Bitcoin was directionless during the early European hours on Tuesday while traditional markets saw another wave of risk aversion as Russian President Vladimir Putin ordered troops to move into eastern Ukraine.

-

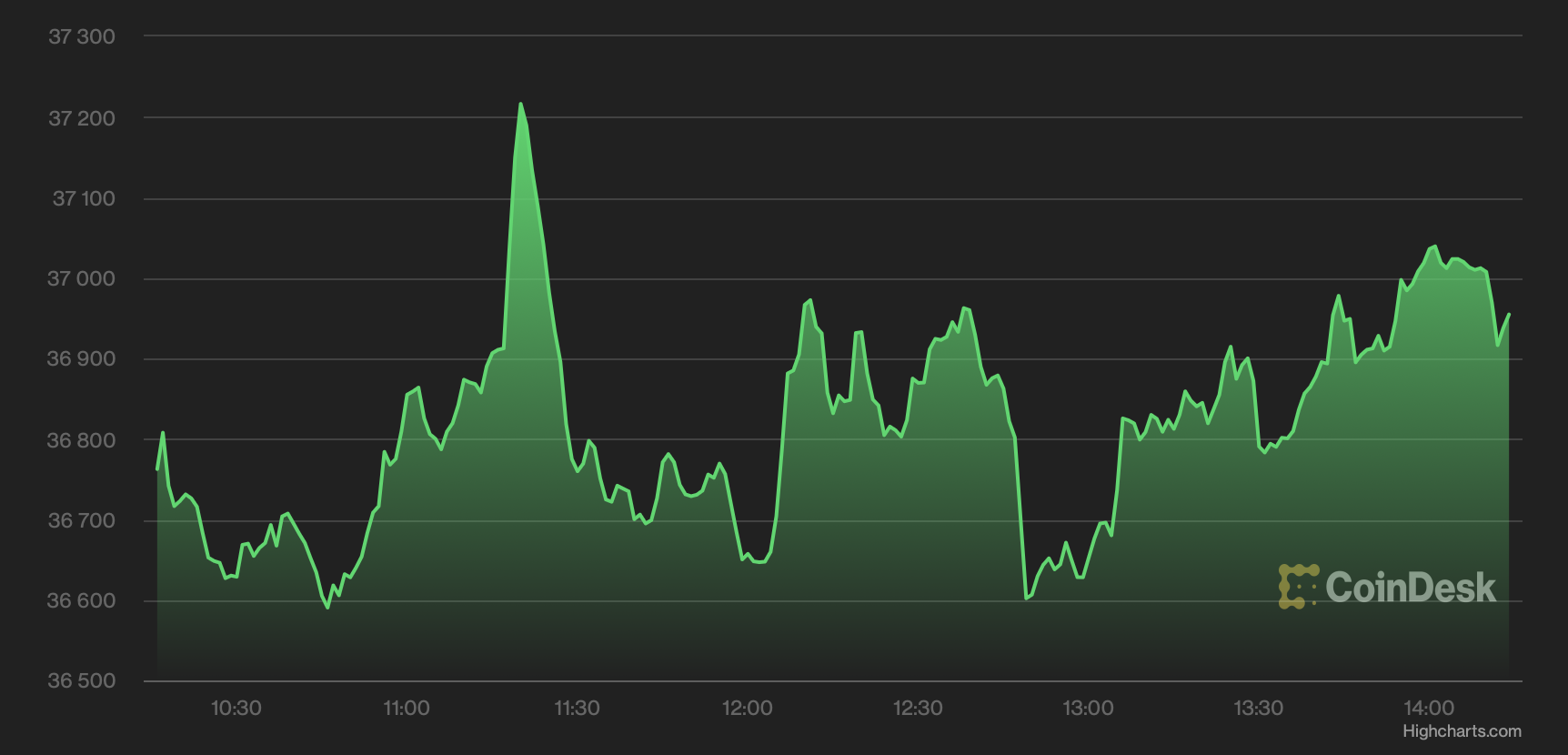

The top cryptocurrency traded largely unchanged on the day near $37,000 at 08:30 UTC, according to CoinDesk data.

-

Gold jumped to fresh eight-month highs of $1,914 per ounce, before trimming gains.

-

"In a tense situation, investors will prioritize commodities such as gold and crude oil rather than riskier stocks and cryptos," said Griffin Ardern, a volatility trader from crypto-asset management company Blofin.

-

The S&P 500 futures dropped over 1%, and the European stock markets nursed 1.2% to 1.5% losses. Oil prices surged with brent breaching the $98 per barrel mark for the first time since late 2014.

-

Putin's move drew criticism from the G7 countries and United Nations, with several nations, including U.K and Japan, threatening to impose sanctions on Russia.

-

Bitcoin has faced a double whammy of the Fed rate hike fears and lingering Russia-Ukraine tensions in recent weeks.

-

The cryptocurrency was down 3% for the month at press time, having failed to hold onto the rally to $45,000 seen earlier this month.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.