Bitcoin is pricing in two Fed rate cuts for 2024, Trader says

Bitcoin remains above $70K as Asia begins its trading day.

One trader told CoinDesk that its too early to tell if slowing GBTC outflows will be a positive sign for Bitcoin's price.

Bitcoin (BTC) looks to extend Wednesday's gain, trading near $70,800 while ether {{ETH}} changed hands above $3,500 as the market continues to digest a higher-than-expected U.S. CPI and slowing outflows from the Grayscale Bitcoin Trust (GBTC).

"Bitcoin exhibited strength against a hawkish CPI report and strong inflation data seeing only a retracement back down to $67,000 following the fed minutes announcement," Semir Gabeljic, director of Capital Formation at Pythagoras Investments, said in an email note.

"[Still] The drop of -2% from Monday's retest of $73,000 showcases risk assets, including BTC, pricing in two rate cuts instead of three for the remainder of 2024," he added.

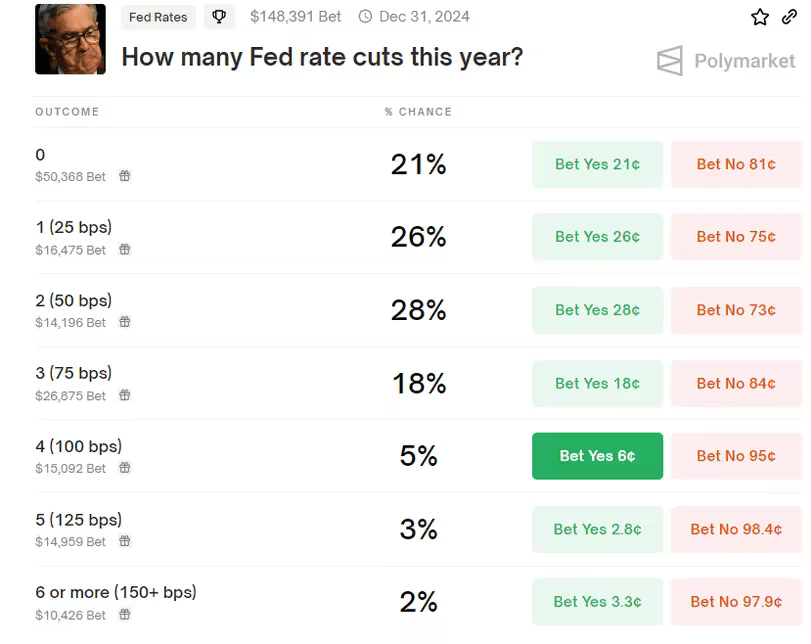

Bettors on decentralized predictions platform Polymarket seem to be evenly split on the number of rate cuts by the end of 2024.

(Polymarket)

Twenty-six percent of bettors have put money on there being one cut, while 28% believe there will be two cuts, and 21% bet on no cuts at all.

Meanwhile, Jun-Young Heo, a derivative trader at Singapore-based Presto, pointed out that the market recovered quickly after the higher-than-expected CPI announcement compared to gold or the S&P 500 index.

The implied volatility of options expiring on April 26th is still trading at a premium while recent historical volatility is still trending down, Heo noted.

Some market participants are noting that bitcoin prices are reacting favorably to slower than usual outflows from the Grayscale Bitcoin Trust (GBTC).

(Checkonchain)

On-chain data shows that outflow from GBTC is at $18 million, which is the lowest since the launch of the U.S. bitcoin ETFs.

"But we need to see a few more dates to find out whether GBTC outflows are becoming negligible amount since it has a higher fee than any other ETFs," Heo added.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.