Glassnode noted that this is the first time in Bitcoin history where the network has been used for purposes other than for monetary purposes.

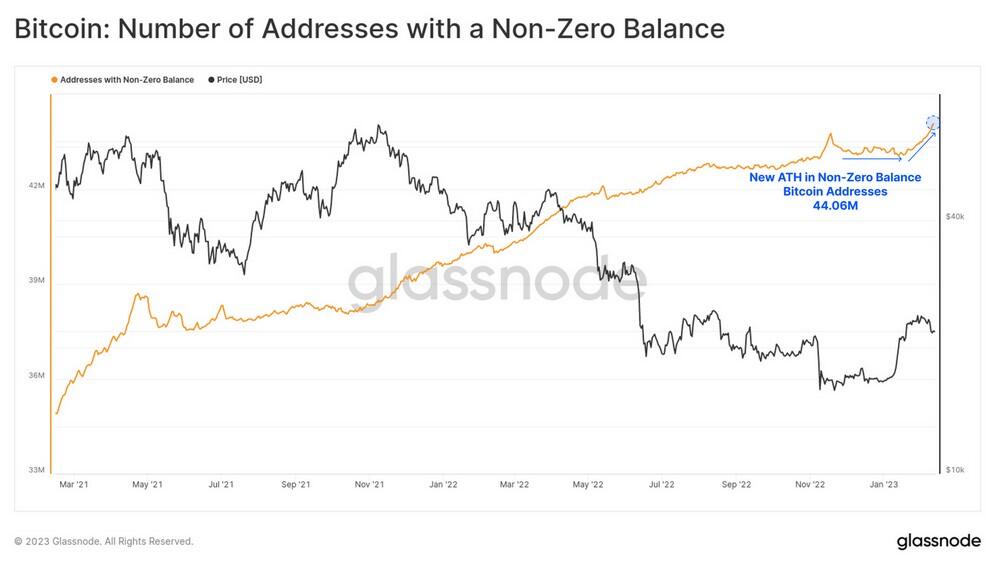

The launch of Bitcoin nonfungible tokens (NFTs) — known as Ordinals — has tipped the number of non-zero Bitcoin addresses to a new all-time high of 44 million, according to crypto analytics platform Glassnode.

In a Feb. 13 report from Glassnode, the firm explained that for the first time in Bitcoin’s 14-year history, a portion of network activity is being used for purposes other than peer-to-peer monetary Bitcoin (BTC) transfers:

This is a new and unique moment in Bitcoin history, where an innovation is generating network activity without a classical transfer of coin volume for monetary purposes.

Glassnode explained that the Ordinals surge has contributed to a “short-term uptick in Bitcoin network usage of late” which has brought many “new active users” with a non-zero BTC balance to the network:

Bitcoin addresses with a non-zero balance is surging. Source: Glassnode

“The primary source of this activity is due to Ordinals, which instead of carrying a large payload of coin volume, is instead carrying a larger payload of data and new active users,” said Glassnode.

“This describes a growth in the user base [...] from usage beyond the typical investment and monetary transfer use cases,” it added.

A new player competing for block space

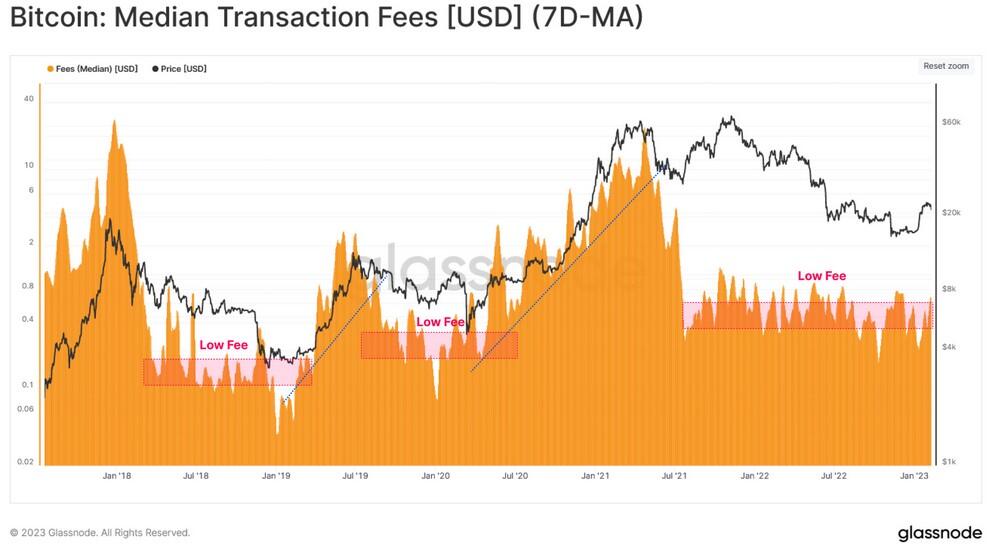

Glassnode noted that Ordinals is now competing for block space demand, which is “creating upward pressure on the fee market,” but noted that this hasn’t led to a significant increase in Bitcoin transaction fees.

According to Glassnode, since Ordinals launched on Jan. 21, the upper range of the mean Bitcoin block size has increased from 1.5-2.0 MB to 3.0-3.5 MB in a matter of weeks.

Mean Bitcoin block sizes over the last three months. Source: Glassnode

However, this hasn't led to a surge in fees. While there have been some short-lived spikes, Glassnode stated that a “new lower bound transaction fee required for block inclusion” has been reached since Ordinals made their mark on Jan. 21.

Median transaction fees on the Bitcoin network over the last five years. Source: Glassnode

The technological applications behind the Ordinal protocol were enabled by the Taproot soft fork, which took effect in November 2021. Bitcoin Ordinals launched on Jan. 21.

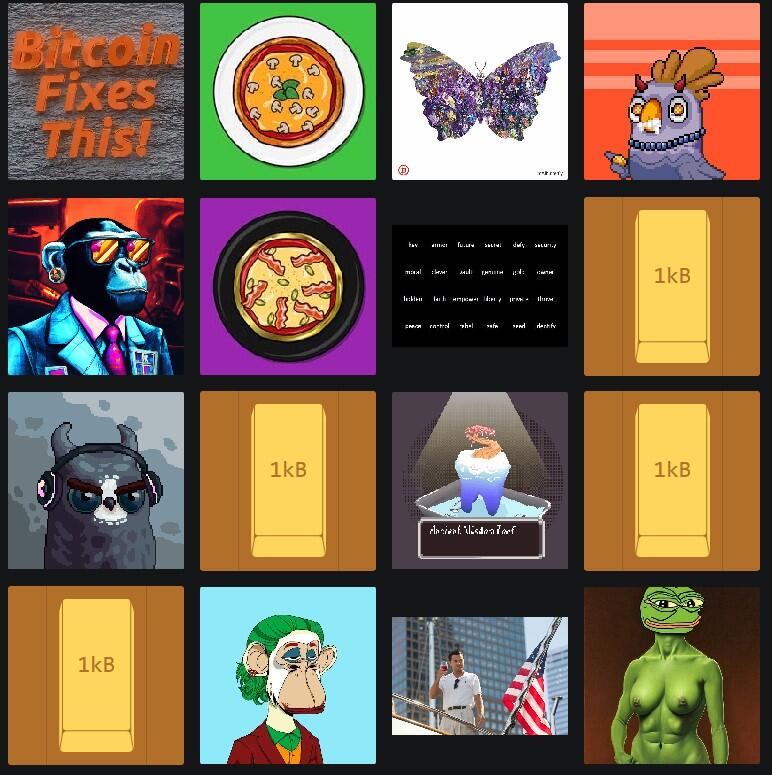

Through the use of the Ordinals numbering scheme, Bitcoin users can assign arbitrary content to satoshis — the smallest denomination of BTC — which enables them to inscribe Bitcoin-native, nonfungible token (NFT)-like images.

There have been over 78,400 NFT-like images and videos inscribed thus far.

The latest Ordinals inscripted onto the Bitcoin network. Source. Ordinals

The impact of the NFT-like images on Bitcoin hasn’t come without controversy though.

Some notable “Bitcoiners” such as Blockstream CEO Adam Back have recently expressed their dislike for the Ordinals protocol, suggesting that it deviates from Bitcoin’s purpose as a peer-to-peer electronic cash system.

However, others have been more open to the idea. Bitcoin bull Dan Held has asserted on several occasions that Ordinals bring more “financial use cases to Bitcoin.”

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.