- Bitcoin’s liquid supply continues to decrease as institutions are stockpiling the leading cryptocurrency.

- After Canadian Bitcoin exchange-traded funds were approved in the country, Grayscale’s dominance in the market declined.

- It could just be a matter of time until Bitcoin exchange-traded funds are approved by the United States Securities & Exchange Commission.

Investment firms have been absorbing massive amounts of Bitcoin, as exchange-traded BTC vehicles now manage $46 billion worth of the cryptocurrency.

Investment vehicles hold 4.3% of Bitcoin's circulating supply

Since February 2021, the amount of Bitcoin supply in the network has grown more than the circulating supply since 2017. The pioneer digital currency, with its advantage of scarcity — a limited supply cap of 21 million — has seen its liquid supply continuously decrease.

Institutional demand for the leading cryptocurrency has not been slowing down. Nasdaq-listed firm MicroStrategy continues to stack sats, with its CEO Michael Saylor even turning to debt offerings to finance purchases of Bitcoin worth billions.

Bitcoin exchange-traded funds (ETFs) currently have over 800,000 BTC under management, roughly 4.3% of the circulating supply of the digital asset. More than 100,000 BTC has been absorbed by Bitcoin funds since the start of 2021.

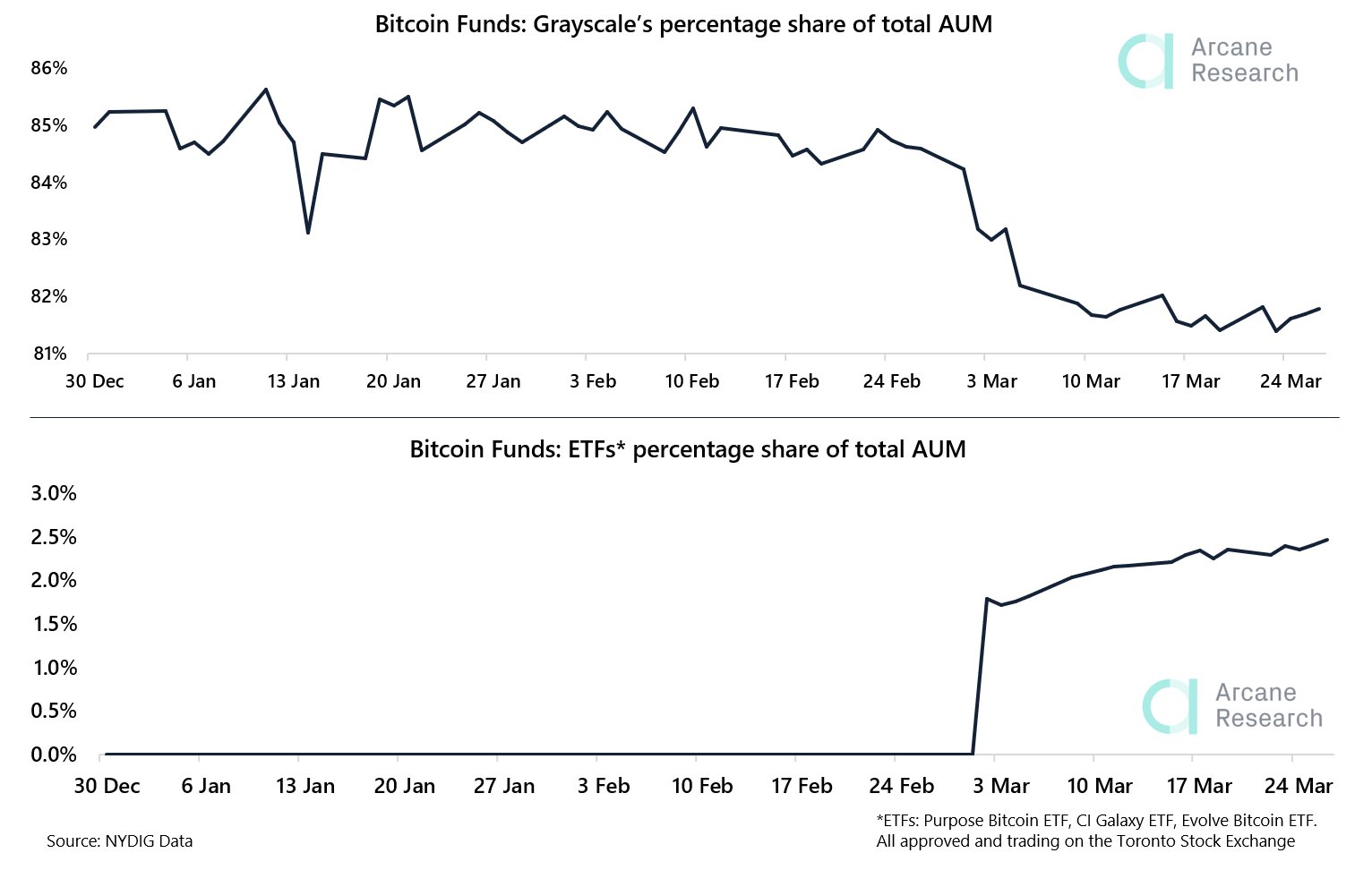

Grayscale Investments continues to dominate the space, accounting for 82% of the management market, equivalent to $34.7 billion worth of Bitcoin. However, Grayscale’s dominance has declined as three Canadian ETFs have been approved in the country, according to Arcane Research

The Canadian Bitcoin ETFs – Purpose ETF, Evolve ETF and Galaxy ETF – now account for 2.5% of the market share. Just after one month of the launch of the world’s first Bitcoin ETF by Purpose Investments, the product’s assets under management has crossed $1 billion.

Bitcoin funds: Grayscale's percentage share of total AUM

Just a matter of time until the SEC approves a Bitcoin ETF

ETFs are a type of investment product that tracks the prices of certain underlying assets. These investment vehicles enable institutional investors to get exposure to the cryptocurrency without holding the digital asset itself. According to JPMorgan, most asset managers still prefer Bitcoin in the format of a fund.

Although three crypto ETFs have been approved in Canada, the US Securities & Exchange Commission (SEC) has turned down all applications for Bitcoin ETFs so far. Therefore, these products are unavailable in the United States.

VanEck, Fidelity Investments and SkyBridge Capital have recently applied for Bitcoin ETFs with the SEC. However, the securities regulator has not decided to reject or accept these applications.

As the SEC has acknowledged VanEck’s Bitcoin ETF proposal, the clock started ticking as the regulator has 45 days to approve, deny or prolong its review of the proposal.

However, as institutional demand increases for exposure to the leading cryptocurrency, it could just be a matter of time before Bitcoin ETFs get approved in the country. According to John Davi, CEO at Astoria Portfolio Advisors, the Biden administration has appointed officials to the SEC with expertise in cryptocurrencies who may speed up the approval process. He added:

It’s just a matter of time. I think the time has come and there is a place in people’s portfolio for digital assets.

Digital asset fund inflows lowest in six months

Although flows into cryptocurrency investments remained positive for the week ending March 27, the net inflows of $21 million were the lowest in six months. This was the lowest level since October 2020, when Bitcoin was trading at the $14,000 price level.

According to the CoinShares report, investor appetite for digital currencies seemed to have waned, coupled with the horizontal movement of the Bitcoin price. Institutions were taking profit to lock-in some of their unrealized gains.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.