Bitcoin investors in extreme fear, unaware of incoming bullish supply shock

- Bitcoin Fear and Greed index shows that fear has gripped the market for over 60 days in a row.

- The popularity and demand for altcoins with small market capitalization have increased.

- No big spikes are noted in Bitcoin net flows, whales with less than 10,000 Bitcoins continue accumulating.

Market timing strategy guided by the fear and greed index suggests that the risk-averse should stay away from the crypto market. In previous instances ‘extreme fear’ has offered some of the most profitable buying opportunities. Bitcoin analyst Willy Woo noted that whale accumulation is on and Bitcoin is heading towards a supply shock.

Fear and Greed index shows extreme fear, hit March 2020 level

The Fear and Greed index is calculated by analyzing emotions and sentiments from different sources. The value of the index ranges from 0-100 and relies on data points like volatility, market momentum/volume, social media, surveys, dominance and trends in the crypto market.

When it reads between 0-25 traders are extremely fearful, 25-50 signals fear, 50-75 suggests that investors are greedy, and 75-100 points at extreme greed. With a reading of 21 at the time of writing, traders are experiencing extreme fear of further downside.

The last time the index consistently indicated fear was in March 2020. Bitcoin dropped to half its price in the two-day plunge and the asset traded within a tight price range. Several data points of the index were at nearly the same level.

Such strong currents of fear and grim sentiment have often led traders to hunt for better alternatives. In this case, the crypto community is looking for the next Bitcoin and the demand for cryptocurrencies with small market capitalization has increased.

Social trading platform eToro shared its latest report on the number of crypto assets being held by eToro clients during the last quarter. The report revealed that Cardano replaced Bitcoin and became the most held cryptocurrency in Q2 2021. Demand for Bitcoin was up 42% since Q1, however, the attention was focused on Tron (TRX) and Ethereum Classic (ETC). Both altcoins increased in popularity by over 150% QoQ. Cheaper alternatives like Cardano (ADA), and IOTA (MIOTA) that are priced around $1 have attracted investors.

Bitcoin analyst Willy Woo has a different narrative to describe what is happening right now in the crypto market. He does not comment on the demand for altcoins, however, he describes a “bullish supply shock” building on cryptocurrency exchanges.

Whales continue accumulating, no significant change in net flow on crypto exchanges

Volatility is low for Bitcoin and fewer traders are sending their coins to exchanges for trading.

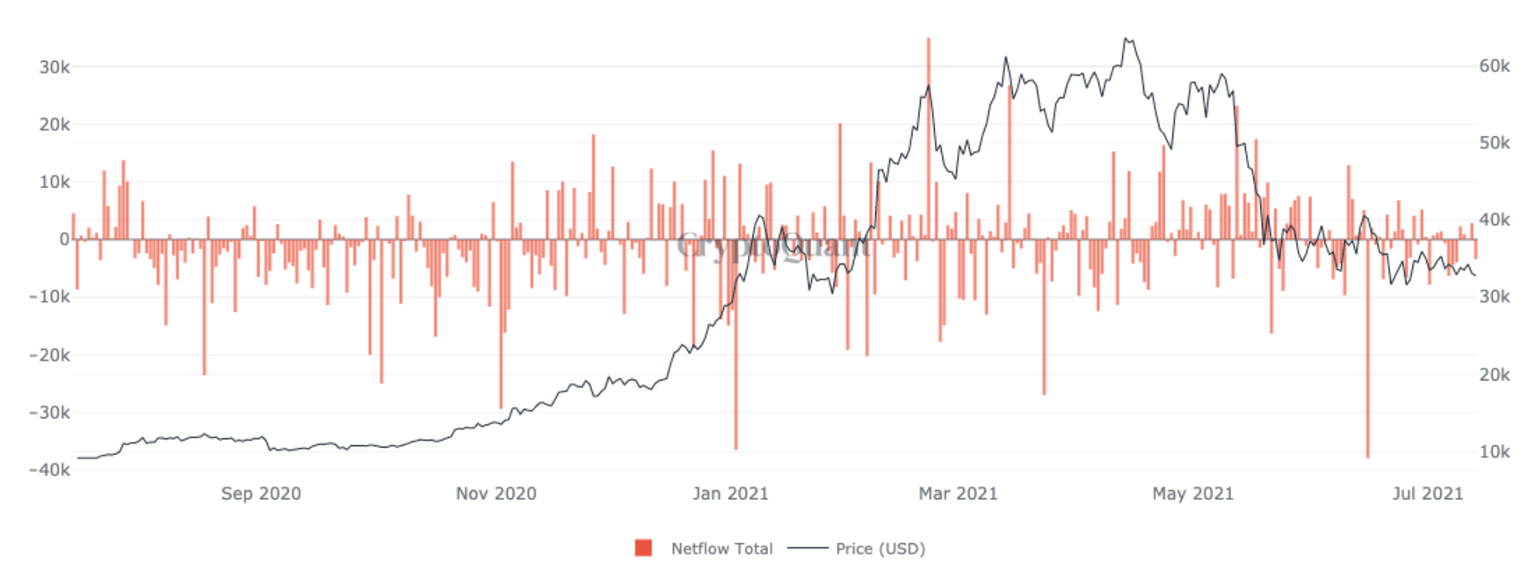

The unprecedented growth of users joining the network during this price dip while active addresses plummet. China’s crackdown on mining farms and the largest negative adjustment in Bitcoin’s mining difficulty, -27.94% among other events, is one factor that led to this activity as well as the increase in stricter regulations against Binance. The difference between the number of BTC flowing into and out of all exchanges' wallets, the Netflow Total, shows no significant spikes.

Bitcoin Net Flow

Woo’s analysis across all market participants including exchanges shows that whales with a balance of 10,000 are selling, whales with balances of 1,000 to 10,000 are buying. The remaining traders in the market are stacking. Woo describes this as a ‘bullish supply shock’.

In reality, under entity analysis across ALL participants including exchanges... whales 10k+ are selling, while 1k-10k are buying what was sold. Everyone else is stacking. Speculative exchange inventory is depleting.

— Willy Woo (@woonomic) July 14, 2021

(It's bullish supply shock) pic.twitter.com/B0UyFUw4cq

The extreme fear poses an opportunity for large investors to increase their BTC balance, while Woo has a bullish outlook for Bitcoin. Traders and investors alike will need to make calculated decisions on their strategies for the rest of the year.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.