Bitcoin hovers below $30,000 as Coinbase CEO recalls SEC's request before the lawsuit

- The SEC asked US crypto exchange Coinbase to halt the trading of all cryptocurrencies except Bitcoin.

- Coinbase CEO mentioned that if they complied, it could mean the end of crypto in the US.

- Bitcoin price continues to hover below the $30,000 psychological level as volatility disappears.

A recent report from the Financial Times notes that the United States Securities and Exchange Commission (SEC) asked Coinbase to halt trading all cryptos except Bitcoin a month prior to serving legal notice.

SEC tries to assertwider regulatory authority over cryptos

Coinbase, the poster child for cryptocurrency exchanges in the US, is currently facing off against the SEC for allowing ‘securities’ to trade on their platform. In a recent report from Financial Times, the exchange CEO Brian Armstrong reveals that the regulatory body asked Coinbase to halt the trading of all cryptocurrencies except Bitcoin.

The CEO recalls that they did not have a choice at that point and that complying with the SEC would have “meant the end of the crypto industry in the US.”

Read more: Coinbase vs. SEC lawsuit: Regulatory body set to face exchange in court on August 4

Bitcoin price struggles to make a move

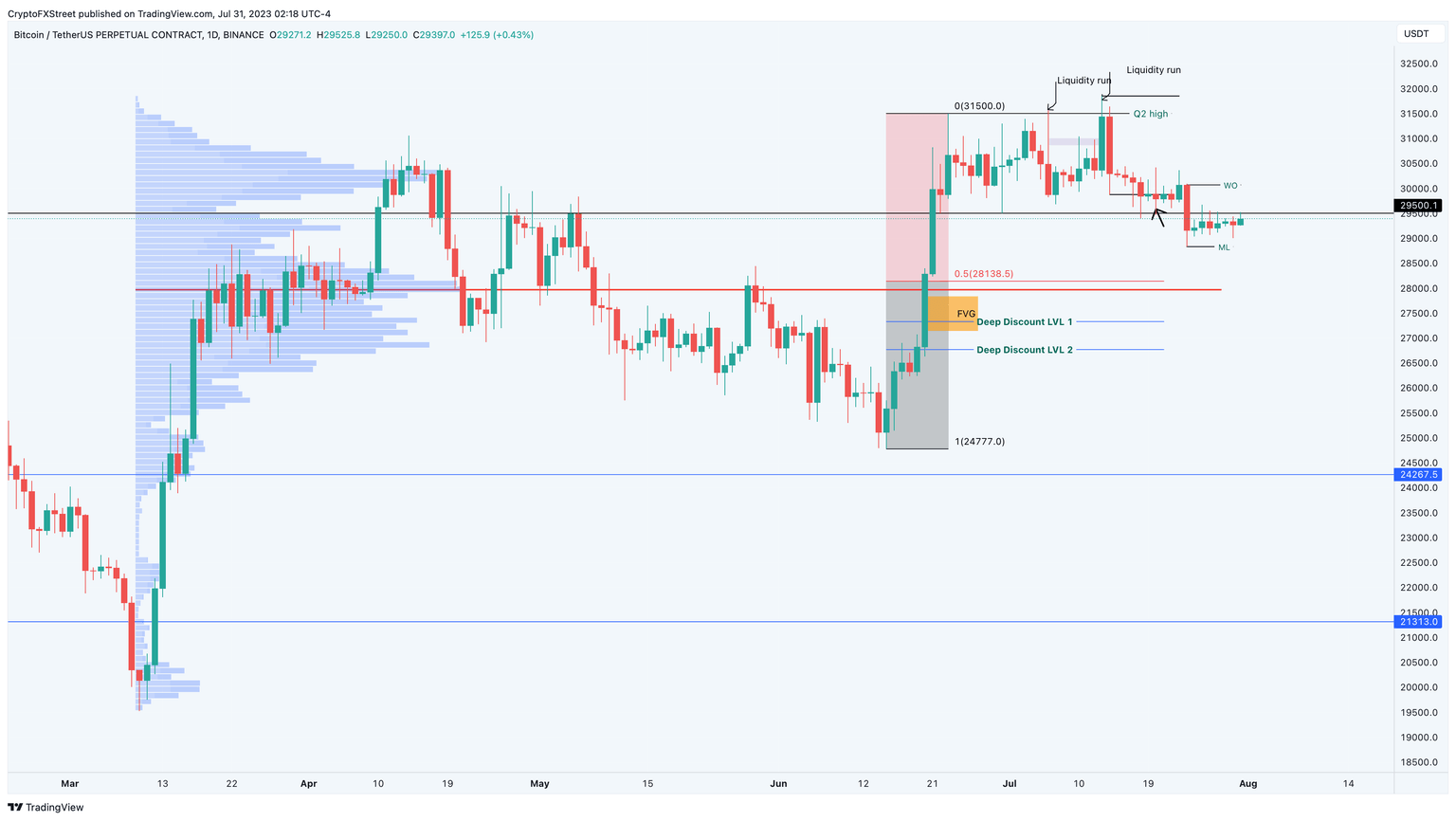

Bitcoin price has lost its volatility once again after the 3.02% move ended on July 24. Since then, BTC has been trying to get past the $29,500 hurdle. As seen in the chart, a sweep of last Monday’s low at $28,830 would allow sidelined buyers to trigger a quick run-up to $29,500, and even the $30,000 psychological level.

On the other hand, a failure to push higher could knock Bitcoin price to $28,138.

BTC/USDT 1-day chart

Read more:

PEPE market left unattended as Shibarium news drives meme coiners to Shiba Inu and BONE

Litecoin trading volume rises 50% to $5 million in the final countdown to LTC halving

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.