Bitcoin is vulnerable to losses as SMA200 daily in danger

- Macroeconomic factors may bode ill for the first cryptocurrency.

- BTC/USD has come close to the critical support level.

The cryptocurrency market is range-bound with a bearish bias as Bitcoin and most of the major altcoins are nursing day-to-day losses from 1% to 5%. The total cryptocurrency market capitalization has not edged lower to $249 billion from $251 billion the day before; an average daily trading volume decreased from $79 billion to $77 billion, while bitcoin's market share stayed at 66.9%.

Read also: Cryptocurrency market update: Where is this Directionless Bitcoin trading going?

Fundamental picrure

The cryptocurrency market is usually insensitive to fundamental developments; however, the risk-on sentiments caused by a detente in the U.S.-China trade war and improved global macroeconomic profile may eventually influence the sentiments on digital assets market.

Gold, Treasuries, JPY and other save-haven assets go down amid growing interest to high-yielding assets. While bitcoin has no clear correlation with other asset classes, it is often regarded as a defence asset, which makes it vulnerable to further losses.

Read also:

Antony Pompliano adds Bitcoin in the US-China trade war equation

US-China trade war makes Bitcoin more attractive

Technical picture

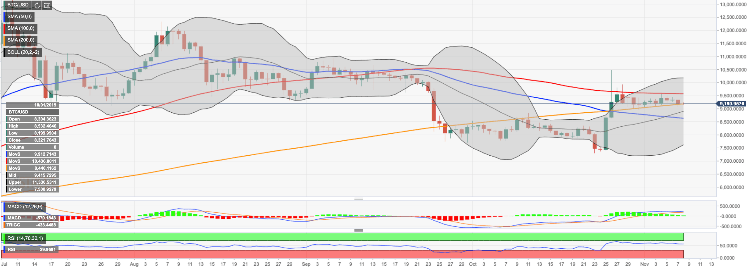

Looking technically, BTC/USD movements have been limited by a tight range amid decreased volatility. It is a risky situation for bitcoin as bulls are not motivated enough to push the price to higher and may lose the initiative to bears.

"Recent price action has choppy, quiet and sideways. This “collapse in volatility” suggests a much bigger price move is right over the horizon—maybe yet this week. The bulls still have the slight overall near-term technical advantage amid this pause," according to Jim Wyckoff from Kitco news.

At the time of writing, BTC/USD is changing hands at at $9,185. The price is testing SMA200 (Simple Moving Average) daily that served as a strong support area for the coin since the end of October. Once it is out of the way, the sell-off is likely to gain traction with the next focus on $8,635 (SMA50 daily). On the upside, we will need to see a sustainable move above $9,574 to improve the technical picture.

BTC/USD, the daily chart

Author

Tanya Abrosimova

Independent Analyst