Bitcoin’s correction from its January peak is a typical cycle pullback and is not out of the ordinary, with a price top still on the horizon, crypto analysts and executives tell Cointelegraph.

“I don’t think the bull run is over; I think the peak of the cycle has been pushed back due to macro conditions, and global liquidity isn’t pretty, which isn’t helping crypto,” Collective Shift CEO Ben Simpson told Cointelegraph.

Bitcoin experiencing expected retracement

“It is only the third or fourth correction we’ve had over 25% we’ve had in Bitcoin this cycle compared to 12 last cycle,” Simpson said.

Bitcoin (BTC $83,265) is down 24% from its all-time high of $109,000 on Jan. 20 amid uncertainty around US President Donald Trump’s tariffs and the future of US interest rates, but Simpson called it “a normal correction.”

“Things got overheated, and they needed to cool down, and the market needed to find a new foundation, and now we’re waiting for the next new narrative,” he said.

Bitcoin is down 13.58% over the past month. Source: CoinMarketCap

Derive founder Nick Forster shared a similar view, telling Cointelegraph that Bitcoin “is likely in a normal correction phase, with the cycle peak still to come.”

“Historically, Bitcoin experiences these types of corrections during long-term rallies, and there’s no reason to believe this time is different,” he said.

After Trump’s election in November, Bitcoin surged almost 36% over a month, hitting $100,000 for the first time in December. At the time of publication, Bitcoin is trading at $82,824, according to CoinMarketCap.

However, Forster added that the six-month fate of Bitcoin seems increasingly tied to traditional markets. Similarly, Independent Reserve CEO Adrian Przelozny told Cointelegraph that it isn’t just Bitcoin being impacted by the macroeconomic conditions.

“This is pervading all asset classes and may lead to a spike in global inflation and a contraction in international growth,” Przelozny said.

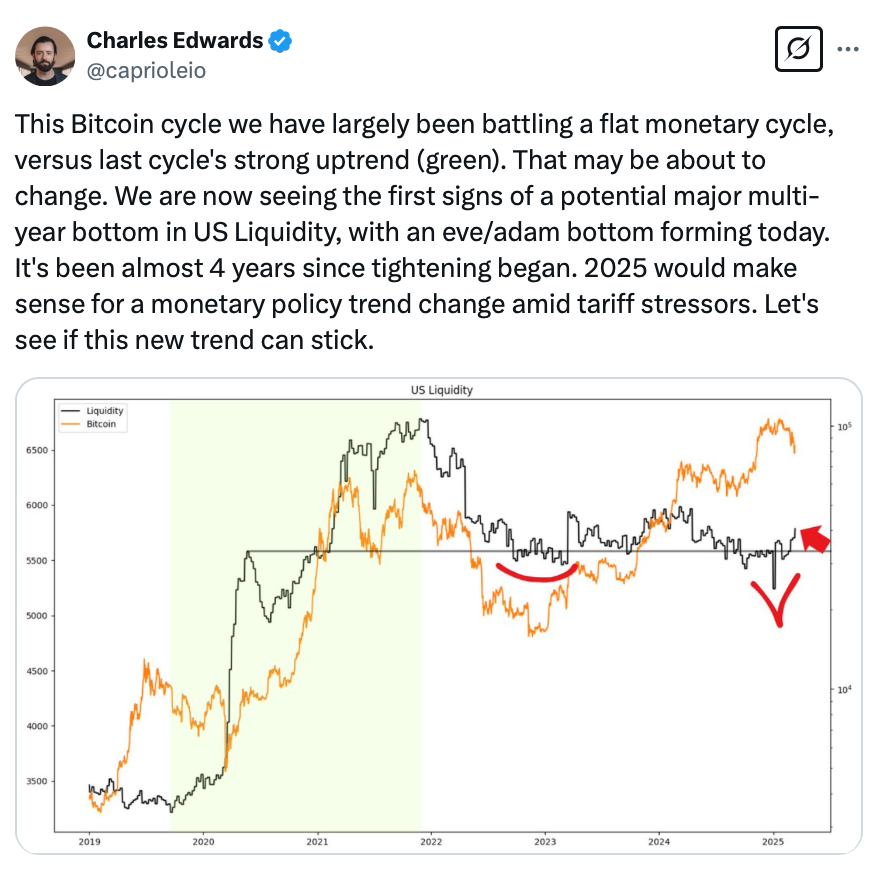

Source: Charles Edwards

Forster said Bitcoin’s current price trend aligns with past behavior before a price rally, even though it appears “tumultuous” at the moment.

Bitcoin’s current trend may “change quickly”

Collective Shift’s Simpson said the next narrative will likely revolve around US rate cuts, easing quantitative tightening, and increasing global liquidity.

However, Capriole Investments founder Charles Edwards said he isn’t so sure if the Bitcoin bull run is over or not.

The odds are “50:50, in my opinion,” Edwards told Cointelegraph.

“Yes, from an onchain perspective at present, but that could change quickly if the Fed starts easing in the second half of the year, stops balance sheet reduction, and dollar liquidity grows as a result, which I think has decent odds of happening,” Edwards explained.

The comments come a day after CryptoQuant founder and CEO Ki Young Ju declared that the “Bitcoin bull cycle is over.”

“Expecting 6-12 months of bearish or sideways price action,” Ju said.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Monero Price Forecast: XMR soars over 19% amid rising demand for privacy coins

Monero (XMR) price is extending its gains by 19% at the time of writing on Monday, following a 9.33% rally the previous week. On-chain metrics support this price surge, with XMR’s open interest reaching its highest level since December 20.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH stabilize while XRP shows strength

Bitcoin and Ethereum prices are stabilizing at around $93,500 and $1,770 at the time of writing on Monday, following a rally of over 10% and 12% the previous week. Ripple price also rallied 8.3% and closed above its key resistance level last week, indicating an uptrend ahead.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.