Bitcoin held above the $41,500 resistance level over the weekend after a slide from the $46,000 level last week. The move came as hashrates for the Bitcoin network hit lifetime highs.

Bitcoin has shown strength this month after a slide to yearly lows of $33,000 in January. It broke above the $38,000 and $41,500 resistance level in the first week of February to monthly highs of $46,000, a level previously seen in the final weeks of 2021.

Traders have since taken profits on the move as bitcoin saw weekly lows of $41,600 in early Asian hours on Monday but recovered to nearly $42,000 in afternoon hours.

Bitcoin hit resistance at $45,000 and has since fell. (TradingView)

RSI, or Relative Strength Index, levels showed readings of 39 on Monday, suggesting an end to the weekend slide and a continuation of the uptrend to the $48,000 level.

RSI is a price-chart indicator that calculates the magnitude of price changes. Readings above 70 suggest an asset is "overbought" and could see a correction, while below 30 imply “oversold” wherein assets may recover.

The weekend price action came as hashrates surged to new all-time highs, as per data from analytics tool YCharts. Hashrates are a measure of the computing power required to mine blocks on the Bitcoin network, and higher rates make it much more difficult for singular entities to try and control the network in the so-called “51% attack.”

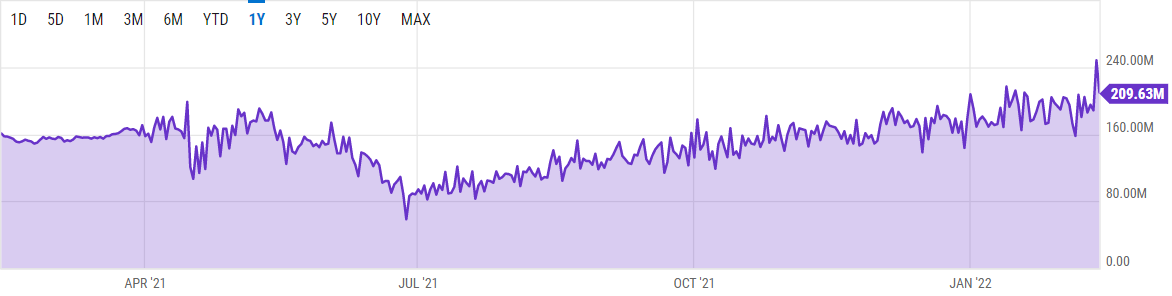

Hashrates hit 248.11 million terahashes per second (TH/s) on Saturday, increasing from the 180 million TH/s level from last week. It currently hovers at 209.63 million TH/s, falling 15.51% in the past 24 hours, data show.

Hash rate surged to all-time highs. (YCharts)

Bitcoin hashrates have increased by over 50% in the past year. As of last July, miners based in the U.S. accounted for 35.4% of the hashrate on the network.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Lukas Enzersdorfer-Konrad, Bitpanda deputy CEO: “Crypto needs Gary Gensler gone”

Lukas Enzersdorfer-Konrad is the deputy CEO at Bitpanda, a broker based in Europe with more than five million users. At the European Blockchain Convention held in Barcelona, the executive shared with FXStreet his views on the current state of the crypto industry and its regulation.

Bitcoin still consolidates despite positive spot ETFs demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

Why is ONDO’s price outlook bullish?

DefiLlama data shows that Ondo TVL reached a new ATH of $613.75 million. Ondo’s Supply Distribution metric shows whale accumulation. On-chain data shows that ONDO’s daily trading volume is rising, and the supply of exchanges is decreasing.

Maker price eyes a rally on technicals and on-chain metrics

Maker trades above $1,500 on Thursday, suggesting a potential rally as technical indicators show bullish divergence. This positive outlook is reinforced by MKR’s Exchange Flow Balance, which shows a negative spike, indicating growing investor confidence in the platform.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin is poised for a second consecutive week of gains, supported by the recent 50-basis-point cut in interest rates by the Federal Reserve. Bitcoin broke above several key technical resistances this week, signaling a rally continuation.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.