Bitcoin goes through supply shock while analyst forecasts $200,000 BTC

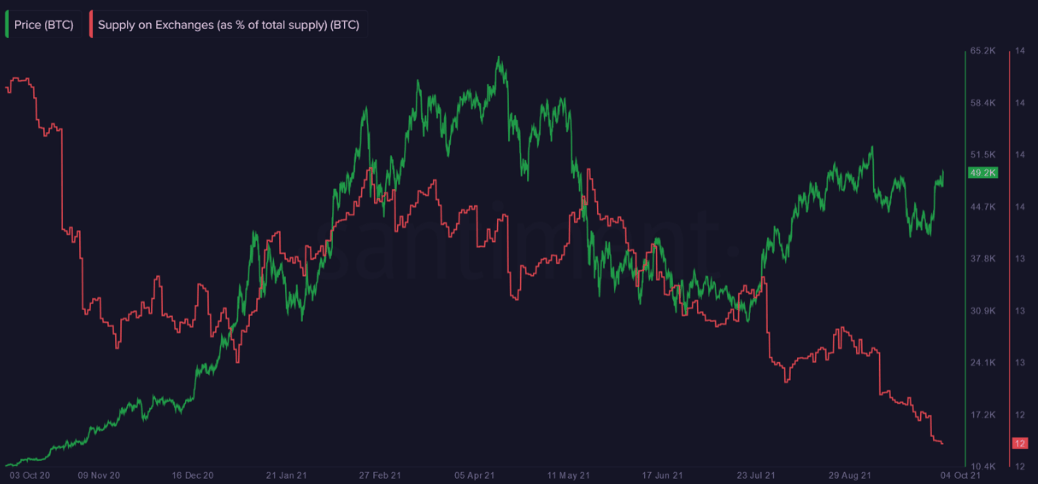

- Bitcoin supply on exchanges continues to drop, no signs of major BTC inflows to exchange wallets.

- Will Clemente's Delta Top Model currently predicts a top of $109,000, BTC rally is expected to push the peak above $200,000.

- Wallets that own 10 to 10,000 BTC currently hold a total of 9.26 million tokens, and large investors take a "wait and see" approach.

Bitcoin supply shocks have historically pushed the asset’s price higher. Bitcoin’s previous rallies have been triggered by a drop in supply across exchanges and a spike in whale accumulation.

Analyst sets target of $200,000 for Bitcoin, whale accumulation continues

As more institutions throw their weight behind the largest cryptocurrency, BTC has rallied to $50,000. The asset has been making gains since El Salvador’s acceptance of BTC as legal tender.

Bitcoin balance across exchanges is considered a key indicator of a bullish trend reversal. The asset’s on-chain activity across exchanges is fairly neutral and there are no significant BTC inflows over the past week.

Interestingly, the supply of BTC is on a downward trend. Since there is no increase in exchange BTC balance, sell-side pressure on Bitcoin is relatively low. Low sell-side pressure is generally considered an indicator of a bullish reversal in BTC price.

Bitcoin supply on exchanges (past 12 months).

When Bitcoin holders start selling and decrease their exposure to the asset, there is a negative impact on price. The MVRV ratio (market-value-to-realized-value) plays a key role here. MVRV is calculated as the ratio of the asset’s market capitalization to realized capitalization.

A higher MVRV ratio indicates higher unclaimed profits and increased chances of holders and profitable investors selling their holdings.

Currently, Bitcoin’s MVRV is 6.4%, meaning addresses that acquired BTC last month are profitable.

If MVRV climbs up, there is a possibility of a sell-off.

However, it is important to note that two weeks ago MVRV was at -12.5%, and a low MVRV ratio presents an opportunity for whales to accumulate.

Not surprisingly then there has been notable whale accumulation. Large wallet addresses (with 10 to 10,000 BTC) are currently holding 9.26 million BTC, waiting for the next move in the asset’s price.

Bitcoin 30-day MVRV over the past 3 years.

On-chain analysts are predicting a bullish turn of events in BTC, and predictions are consistent with $100,000 BTC by the end of 2021.

Will Clemente, the on-chain analyst best known for his “BTC supply shock” narrative recently proposed the “Delta Top Model” for predicting BTC price.

Clemente has used a reactive price model that is based on the “Mean Reversion theory,” assuming an asset’s price converges with its average price over time.

As of October 4, the model predicts $109,000 BTC, though Clemente is waiting for the slope to get steeper as BTC price continues its upward climb. If the slope hits the 2013 level, the next target is $200,000.

Delta Valuation Model proposed by on-chain analyst Will Clemente.

FXStreet analysts have evaluated the BTC price trend. Analysts have predicted that the asset will skyrocket to $80,000 if BTC price crosses $55,000 with the current bullish momentum.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.