- Metaplanet announces $69.13 million injection for further investment in Bitcoin.

- Santiment's data shows BTC's swift rebound to $57,000 occurred right after social media predicted a drop in the $40,000-$45,000 range.

- On-chain data shows that institutional investors hold firm despite the recent price decline.

Bitcoin's (BTC) price is recovering its initial weekly losses, trading 1.2% higher at $56,666 at the time of writing on Wednesday after a 7% drop on Monday. The recovery move is bolstered by Metaplanet's announcement of a $69.13 million investment in Bitcoin and on-chain data indicating that institutional investors remain steadfast despite recent declines. However, technical analysis and market conditions suggest that the broader downward trend could resume in the coming days.

Daily digest market movers: Bitcoin holds $56,000 level as Metaplanet announces $69 million injection to increase its BTC holdings

- On Tuesday, Japanese investment and consulting firm Metaplanet announced a "¥10.08 billion Gratis Allotment of Stock Acquisition Rights," aiming to raise approximately $69.13 million for further investment in Bitcoin. This follows Metaplanet's recent decision to adopt Bitcoin as a reserve asset to address risks related to Japan's significant debt and Japanese Yen (JPY) volatility. The firm's strategy mirrors that of MicroStrategy, led by Michael Saylor, which has accumulated 226,500 BTC worth $14.3 billion since 2020, positioning itself as the largest corporate Bitcoin holder. Metaplanet's move could pave the way for broader adoption of Bitcoin and cryptocurrencies, among other companies.

*Metaplanet announces ¥10.08 billion Gratis Allotment of Stock Acquisition Rights; proceeds to fund additional purchases of $BTC* pic.twitter.com/4OdTFdHnfF

— Metaplanet Inc. (@Metaplanet_JP) August 6, 2024

- According to Santiment's data, Bitcoin's swift rebound to nearly $57,000 occurred right after social media predicted a drop in the $40,000-$45,000 range. This demonstrates the significant role of crowd sentiment in the cryptocurrency's recent recovery, as historically, as shown in the graph below, similar concerns about Bitcoin falling to between $40,000 and $45,000 have often led to rapid price recoveries.

Santiments Bitcoin Social mentions chart

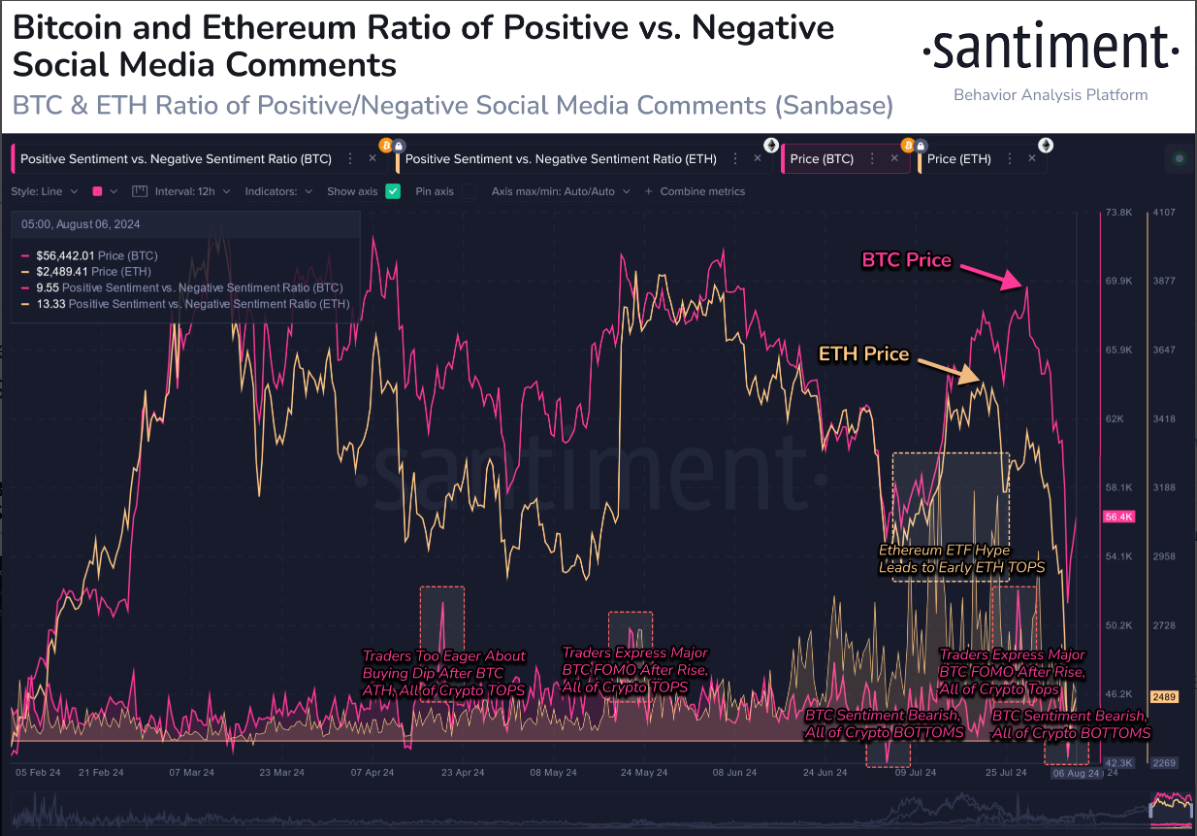

- Additionally, Santiment's data shows that the ratio of positive to negative comments on social media frequently signals key top and bottom opportunities in the market. For example, Ethereum peaked shortly after the mid-July ETF hype, and Bitcoin's recent highs and lows, influenced by waves of greed and fear, were also evident. Currently, Bitcoin's social sentiment indicates potential bottoming opportunities, signaling possible entry points for investors.

Bitcoin ratio of positive to negative comments chart

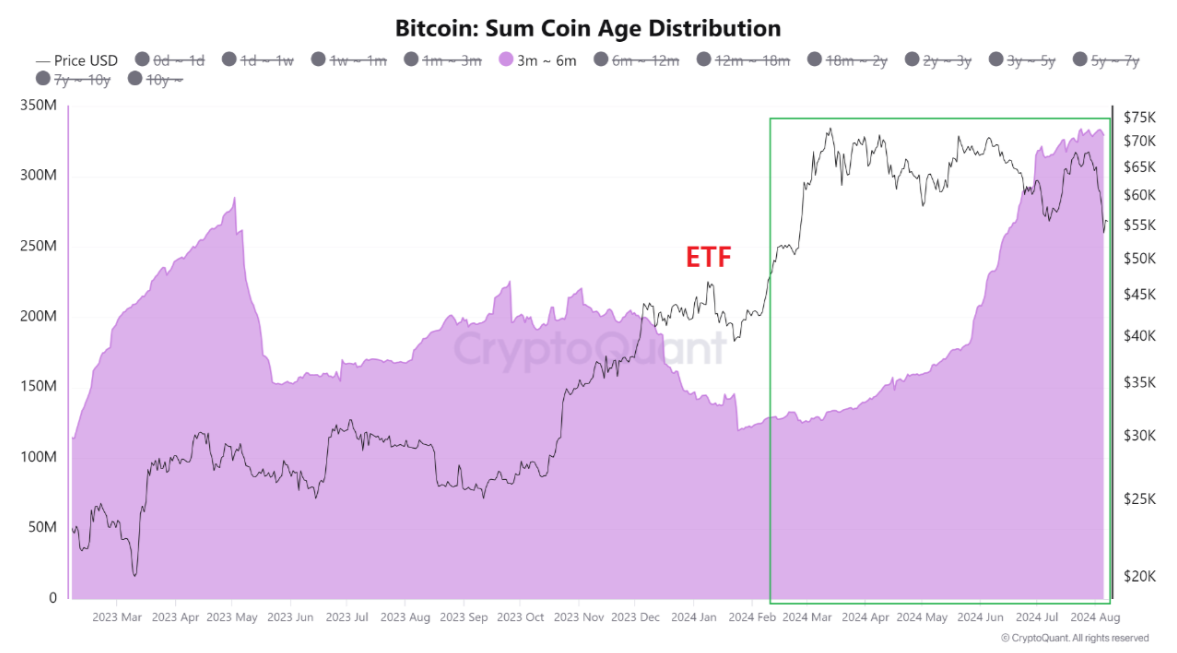

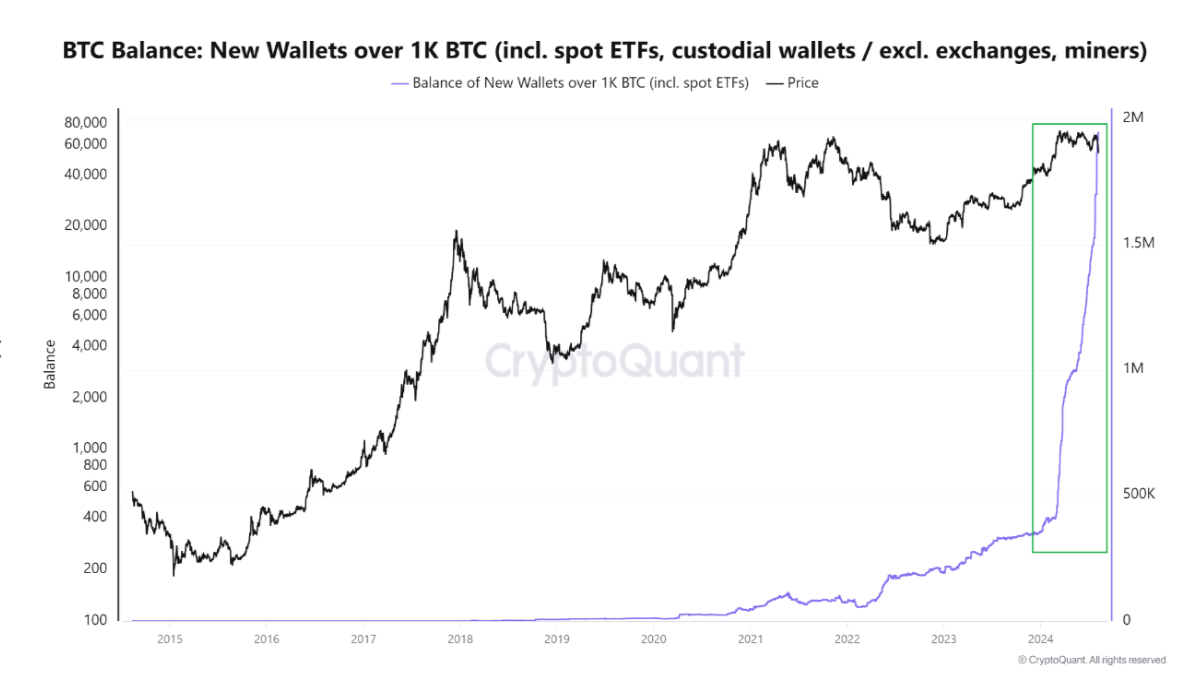

- CryptoQuant data indicates that smart money remains active in the market, as institutional investors have not exited despite the recent price drop. These investors might have pulled out if the decline had been a significant issue tied to the US economic situation. However, the Bitcoin Balance chart and Bitcoin Sum Coin Age chart show no decrease in smart money, suggesting that institutional investors have not cashed out or withdrawn amid the recent market downturn.

Bitcoin Sum Coin Age chart

Bitcoin Balance chart

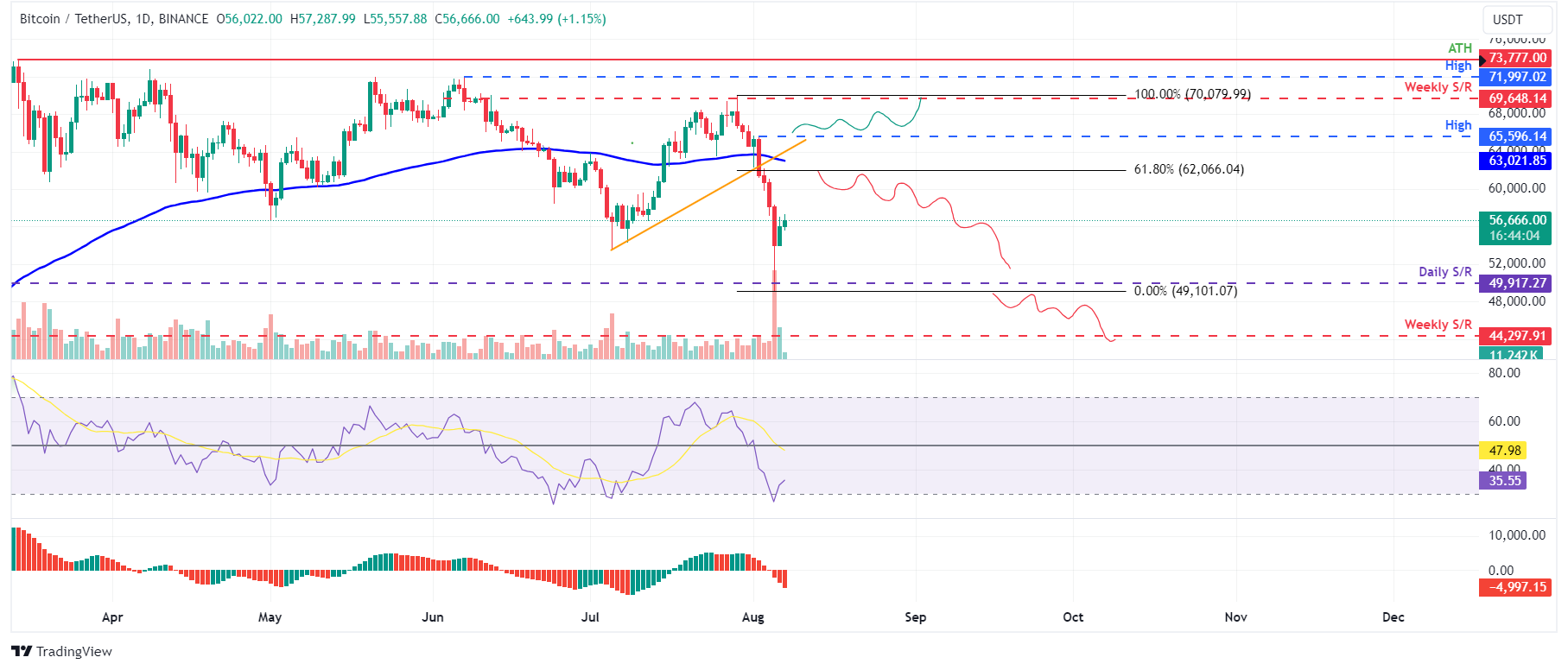

Technical analysis: BTC primed for temporary upsurge before downtrend resumes

Bitcoin’s price broke below the ascending trendline (drawn from multiple swing lows starting July 5) on Friday, leading to a 12% decline over the following three days. However, it tested support at $49,917, bounced back with a 3.7% increase on Tuesday, and showed a slight recovery to trade 1.2% higher at $56,666 at the time of writing on Wednesday.

In this scenario, BTC might see a dead-cat bounce — a short-lived price increase amid a broader downtrend — potentially encountering resistance at the 61.8% Fibonacci retracement level of $62,066 (drawn from the swing high of $70,079 on July 29 to Monday's low of $49,101).

This level aligns with the broken trendline and the 100-day Exponential Moving Average (EMA) at around $63,021, marking it a critical reversal zone.

Failure to break above $62,066 might trigger a 19% crash, back to retest the $49,917 daily support level.

The Relative Strength Index (RSI) indicator in the daily chart is around 35, just above the oversold threshold. This indicates the possibility of a temporary relief rally before the downward trend resumes.

BTC/USDT daily chart

However, a close above the August 2 high of $65,596 would change the market structure by forming a higher high on the daily timeframe. Such a scenario might drive a 6% rise in Bitcoin's price to retest its weekly resistance at $69,648.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

US SEC Crypto Task Force to host the first-ever roundtable on crypto asset regulation

The US Securities and Exchange Commission Crypto Task Force will host a series of roundtables to discuss key areas of interest in regulating crypto assets. The “Spring Sprint Toward Crypto Clarity” series’ first-ever roundtable begins on Friday.

Bitcoin stabilizes around $84,000 despite US SEC regularity clarity and Fed rate stability

Bitcoin price stabilizes around $84,000 at the time of writing on Friday after recovering nearly 2% so far this week. The recent announcement by the US SEC that Proof-of-Work mining rewards are not securities could boost BTC investors' confidence.

BTC, ETH and XRP stabilize as SEC Crypto Task Force prepares for First roundtable discussion

Bitcoin (BTC) price hovers around $84,500 on Friday after recovering nearly 3% so far this week. Ethereum (ETH) and Ripple (XRP) find support around their key levels, suggesting a recovery on their cards.

XRP sees growing investor confidence following SEC ending legal battle against Ripple

XRP whale holdings and network activity signal rising optimism among investors. However, signs of bearish sentiment in the derivatives market could hamper XRP's price growth.

Bitcoin: BTC stabilizes around $84,000 despite US SEC regularity clarity and Fed rate stability

Bitcoin (BTC) price stabilizes around $84,000 at the time of writing on Friday after recovering nearly 2% so far this week. The recent announcement by the United States (US) Securities and Exchange Commission (SEC) that Proof-of-Work (PoW) mining rewards are not securities could boost BTC investors' confidence.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.