Bitcoin records largest transaction of 2024, $665.3 million BTC transferred on Tuesday

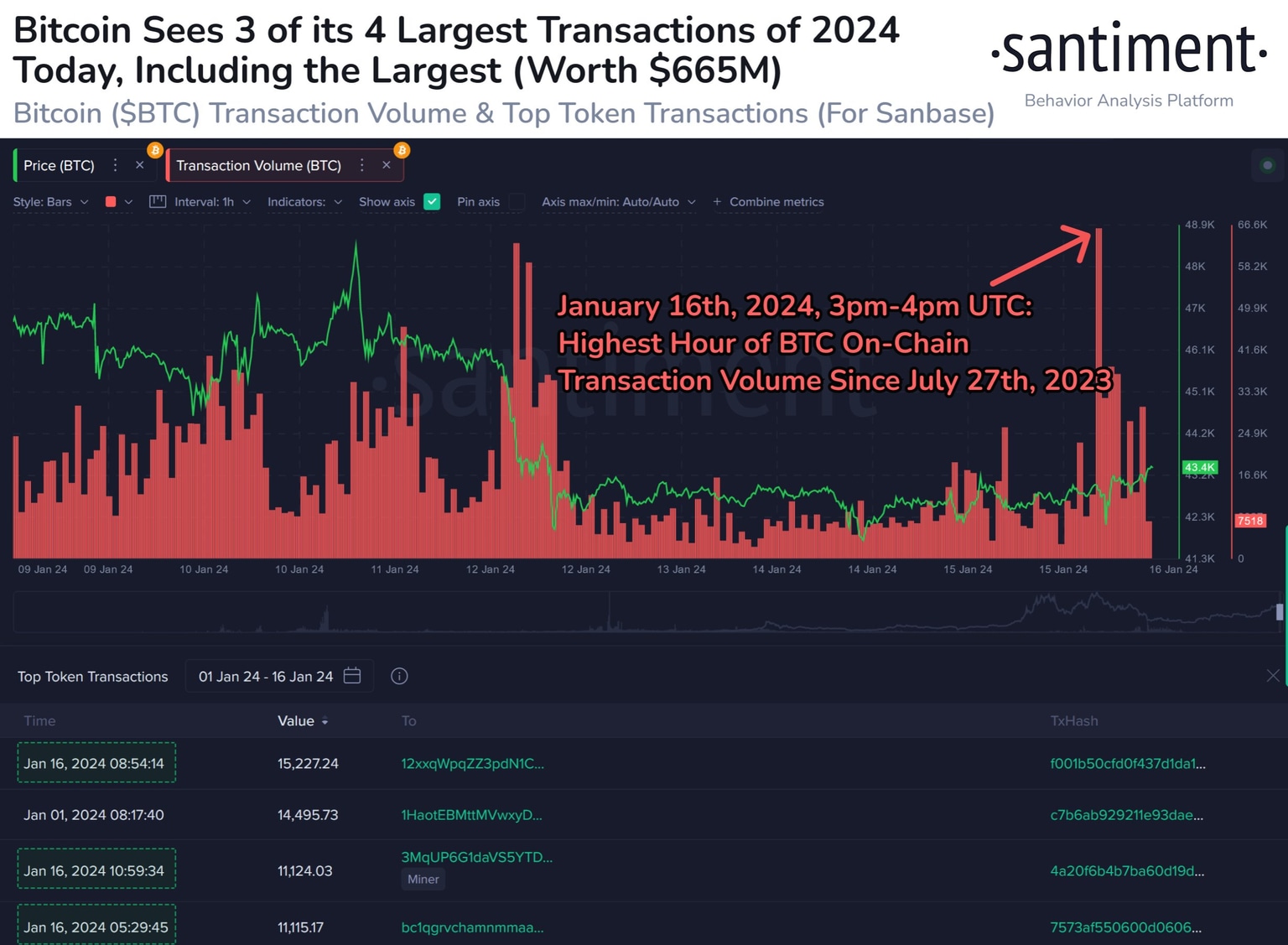

- Bitcoin’s three of four largest transactions so far in 2024 occurred on Tuesday, when $665.3 million in BTC was transferred.

- A total of 42,870 Bitcoin ware moved within an hour, the highest transaction in nearly six months.

- ProShares filed for five leveraged and inverse Bitcoin Exchange Traded Funds on Tuesday.

Bitcoin (BTC) price trades around $42,800 on Wednesday as the network has registered a spike in large transactions after the approval of the Exchange Traded Funds. There were three big moves on Tuesday, when Bitcoin traders moved 42,870 BTC in one hour, the highest hourly movement recorded in the last six months.

Daily digest market movers: Bitcoin transactions worth $665.3 million

- Bitcoin ETF approval ushered an increase in large volume of transactions on the chain.

- According to data from on-chain data intelligence tracker Santiment, three of the four largest BTC transactions in 2024 occurred a few on Tuesday.

- The largest transaction in 2024 was a BTC transfer worth $665.3 million. Santiment recorded the transaction between 3 PM and 4 PM UTC on January 16.

- This move also marked the highest hourly movement on the Bitcoin network in six months.

Bitcoin sees 3 of 4 largest transactions of 2024. Source: Santiment

- ProShares, a Bitcoin ETF issuer, filed prospectus materials for five leveraged and inverse Bitcoin Exchange Traded Products (ETPs). Within days of Spot Bitcoin ETF approval, the issuer is keen on offering leveraged and inverse BTC securities products. This supports a thesis of rising demand for BTC among market participants.

Technical Analysis: Bitcoin price fails to breach resistance zone

Bitcoin price failed to breach the bearish imbalance zone between $43,500 and $45,600, as shown in the chart below. BTC price remained rangebound below $43,500 on Tuesday and declined to $42,810 on Wednesday at the time of writing.

BTC must break through the resistance zone and present a daily candlestick close above the $45,600 mark to break out of the rangebound price action. BTC is currently above its two long-term 50-day and 200-day Exponential Moving Averages (EMAs) at $42,154 and $35,070, respectively.

BTC/USDT 1-day chart

A daily candlestick close below the 50-day EMA at $42,154 could cement the downward trend of the asset, quashing hopes of a recovery in the short term.

Ethereum FAQs

What is Ethereum?

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

What blockchain technology does Ethereum use?

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

What is staking?

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Why did Ethereum shift from Proof-of-Work to Proof-of-Stake?

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.