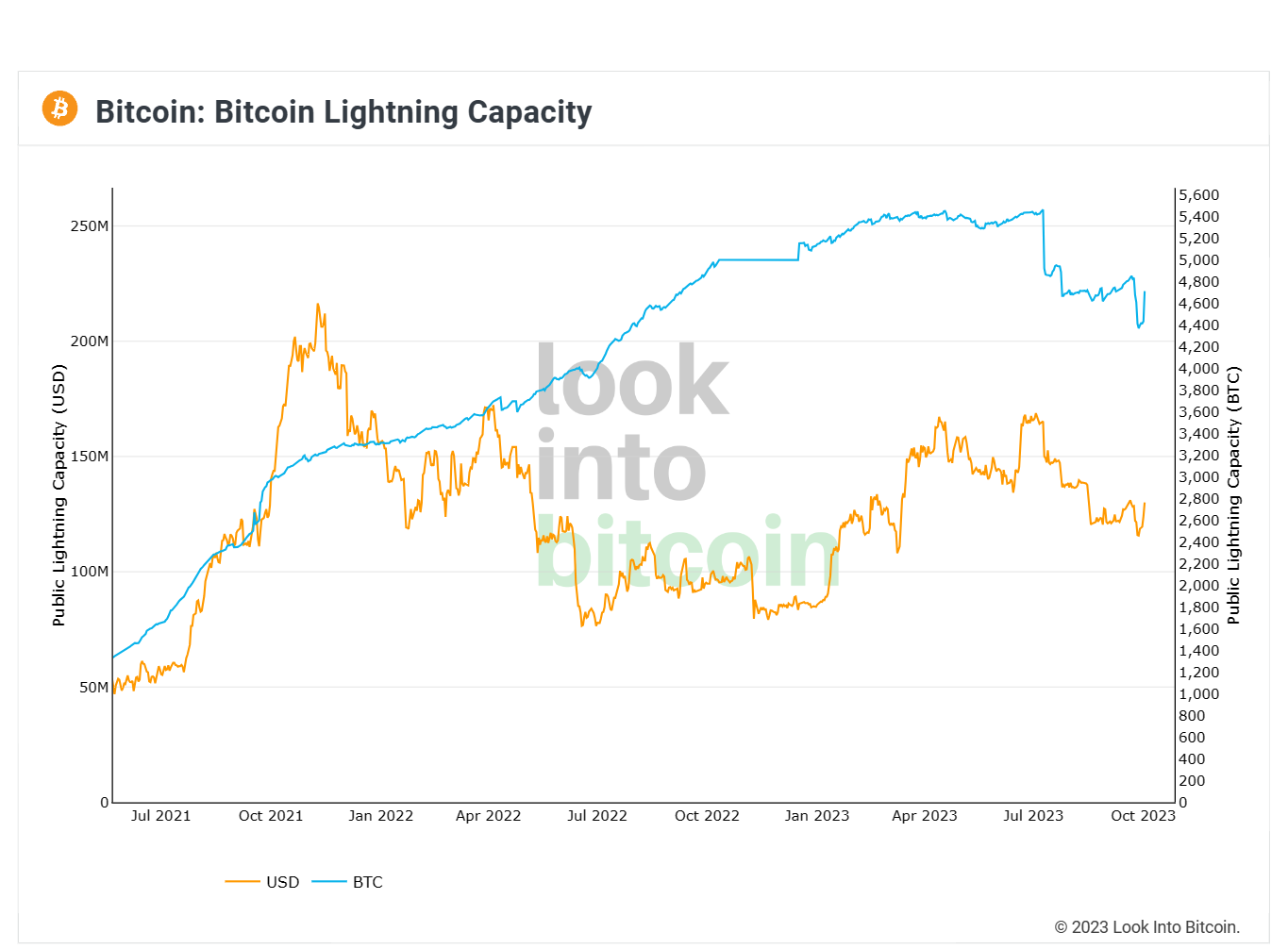

- Bitcoin Lightning Network, a Layer-2 solution that scales the network, has seen a consistent decrease in the cumulative BTC held by all nodes.

- The decrease in capacity is actually bullish as it enables protocols to align capital and manage channels.

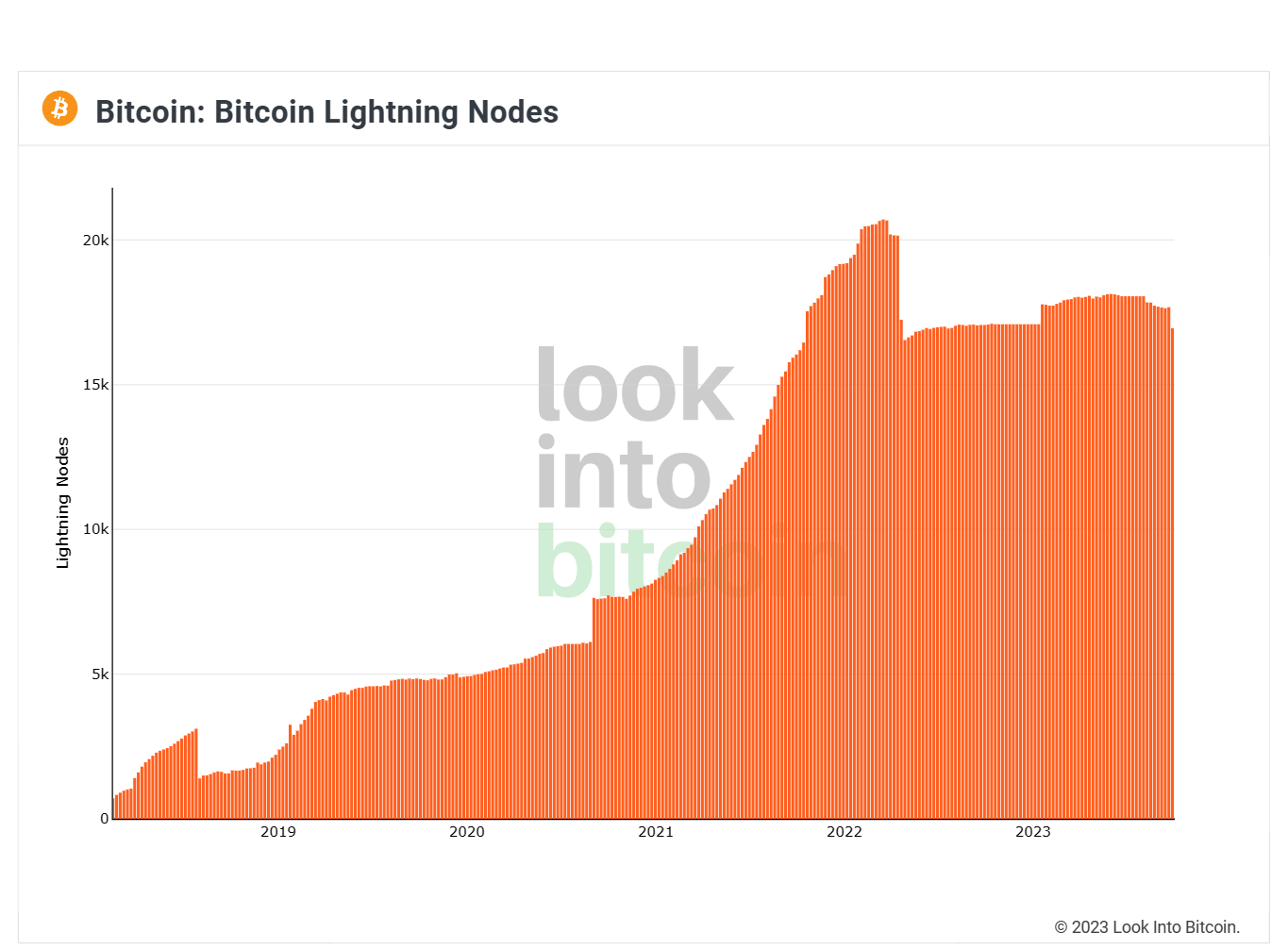

- Bitcoin Lightning Network nodes stand at the same number as they did in January 2023, which is a sign of lack of adoption.

Before Bitcoin Ordinals and BRC-20, the world’s first cryptocurrency network ran the most prominent Layer-2 solution – Lightning Network (LN). Over the past, the network was widely utilized for conducting faster transactions, but LN seems to be losing the amount of BTC on it at the moment.

Bitcoin Lightning Network loses BTC

Bitcoin Lightning Network, at its peak in March 2022, was operating more than 20,000 nodes. Since then, the nodes on the network began falling considerably. However, the BTC capacity of the LN continued rising, reaching its all-time high of 5,498 BTC in July this year. Both nodes and capacity help in measuring the demand of the network.

A lightning node is the point of contact that verifies the transactions interacting directly with the network. These nodes represent computers connected to the network, which makes the transfer of BTC quicker and cheaper.

The capacity, on the other hand, refers to the BTC present on the network at the given time. This, however, is not as important as nodes. The reason behind it is that capacity simply represents the liquidity function of the network, which can increase or decrease as it only refers to the volume of total payment.

Thus, the recent decline in the capacity is not a matter of concern. Over the past four months, the number of BTC on the network has been declining consistently, falling by 13.7% from 5,468 BTC to 4,716 BTC.

Bitcoin Lightning Network capacity

Analyzing the same, Sam Wouters, Research Analyst at River Lightning, an LN protocol, stated,

“Node operators are beginning to discover that they can accomplish the same or more with less capacity.”

This was in reference to the protocol slashing its nodes’ capacity by 48% towards the end of August, stating the reason behind the decision to properly align capital and manage channels to the right peers.

Bitcoin LN nodes aren’t growing

While the decline in capacity is not a concern, a fall in nodes or lack of growth certainly is. The rise and fall in nodes provide an insight into the rising or falling adoption of Lightning Network. Since the beginning of the year, the number of nodes on the network has been the same despite the increase and decrease at around 17,000.

Bitcoin Lightning Network nodes

The impact of the same on investors has not been significant, which leaves BTC holders safe from any sudden volatility. However, from a wider view,the fall in nodes would be a bearish sign for the network.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple's XRP saw increased buying pressure as Trump taps pro-crypto Mark Uyeda as acting SEC Chair

Ripple is up 5% on Monday after US President Donald Trump announced pro-crypto Mark Uyeda as the new acting Securities & Exchange Commission Chair. It follows increased buying activity across XRP market.

Donald Trump selects pro-crypto Mark Uyeda as acting SEC Chair

A notice from the White House on Monday revealed that President Donald Trump selected Securities & Exchange Commission Commissioner Mark Uyeda to replace Gary Gensler as the agency's acting Chairman.

Crypto Today: BTC, Solana, XRP set new $3.7T record on Trump inauguration

The global crypto market capitalization grew by 2.4% on Monday, reaching a new all-time high of $3.7 trillion. Cumulative crypto market trading volume crossed the $640 billion mark for the first time since November.

Ethereum Price Forecast: ETH set for rally as its Foundation allocates 50,000 ETH to DeFi

Ethereum trades around $3,330 on Monday following the general crypto market decline stemming from traders' reaction to Unites States President Donald Trump's failure to mention crypto during his inauguration.

Bitcoin: BTC rallies above $102,000 ahead of Trump’s inauguration

BTC's price continues to trade in the green, trading above $102,000 at the time of writing on Friday after rallying more than 7% this week. Recent US macroeconomic data released this week supported the rise of risky assets like BTC.

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.