Here’s a quick summary of what’s happening in the crypto space and what to expect next.

- On-chain gambling on low market capitalization tokens takes a back seat after a volatile week for Bitcoin.

- Macroeconomic events fail to induce directional moves.

- Vitalik Buterin dumps his Maker (MKR) stack worth $580,000.

- Investors expect more downside for Bitcoin.

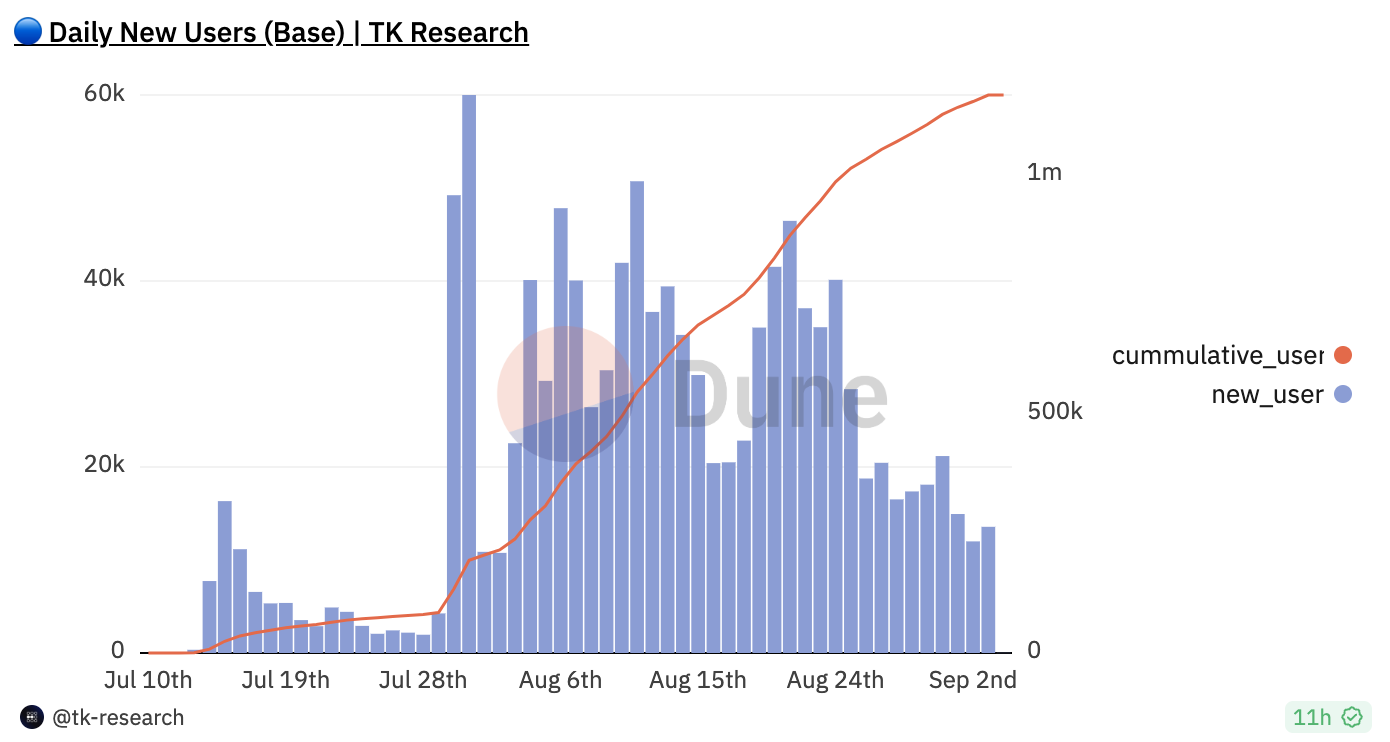

Crypto’s on-chain summer, which began with the launch of Coinbase’s Layer 2 solution BASE, seems to have slowed down. This can be seen in the chart attached below, which shows a steady decline in new users joining the network. As a result, gambling of on-chain altcoins has also dropped.

BASE new users

Read more:

What BASE and Optimism’s collaboration means for OP price

New PEPE coin debuts amid skepticism; critics believe original will prevail

The US PCE and NFP releases last week failed to trigger a sharp move. The two significant reports were underwhelming, which caused Bitcoin prices to hover around $26,000 after the events. However, as time passed, BTC took a sharp nosedive and retested $25,300.

Read more:

Could US Nonfarm Payrolls provide directional cues Bitcoin needs?

Bitcoin price tests support at $26,000 with August’s US NFP data exceeding market expectations

Vitalk Buterin has sold $580,000 worth of his MKR holdings after seeing the project “torpedo itself in weird directions.” Long before Buterin offloaded his holdings, whales of MKR were battling each other out. Nearly $14 million worth of MKR moved out of centralized exchanges, as indicated by Santiment’s exchange’s netflow metric. This negative flow of MKR tokens indicates that investors are moving their holdings off exchanges, which effectively reduces the sell-side pressure. But other on-chain metrics suggest a bearish fate for MKR.

Read more:

Maker price risks further decline as whale transactions spike, MKR wipes out recent gains

MKR price falls 5% as Ethereum’s Vitalik Buterin liquidates his entire MakerDAO portfolio

MKR Whales’ holding hits a six-month high as Maker price crashes by 25%

Investors increase their exposure to Bitcoin put options, according to Twitter user HanSolar.eth. They mention that the spike in BTC skews could mean that negative news is incoming.

Skews are up majorly over the weekend. Weird.

— HanSolar.eth (@hansolar21) September 3, 2023

Negative news incoming? pic.twitter.com/eafEXiOtOp

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Monero Price Forecast: XMR soars over 19% amid rising demand for privacy coins

Monero (XMR) price is extending its gains by 19% at the time of writing on Monday, following a 9.33% rally the previous week. On-chain metrics support this price surge, with XMR’s open interest reaching its highest level since December 20.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH stabilize while XRP shows strength

Bitcoin and Ethereum prices are stabilizing at around $93,500 and $1,770 at the time of writing on Monday, following a rally of over 10% and 12% the previous week. Ripple price also rallied 8.3% and closed above its key resistance level last week, indicating an uptrend ahead.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.