- Bitcoin price begins next expansion move, first target at $77,000.

- A slight pause at a double-top near $66,000 is likely.

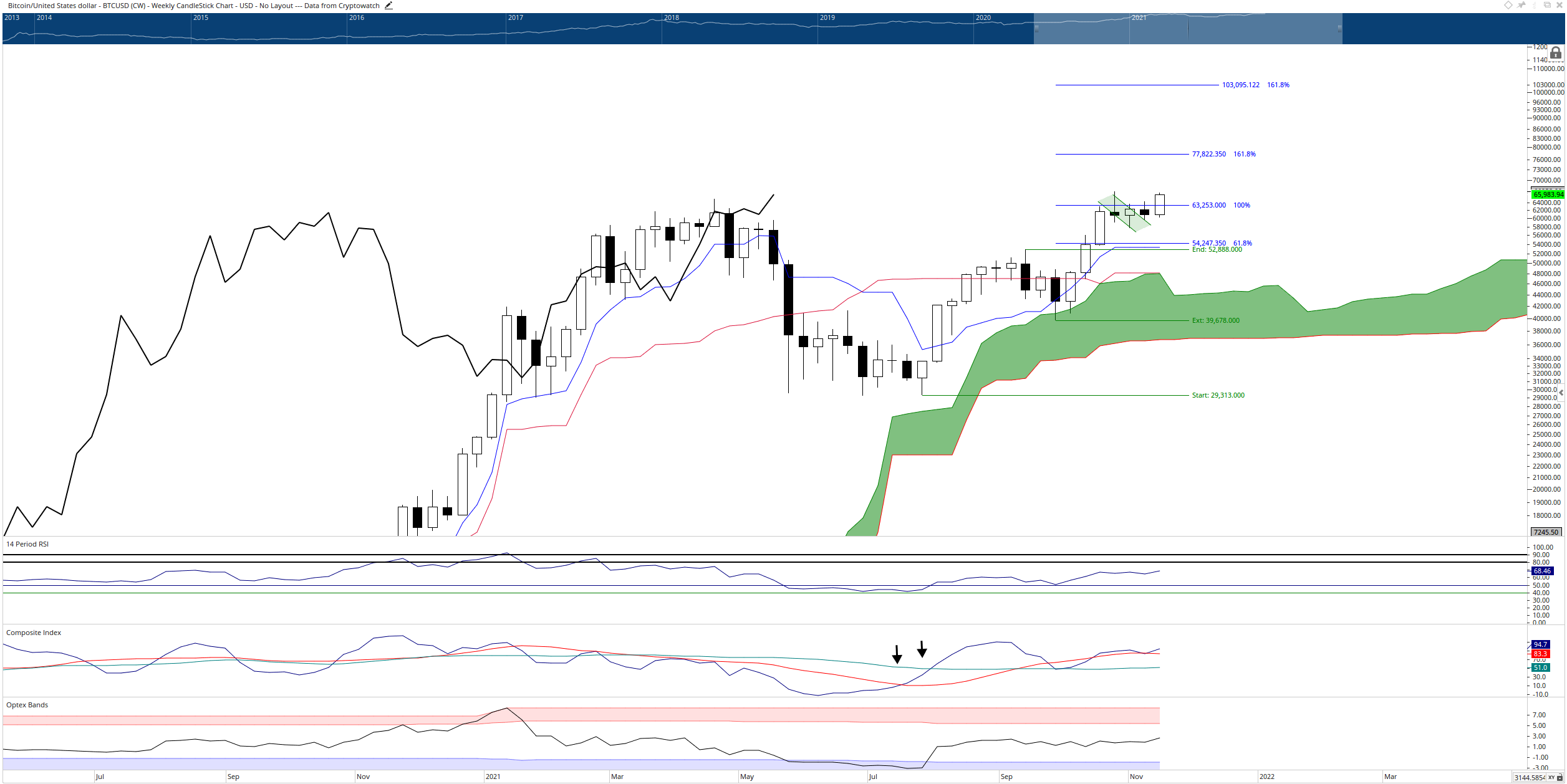

- The Weekly Ichimoku chart shows a massively bullish technical position.

Bitcoin price action shows its weekly Ichimoku chart to be in the most bullish position it has been in since the week of July 31st, 2021. Thus, bulls are positioned perfectly to see Bitcoin rally to $77,000 and beyond.

Bitcoin price ready to pop, $67,000 final best buy opportunity before six-digit Bitcoin

Bitcoin price is locked and loaded for a monster move higher. On the weekly Ichimoku chart, every single condition necessary for an Ideal Bullish Ichimoku Breakout is present. The current close is above the Cloud, the Tenkan-Sen and the Kijun-Sen. Future Span A is above Future Span B. And, most importantly, the Chikou Span is above the candlesticks and in open space.

The first breakout target for Bitcoin is the 161.8% Fibonacci expansion level at $77,000. From there, Bitcoin would likely initiate a retracement to test the Tenkan-Sen if a big enough gap exists. Above $77,000 is another 161.8% Fibonacci expansion (derived from a logarithmic measurement) at $103,000.

While the current technical conditions of Bitcoin are incredibly bullish, buyers should be aware of the growing and expanding gap between the weekly candlesticks and the Tenkan-Sen. The following weekly candlestick will likely see the Tenkan-Sen slope higher, reducing the existing gap somewhat. But the further Bitcoin travels away from the Tenkan-Sen, the more likely a violent mean reversion correction could occur.

BTC/USD Weekly Ichimoku Chart

A double-top at $66,000 could act as a source of near-term resistance. The current outlook would be invalidated if sudden and unexpected selling pressure were to push Bitcoin below the Tenkan-Sen at $54,250. Total nullification of any bullish sentiment will be complete if Bitcoin moves below the weekly Cloud at $35,000 – an improbable, but possible event.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Polygon joins forces with WSPN to expand stablecoin adoption

WSPN, a stablecoin infrastructure company based in Singapore, has teamed up with Polygon Labs to make its stablecoin, WUSD, more useful in payment and decentralized finance.

Coinbase envisages listing of more meme coins amid regulatory optimism

Donald Trump's expected return to the White House creates excitement in the cryptocurrency sector, especially at Coinbase, the largest US-based crypto exchange. The platform is optimistic that the new administration will focus on regulatory clarity, which could lead to more token listings, including popular meme coins.

Cardano's ADA leaps to 2.5-year high of 90 cents as whale holdings exceed $12B

As Bitcoin (BTC) gets closer to the $100,000 mark for the first time — it crossed $99,000 earlier Friday — capital is rotating into alternative cryptocurrencies, creating a buzz in the broader crypto market.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.