Bitcoin hashrate approaches full recovery from China crackdown

The bitcoin hashrate, a measure of computing power on the network, has almost completely recovered to its level in May, when Chinese authorities started a crackdown on the industry.

At the time, China was the biggest bitcoin miner in the world, accounting for 71% of the global hashrate, according to the Bitcoin Mining Electricity Index compiled by the University of Cambridge’s Centre for Alternative Finance.

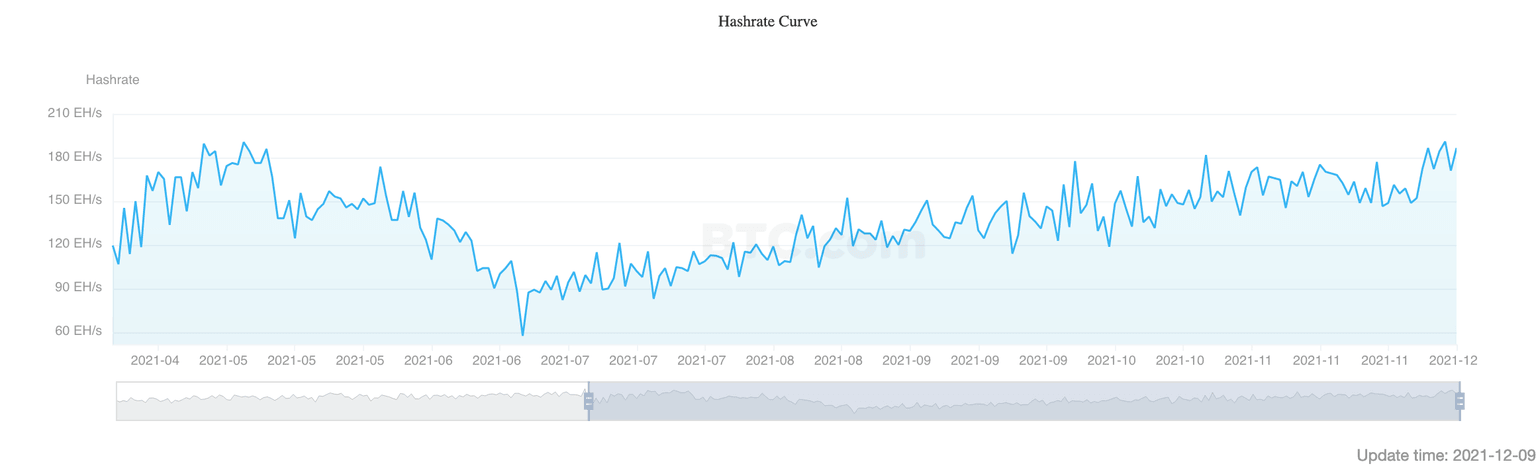

From May to June, the global hashrate roughly halved, data from mining pool BTC.com shows, as Chinese miners went dark en masse to comply with government orders. Since then it’s been increasing steadily as they set up operations overseas and North American miners deployed their mammoth operations.

In the past three days the hashrate has averaged 182.83 exahashes per second, close to the May peak of 190.55 EH/s, data from BTC.com shows.

The bitcoin hashrate since April. (BTC.com)

As the hashrate increases, the difficulty of mining a bitcoin block also increases, in order to keep the time required to mine a block fairly constant.

The difficulty decreased by 1.49% on Nov. 28 after nine consecutive increases, said OKLink senior researcher Eddie Wang. The drop coincided with widespread domain name service attacks on Chinese mining pools, Wang said.

Wang expects the difficulty to increase this weekend by 4%. Arcane Research’s Jaran Mellerud expects a 7% increase, citing website Coinwarz.com.

But “even after that adjustment, mining is still so profitable that everyone and their grandma will want to plug in their machines as fast as possible,” Mellerud said. “It definitely looks like the hashrate will hit an all-time high before the new year, unless we get another brutal bitcoin sell-off shortly after the next difficulty adjustment.”

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.