Bitcoin inches closer to a 10-year record, as other stats turn bullish

The world's first cryptocurrency Bitcoin (BTC $21,282) is one day away from matching its historic 15-day win streak if its positive price movement keeps up.

In November 2013 Bitcoin posted a 15-day consistent positive price movement, the longest in its history.

Right now, BTC is on day 14 of its win streak, hitting four-month highs in the process.

One more day of upward price movement will match its 2013 streak. If Bitcoin keeps gaining another day after that it will set a new all-time record with a 16-day winning streak.

It’s not the only bullish metric crossing into new territory.

Ethereum to soon cross 100M non-zero addresses

Ethereum addresses holding at least some Ether (ETH $1,583) will soon cross the 100 million mark given the current amount of wallet addresses and the historical growth rate of the metric.

On Jan. 16, crypto analytics firm Glassnode said that the number of non-zero ETH addresses reached an all-time high of nearly 92.5 million.

According to the data, Ethereum is just 7.5 million non-zero addresses away from crossing the 100 million milestone.

Since 2019 the figure has risen by roughly 20 million per year. If that rate continues, it’s likely non-zero ETH wallets could hit 100 million by sometime in the second quarter of 2023.

ETH hits half a million validators

Another Ethereum statistic that has continued to grow is the count of its validators — entities responsible for validating transactions made on the blockchain.

The ETH validator count crossed the 500,000 mark on Jan. 12, according to BeaconScan data.

The number of validators over a six-month period ending Jan. 17, the number currently sits at 502,218. Image: BeaconScan

It comes as the Shanghai hard fork slated for March would — among other updates — allow validators to finally withdraw their ETH thawas staked so they could help validate the network.

US top country for crypto payments acceptance

The United States is the most accepting country for those who want to splash their crypto on purchases.

More than half of the companies from a list of 250 accepting crypto as payment were U.S.-based, according to the Jan. 14 Forex Suggest Crypto Acceptance Report, giving the country the top spot for the number of crypto-accepting firms.

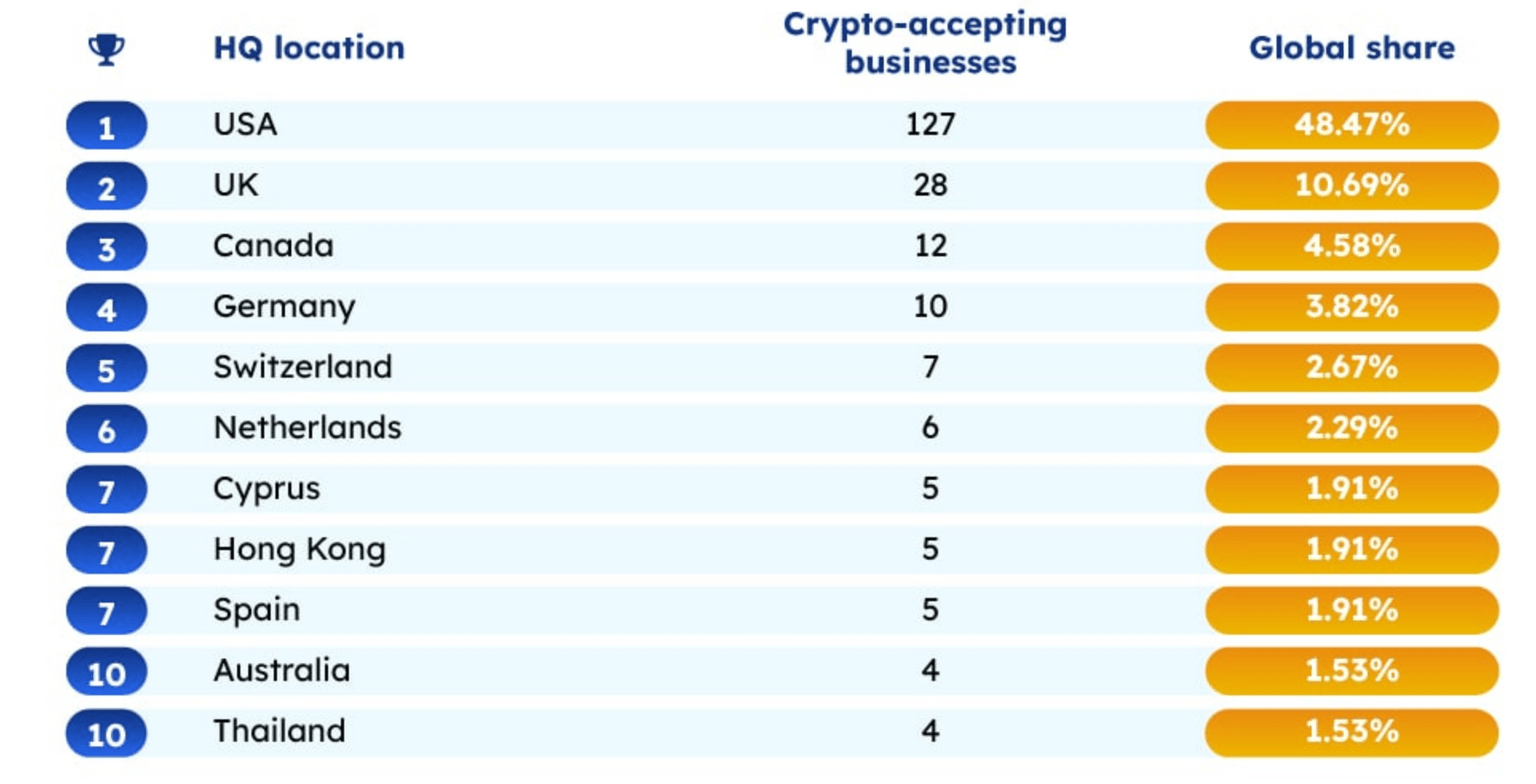

The top 10 countries with the most businesses accepting crypto as a payment method. Source: Forex Suggest

The U.S. was trailed by runner-up the United Kingdom, while third place went to America’s neighbors to the north, Canada.

E-commerce was the most accepting industry of crypto closely followed by the travel industry.

The largest business by market capitalization to accept crypto was the $1.8 trillion big tech player Microsoft.

Wrapped Bitcoin on Ethereum falls 35% from 2022’s peak

Not everything was bullish. Wrapped Bitcoin (WBTC), a tokenized and 1:1 backed version of BTC on Ethereum, has seen its supply on the Ethereum blockchain drop by 35% since May.

A Jan. 17 tweet from Glassnode revealed the May 2022 all-time high of 285,000 WBTC on Ethereum came right before the price collapse of TerraLunaClassic (LUNC) and its paired algorithmic stablecoin TerraClassicUSD (USTC).

The amount of WBTC has fallen by 101,550 over the course of 2022 and the blockchain now hosts around 183,500 tokenized Bitcoin.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.