Bitcoin is a better investment vehicle than gold and institutional investors buy it

- More corporate investors turn to Bitcoin as Grayscale reports over $1 billion added to its cryptocurrency funds in Q3 2020

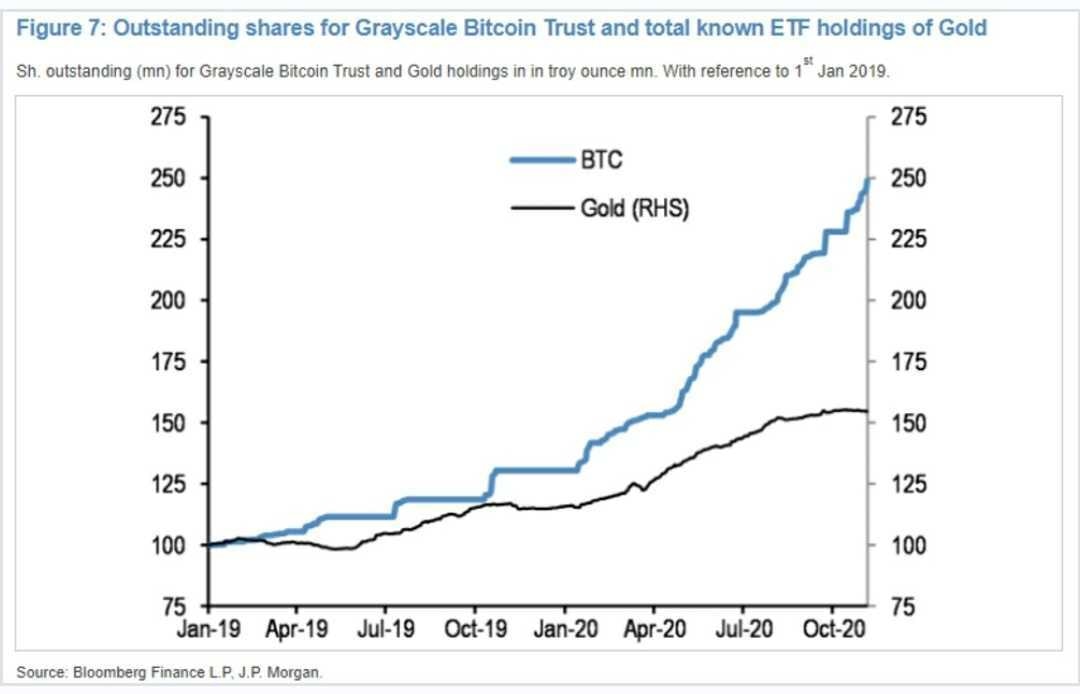

- JPMorgan also points to evidence of institutional demand for Bitcoin as investors move from its gold exchange-traded funds to cryptocurrency.

Besides the fear of missing out, a shift from gold to Bitcoin quickly picks up momentum among corporate investors as they now see it as a better store of value.

Bitcoin outclasses gold as a store of value

For a long time, gold has been considered one of the safest ways to store wealth. While it has held up this position against paper money, which is way prone to inflation, the same cannot be said about Bitcoin. One of the arguments presented by investors is that gold appears to be a lot less volatile in the short term. Famous Bitcoin analyst, Willy Woo, refuted this by looking at both in a broader time frame.

The volatility of the pioneer cryptocurrency tends to drown over time, thereby making it more profitable for long term holders.

Bitcoin is more stable than Gold as an investment vehicle.

— Willy Woo (@woonomic) November 23, 2020

If you're in it for the long run, you want long term stability of returns for the risk you're undertaking. Day to day price volatility drops to the background for long term investors. https://t.co/3aE7tzKP1k pic.twitter.com/2DnuRQoWM2

Bitcoin's finite supply further reinforces its value as there can be only 21 million BTC that would ever be in existence. This is different for gold, as the possibility of asteroid mining remains a viable one. Precious metals like gold could be mined from outer space and transported back to earth. If this happens, it will cause a sharp decline in its value as supply would increase, besides, regular mining already has this effect but to a smaller extent.

In response to a statement made by the CEO of Euro Pacific Capital Peter Schiff, Woo also pointed out how gold has performed terribly over the years as a store of value.

But why would I want to store gold at all? It doesn't hold value against hard money. :) pic.twitter.com/CQtyCbjIyr

— Willy Woo (@woonomic) November 23, 2020

When compared to Bitcoin over the last 11 years, gold was seen to have made only a 65% increase when measured against the dollar. This was a large contrast with the exponential growth seen in the cryptocurrency within the same duration.

Institutional investors refuse to be left behind

It would appear that this fear of missing out exhibited by institutional traders is evident as the flow of funds has shown. JPMorgan has pointed out proof of Bitcoin's institutional demand as investors move gold exchange-traded funds (ETFs) to the cryptocurrency. The firm showed that this massive demand for BTC is created not just by younger retail investors but also by corporate investors such as family offices and asset managers.

The direct contrast with the equivalent outflow trajectory for gold ETFs and the inflow into Grayscale Bitcoin Trust makes it more impressive. Over $1 billion was added to its crypto products in Q3 2020

Grayscale Bitcoin Trust and ETF holding of gold

Although Bitcoin is still in its early stages, it is already poised to cut from the precious metal's 9 trillion dollar market. The trajectory is indicative of shifting preferences.

Author

FXStreet Team

FXStreet