Bitcoin hit a new all-time high of over $75,000 on Nov. 6, well above its previous $73,800 high in March as traders piled into crypto with early results from the United States elections putting Donald Trump ahead.

At the start of the New York open, Bitcoin (BTC $74,504) initially showed strength, rallying in excess of 3% to hit an intra-day high at $70,577 as US presidential elections-related volatility spiked in the crypto market.

Several hours after the US trading day closed on Nov. 5, Bitcoin reached a new all-time high, hitting $75,000.85 at 3:08 am UTC on Nov. 6 on Coinbase, according to TradingView.

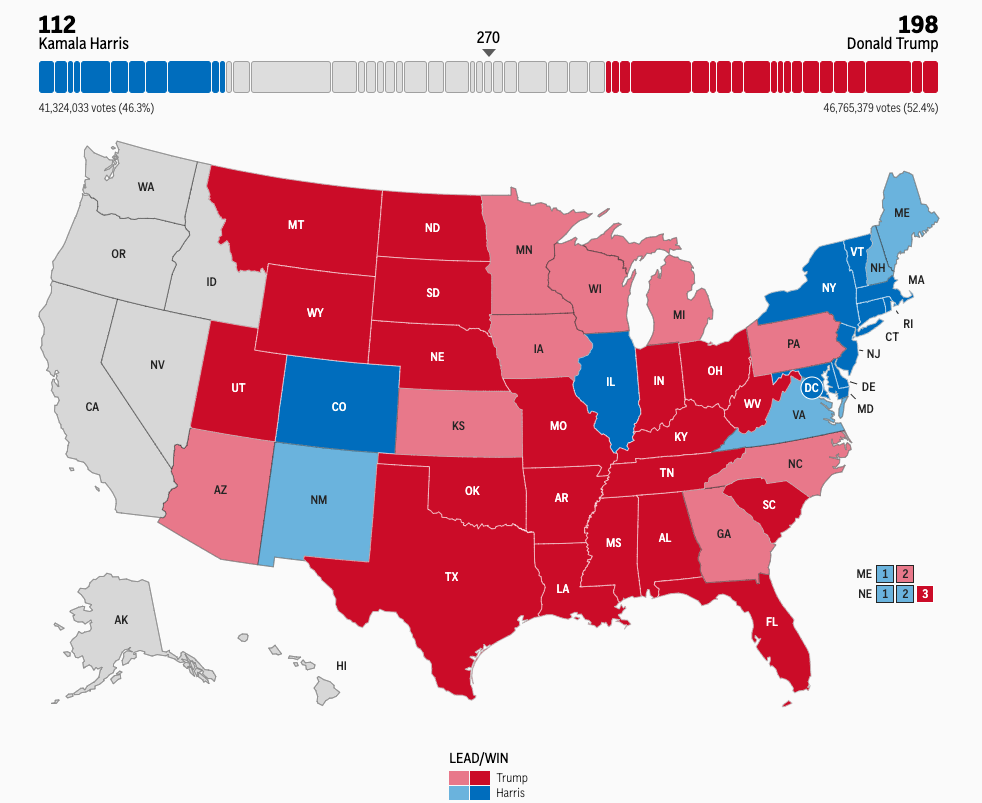

Early election results from the Associated Press showed Trump ahead, winning 198 electoral college votes compared to Kamala Harris’ 112 as of 3:30 am UTC on Nov. 6. Either would need a minimum of 270 electoral votes to win.

Trump led Harris in early results, with many states on the US West Coast and key battleground states still to be called. Source: AP

At the time of publication, Bitcoin is trading at $74,339, up 7.2% over the last 24 hours

For the bulk of 2024, traders have expressed positive views regarding Bitcon’s price potential if Republican presidential candidate Donald Trump won the election, and throughout the year, the Republican and Democratic candidates have evolved their policy views on regulation within the cryptocurrency industry.

On Nov. 5, Bitcoin analyst Tuur Demeester suggested that election news favoring Trump has been connected to rallies in Bitcoin price.

Is Bitcoin’s rally correlated with Trump’s rising odds?

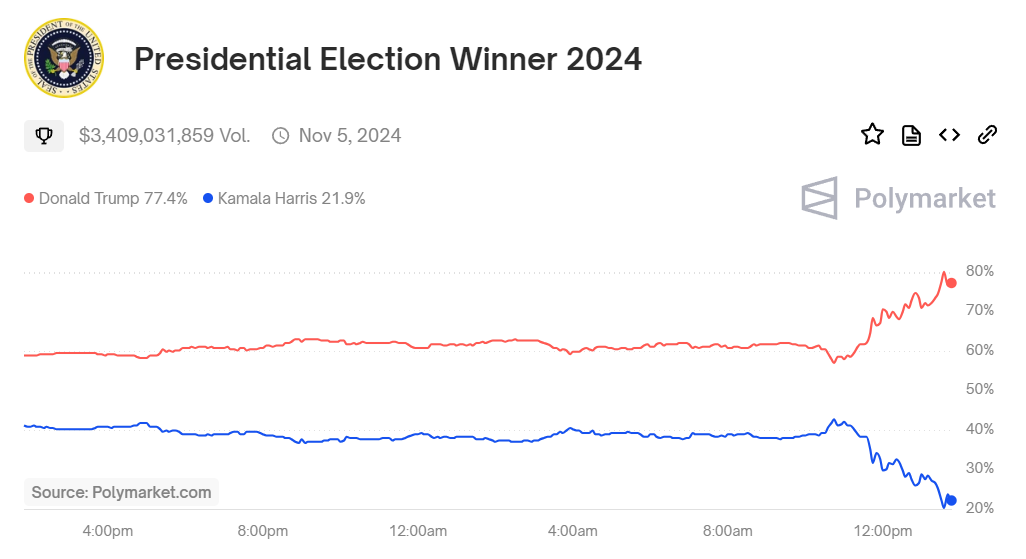

Bitcoin’s price is seemingly aligned with Trump’s rising odds on the decentralized prediction market Polymarket.

On Nov. 5, Bitcoin price rallied back above $70,000 as Trump’s predicted odds of a victory pushed back above 60%, while Harris’ slid below 39%.

Donald Trump’s election win odds hit 80% on Polymarket. Source: Polymarket

Bitcoin price volatility is expected to remain after the US elections

Despite hitting an all-time high, traders expect Bitcoin’s price to remain volatile and changes in market participants’ positioning reflect this sentiment.

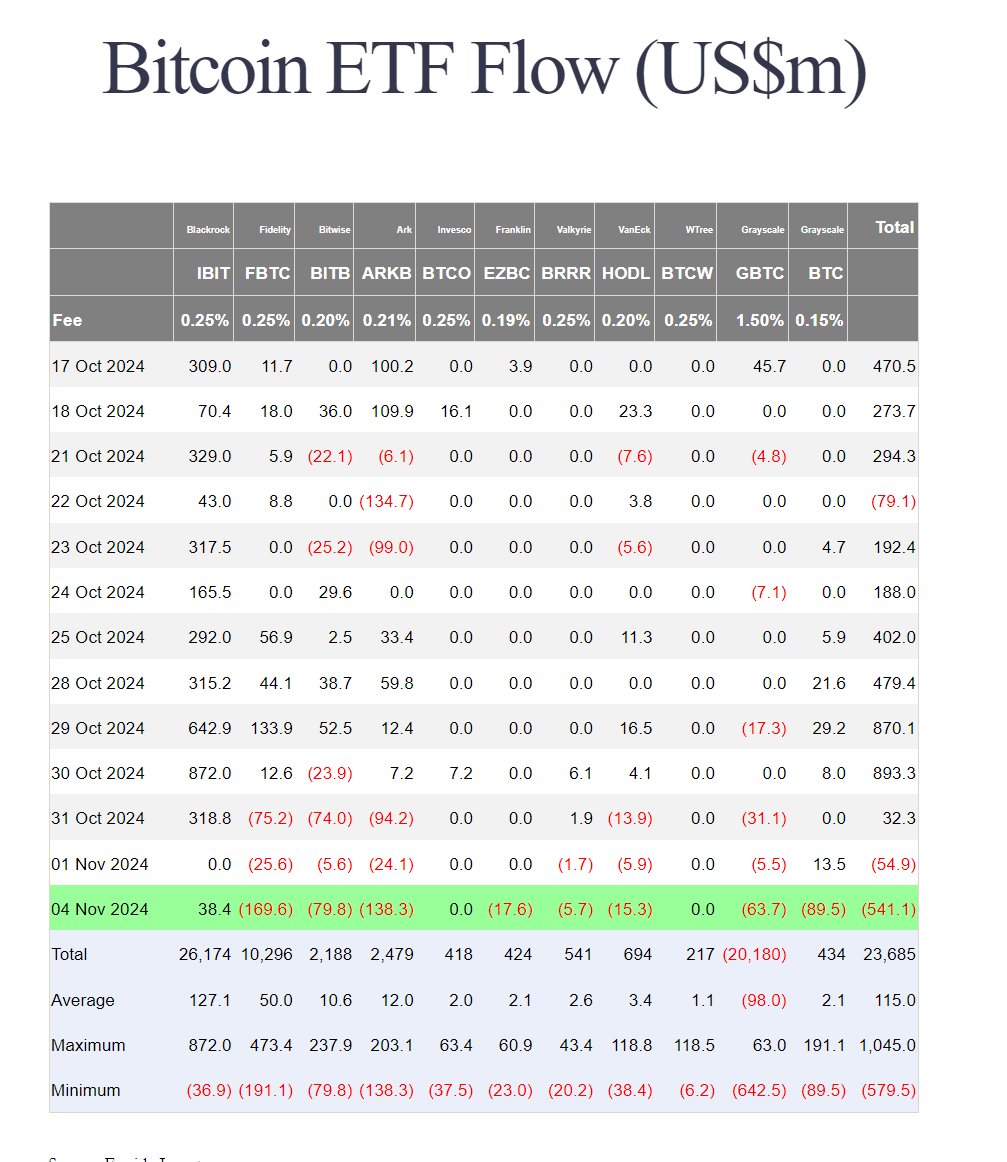

Nov. 4 was a rare day of robust outflows from the Spot Bitcoin ETFs. Total outflows reached $541.1 million as Fidelity, ArkInvest, Bitwise, Grayscale and GBTC saw selling. Meanwhile, BlackRock’s IBIT saw $38.3 million in inflows.

Bitcoin ETF flows ($USD million). Source: Farside Investors

A series of protective measures were observed in the Bitcoin options market, a point that Pelion Capital founder Tony Stewart thoroughly discussed.

Adding a bit of color and translation to Stewart’s comment, Cointelegraph’s options analyst Marcel Pechman said,

Traders are overall more bullish, especially for Nov. 7, Nov. 15, and Nov. 29. Most new bets were on prices at 72,000 to 75,000 or higher. The notable buy of $64,000 puts suggests some fear and market makers face higher risk if Bitcoin drops, as they sold puts at lower prices.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.