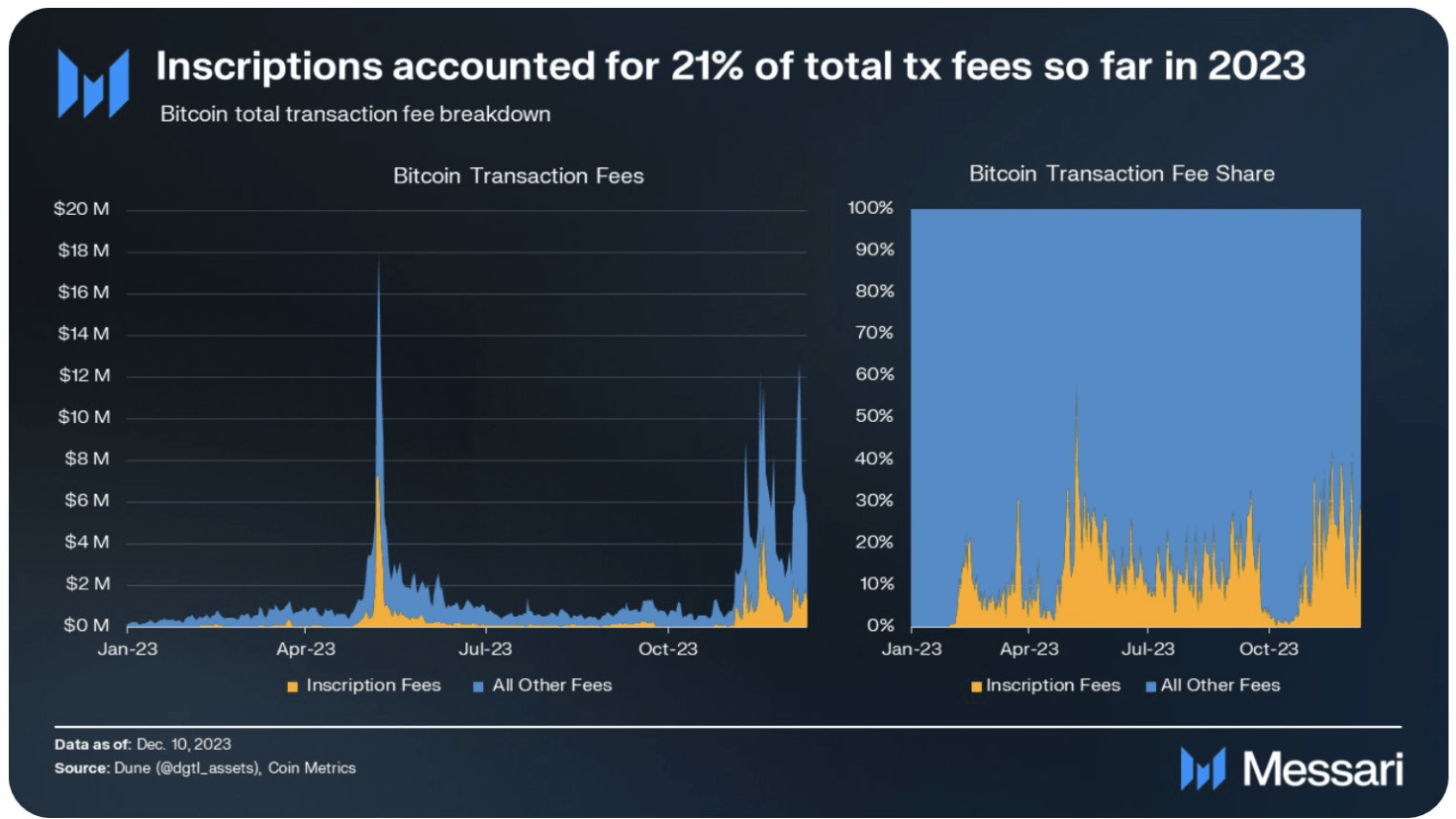

“Bitcoin is so back” says Messari, as Inscriptions account for 21% of total fees in 2023

- Bitcoin BRC-20 and Inscriptions boomed in 2023 with the latter making up for 21% of all transaction fees.

- Messari noted that BRC-20 and other forms of new transactions flooded BTC’s mempool and spiked the fees.

- Bitcoin price remains consolidated above $42,000, awaiting bullish cues that are expected to arrive by January 10, 2024.

Bitcoin is heading into one of the most important years in its history as two major events are expected to skyrocket the digital asset. Ahead of the same, crypto market intelligence data provider Messari has provided its take on what 2024 can bring for Bitcoin and by the looks of it, Inscriptions might lead the year.

Bitcoin in 2024

As part of Messari’s Crypto Theses 2024, the platform highlighted the growth and impact of BRC-20, Ordinals and Inscriptions. These new forms of transactions, along with Stamps and Runes, boomed this year and flooded the Bitcoin mempool, resulting in a spike in its fees.

According to the Theses, Inscriptions alone accounted for about 21% of the total transaction fees in 2023, as per data available on December 10.

Bitcoin fee distribution 2023

In regards to Inscriptions and Ordinals, Messari stated,

“know that new technical upgrades to Bitcoin core have opened the door for a vast design space of scaling and added functionality in the bitcoin ecosystem.”

Bitcoin price sees no move

Bitcoin price has remained sideways bound for nearly the entire month now. Trading at $42,598 at the time of writing, BTC is exhibiting neither a sign of increase nor a decrease likely to remain consolidated within the $42,069 and $44,006 range.

If Bitcoin price breaches the upper resistance of the range, a bullish breakout could occur, sending BTC beyond $45,000.

BTC/USD 1-day chart

But if BTC falls through the support floor of $42,000, some correction might bring it to $40,000 with an attempt at testing the 100-day Exponential Moving Average (EMA) line at $42,000.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.