Bitcoin is set to take off from $7,200

- Bitcoin retreated from the recent high and came close to a strong support area.

- $7,200 may serve as a jumping-off ground for another recovery attempt.

Bitcoin (BTC) is changing hands at $7,300. The first digital coin has lost nearly 3.5% of its value in recent 24 hours and stayed unchanged since the beginning of the day. Despite the pre-Christmas period, Bitcoin's trading volumes increased to $27 billion on December 23, however, the activity is likely to recede later during the day. Bitcoin's market dominance is registered at 68.9%.

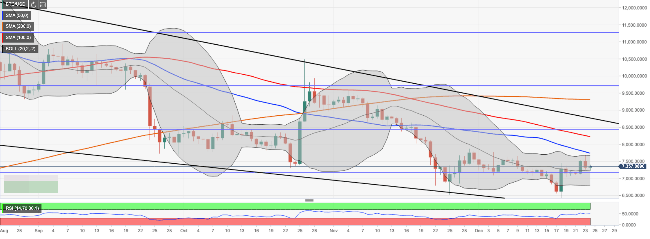

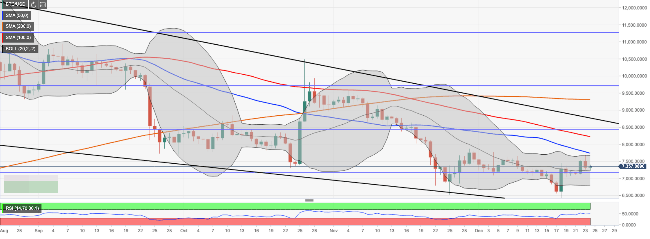

BTC/USD: technical picture

From the long-term point of view, Bitcoin ailed to settle above SMA50 (Simple Moving Average) weekly (currently at $7,535) and retreated towards the next crucial support created by SMA100 weekly at $7,220. This area is reinforced by 61.8% Fibo retracement, so that's where the upside may be resumed.

According to a cryptocurrency trader Crypto Michaël @CryptoMichNL, we will see a retreat towards $7,200 before the upside is resumed towards $8,000. The expert noticed a CME gap below the current price, which needs to be closed.

·

"Wouldn't be surprised with a copy/paste of the movements earlier. However, there's beneath us, so first $7,200ish before $7,800-8,000 would also be fine. Local top defined through bearish divergences. All-in all range-bound.

However, if this area gives what, the sell-off will gain traction and it won't take much time to reach $7,000. Low liquidity conditions often result in sharp moves, which means there is a risk of wide price swings.

Meanwhile, the critical support is created by the lower boundary of the descending wedge at $6,100. A sustainable move below this handle will open up the way towards $5,000 (SMA200 weekly).

On the upside, a recovery above $7,535-$7,550 will bring this week's high of $7,689 back into focus. The next resistance area comes at $7,800 with SMA50 daily and the upper line of the daily Bollinger Band located on approach. Once it is cleared, the upside is likely to gain traction with the next focus on psychological $8,000 and $8,220 (SMA100 daily).

BTC/USD daily chart

Author

Tanya Abrosimova

Independent Analyst