Unwithered by the ongoing bear market, Bitcoin’s (BTC) underlying architecture continues to outperform itself — further securing, decentralizing and speeding up the impenetrable peer-to-peer network. The same holds true for the Bitcoin Lightning Network (LN).

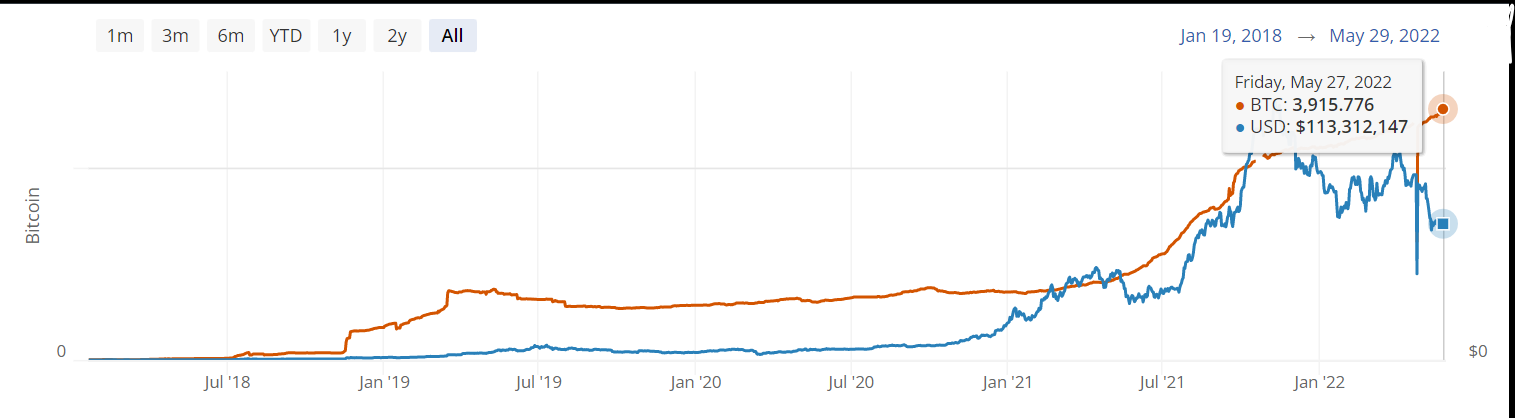

The Bitcoin Lightning Network capacity attained an all-time high of 3915.776 BTC as evidenced by data from Bitcoin Visuals, displaying a commitment to the cause of improving BTC transaction speeds and reducing fees over the layer-2 protocol.

Cumulative Bitcoin capacity across all channels. Source: BitcoinVisuals node

The Bitcoin LN was first implemented into the Bitcoin mainnet in 2018 to address Bitcoin’s infamous scalability issues and has ever since been able to maintain an upward trajectory in terms of expanding its capacity.

The climb, however, saw a temporary disruption on April 18, when the LN capacity dropped by 7.7% — from 3687.051 to 3402.273 BTC in a matter of a week. Showcasing network resilience, the drop was accompanied by a quick recovery back to 3718.351 BTC by May 2.

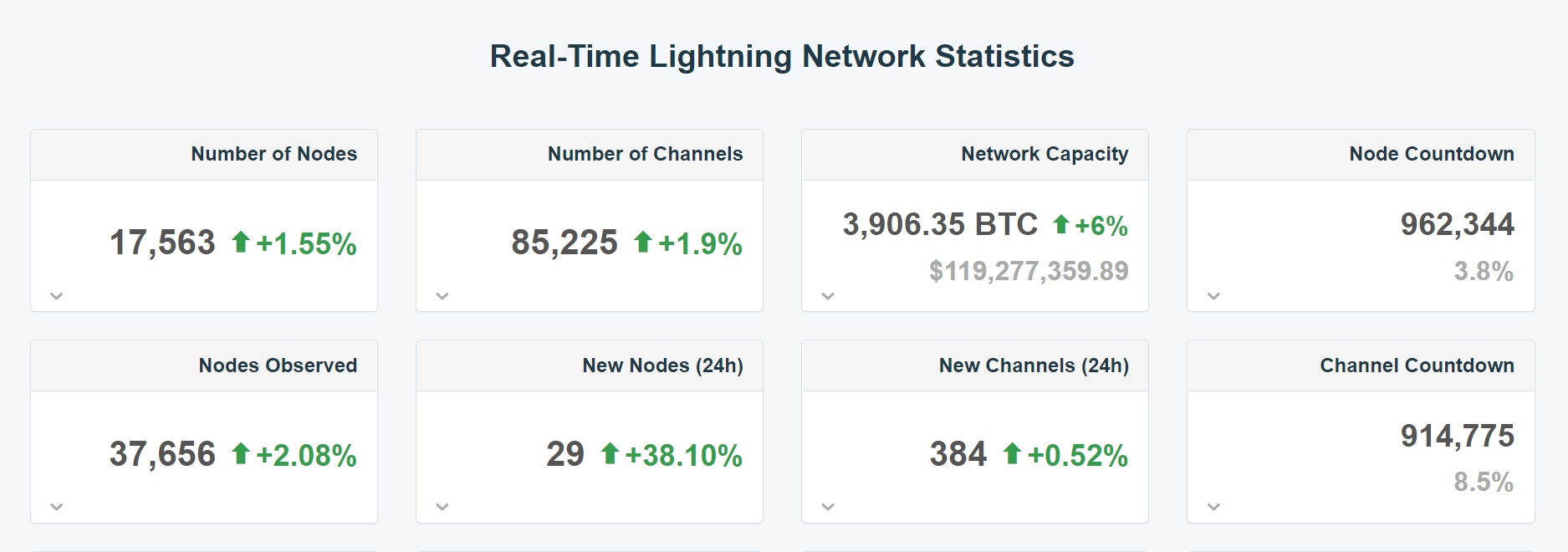

Bitcoin Lightning Network statistics. Source: 1ml

Moreover, statistics data from 1ml shows that all other aspects of the Bitcoin Lightning Network continue to grow parallel to Bitcoin’s global adoption drive.

A Redditor’s data-driven prediction hints at a major disruption that will see the crypto industry move away from bridging between L1 blockchains toward L2s. As explained by the OP:

“L2 adoption is happening now, even if it is slow and in bursts. Behind the scenes, L2’s are improving reliability, decreasing fees, and increasing accessibility. L2’s are still building and improving, and that’s fantastic.”

As Cointelegraph previously reported, L2 scaling solutions take advantage of L1’s security and process multiple transactions into a single package.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.