Bitcoin holds support ahead of Fed minutes, March rate hike probability rises

Bitcoin held critical support even as traditional risk assets dipped amid improved prospects of an early rate hike by the U.S. Federal Reserve (Fed).

The top cryptocurrency by market value rose 1% to $46,300, ensuring a continued squeeze in a four-week trading range of $45,400-$52,100. On Tuesday, the lower end of the trading range came into play, but sellers failed to push through the long-held support.

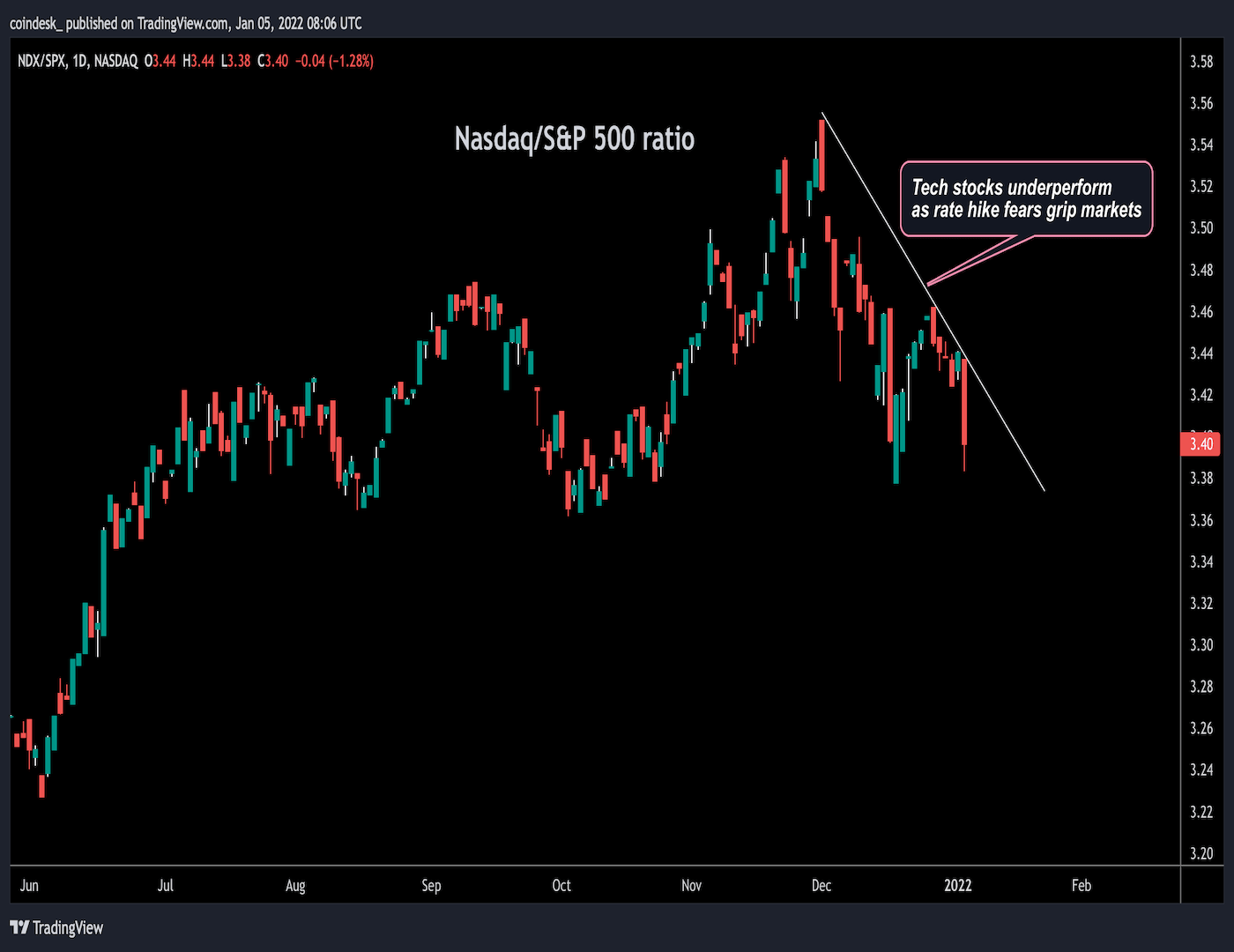

Asian stocks dipped along with the S&P 500 futures and tech-heavy Nasdaq futures. Gold posted marginal gains while copper and other growth-sensitive industrial metals faced losses. The anti-risk currencies like the U.S. dollar, Swiss franc and Japanese yen traded flat to positive, according to Investing.com.

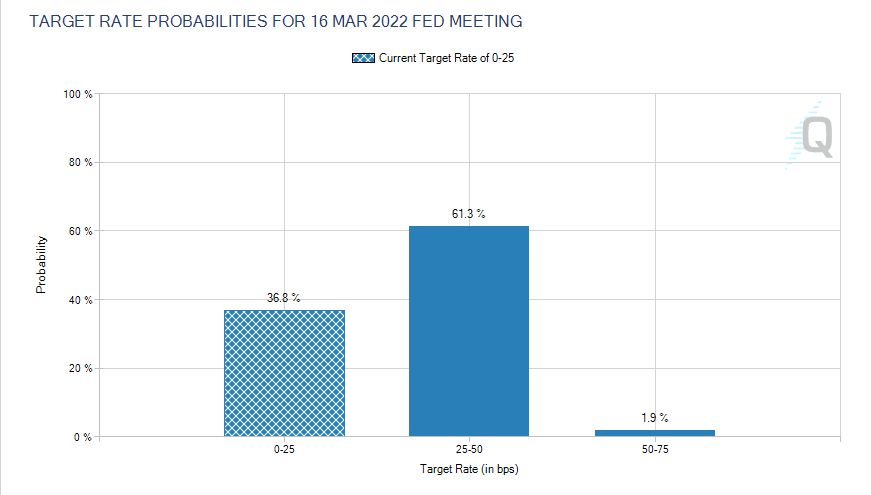

According to the CME Group’s FedWatch Tool, investors were pricing a 61% probability of a 25 basis point rate hike in March. That’s a significant increase from the 25.9% probability a month ago. While last month the central bank signaled three rate hikes for 2022 and an end of liquidity-boosting asset purchase program in March, it assured markets of a gradual pace of policy tightening.

However, a continued rise in the March rate hike probability might mean faster tightening - four rate hikes, each delivered at quarterly meetings.

“If the Fed goes to 4 hikes next year, that is a big statement. That means either two things. First, they are hiking in March, which would be no gap between the end of QE and the first hike. Not impossible, but that is a big statement about intent,” John Turek, the author of the Cheap Convexity blog, said in a blogpost published on Dec. 29. “If they don’t go in March and want to go 4 times next year, that means they will be hiking at a rate faster than quarterly, which is not something they have done in over a decade.”

Bitcoin and asset prices, in general, may come under pressure if the Fed’s December meeting minutes, due at 19:00 UTC on Wednesday, reveal an internal debate on raising rates and starting the balance sheet contraction along with the end of asset purchases in March. That might bolster the probability of a Fed rate hike in two months and perhaps force markets to consider the possibility of four rate rises this year.

“Balance-sheet reduction could be started concurrently with the first-rate hike,” Andrew Hollenhorst, chief U.S. economist at Citigroup, said in a report, according to Bloomberg. “If the first hike occurred in March, it is possible that the committee would simply continue to taper purchases resulting in a reduction in the size of the balance sheet concurrent with the first-rate hike.”

The Fed’s balance sheet has more than doubled to $8.75 trillion since the start of the coronavirus crisis in March 2020, leading to asset price inflation. The balance sheet expansion is set to end with the termination of the asset purchase program in March this year.

While bitcoin is widely touted as a safe haven by the crypto community, it is also an emerging technology and sensitive to monetary policy tightening like the tech-heavy Nasdaq index.

The focus would also be on policymakers’ view of employment and inflation ahead of Friday’s non-farm payrolls report, which is expected to show the economy added 424,000 jobs and the unemployment rate slipped to 4.1% in December.

Bitcoin could pick up a bid if the minutes show that most policymakers were against the idea of controlling inflation at the expense of the labor market strength, implying slower rate hikes. (Policy tightening can bring down inflation, but it hurts businesses).

Last month, Fed’s Chairman Jerome Powell said that the central bank needed to shift its focus from maximum employment to preventing inflation from becoming entrenched. So, while the minutes and Friday’s payrolls may inject some volatility into the crypto market, a clear directional bias may emerge next week after the release of the U.S. inflation data.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.