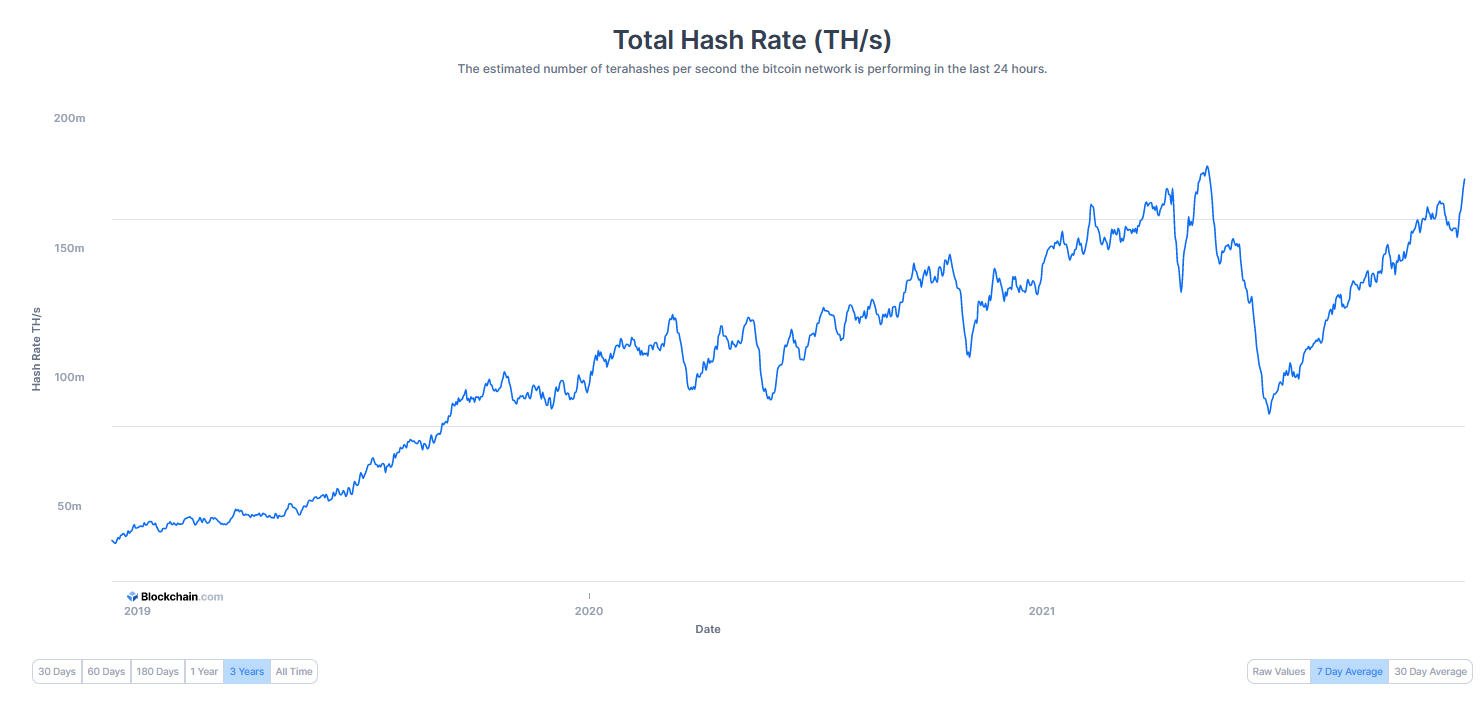

The global hash rate of the Bitcoin network tanked to as low as 84 exahashes per second (EH/s) at the start of June following the Chinese government’s crackdown on the crypto mining sector.

According to Blockchain.com, the global hash rate has increased by 108% since June, with the Bitcoin network performing at a rolling seven-day average of 175 EH/s as of Wednesday.

The figure is roughly 3% shy of peak levels of 180 EH/s seen at the height of the previous bull cycle in May. It is a commonly held belief that the trends in hash rate correspond with the price of Bitcoin (BTC), suggesting that there may be some positive price action on the horizon despite the overall gloomy sentiments in the market at the moment.

Bitcoin's total hash rate. Source: Blockchain.com

The actuality of the global hash rate ATH is hard to determine, however, as a lot of popular platforms differ in their estimates of the history and current performance of the Bitcoin network. According to data from BitInfoCharts, the ATH in May hit 197 EH/s before dropping to the 68 EH/s mark in June. As of Wednesday, the platform had Bitcoin’s hash rate at 191 EH/s, while YCharts has the current performance at 186 EH/s.

Prior to the ban, China-based Bitcoin miners accounted for a whopping 70% of the global hash rate. The landscape has shifted dramatically since then, with the United States becoming the nation that accounts for the majority of Bitcoin’s hash rate at 42%, per estimates from the University of Cambridge’s Bitcoin Electricity Consumption index.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC remains calm before a storm

Bitcoin price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as investors absorb the tariff announcements.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call. Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

BTC stabilizes while ETH and XRP show weakness

Bitcoin price stabilizes at around $87,000 on Friday, as its RSI indicates indecisiveness among traders. However, Ethereum and Ripple show signs of weakness as they face resistance around their key levels and face a pullback this week.

Bitcoin: BTC remains calm before a storm

Bitcoin (BTC) price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.