Bitcoin hodlers accumulate $960.4 million in BTC a month during the crypto bloodbath

- Bitcoin dominance is on the rise and holders are accumulating 37,400 BTC tokens a month despite mass uncertainty in crypto.

- While altcoins suffered massive losses over the past week, BTC price sustained above the key price level of $25,000.

- Accumulation of the asset fuels a bullish thesis for Bitcoin’s recovery.

The regulatory crackdown on cryptocurrencies has triggered a massive bloodbath in altcoins. Cryptocurrencies like Polygon’s MATIC, Cardano (ADA) and Solana (SOL) yielded double-digit losses overnight.

While altcoins bleed, Bitcoin’s dominance is on the rise and hodlers, market participants who hold the asset for a long duration have continued BTC accumulation.

Also read: Top 3 altcoins bleed in double-digits as Bitcoin dominance rises: MATIC, Cardano and Solana

Bitcoin investors continue scooping BTC

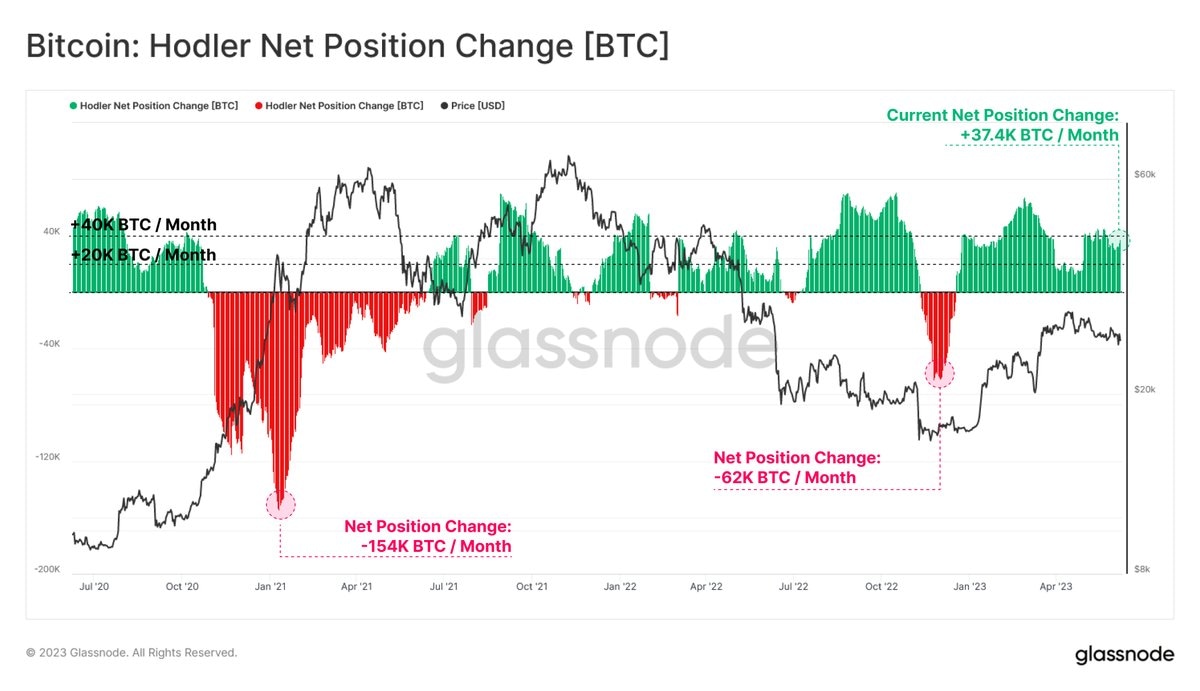

Bitcoin network’s hodlers, the class of investors that prefer to hold the asset instead of taking quick profits have remained resolute. BTC holders continued accumulation of the asset. Based on data from crypto intelligence tracker Glassnode, the cohorts of investors are currently acquiring BTC at the rate of 37,400 tokens a month.

Bitcoin hodler net position change

The chart above shows the net change in the position of hodlers. It shows a consistent green since January 2023, signaling consistent accumulation since the beginning of the year. The regulatory crackdown by the SEC negatively influenced altcoins, however it failed to deter Bitcoin hodlers from scooping up the asset.

The accumulation of Bitcoin is typically considered a bullish sign. Hodlers scooping up the asset are less likely to distribute their holdings to other classes of investors, meaning that the selling pressure on BTC is relatively low.

During crypto market uncertainty, other classes of investors like speculators and traders who hold BTC for less than 12 months, are likely to shed their holdings. Demand from hodlers could absorb the selling pressure and catalyze a recovery in the asset’s price.

At the time of writing, Bitcoin is exchanging hands at $26,071 on Binance.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.