Bitcoin forecast: Shock and awe therapy at work

- Bitcoin retreats from the recent high retains, solid gains.

- The near-term picture implies range-bound trading as long as $8,400 stays intact.

Bitcoin's jaw-dropping rise at the end of the previous week left even the majority of traders and analysts perplexed. The first digital coin gained over 40% in less than 24 hours and hit $10,484, the highest level since the beginning of September 2019. While the price has retreated from the peak to trade at $9,200 by the time of writing, it is still nearly 25% on.a week-to-week basis, which is an impressive growth even in the realm of cryptocurrencies.

On Friday, BTC/USD has been range-bound for the most part of the day amid slow post-Halloween markets. However, if thee history is any guide, this calm may be deceptive and erupt into furious market movements any minute.

This volatile and unpredictable nature of digital coins is something that scares regular folks and holds back their mass adoption.

Riddle wrapped in obscurity

While the true catalysts behind the dramatic move remain unknown, there is no shortage of theories and speculations. Without going deep into details. let's have a quick look at what's being discussed by the crypto community as the most probable growth drivers.

Chinese hand. Chinese President Xi Jinping brought blockchain into focus and proclaimed it as a new top priority for the country. The shares of Chinese blockchain-related companies soared, while cryptocurrency traders credited Xi with Bitcoin's rally. However, considering the timing of the speech and the fact that bitcoin trading is still banned in China, this reasoning seems to be a bit of a stretch. Some experts, including Dovey Wan, a founding partner of Primitive Ventures, the Western trader just overreacted to Xi's comments.

Whales are back to their old ways. This is another conspiracy theory. It implies that some large bitcoin holders use their purchasing power to squeeze out weak or small hands from the market and profit at their benefit. They drive the price lower, and the majority of small buyers leave the market, they jump in and start to pump the price. Considering that they cash out right before the dump and buy at the bottom, their earning should be pretty handsome. In this case, whales morph into perfect scapegoats as it is si easy to blame some mysterious large investors in any strange situation.

Gaps on CME (Chicago Merchantile Exchange) and BitMEX position liquidations are other popular explanations for Bitcoin rally. While they all have the right to exist, none of them can be regarded as a viable reason for a 40%-rally within a 24-hour timeframe.

What else occupy the minds of the crypto community

Many traders seek correlations between cryptocurrency price movements and macroeconomic/geopolitical developments. The theory goes that accommodative monetary policy and a trend of lower rates among global central banks should attract investors to the crypto space. Bitcoin's issuance is limited to 21 million coins, which means that has a defamatory mechanism integrated into its code. Unlike fiat currencies, no one can print Bitcoin at will to satisfy the needs of certain groups, governments and economies.

From this perspective, Bitcoin is more like gold as it has a limited supply. The anti-inflation feature should attract long-term investors and those who want to save the value. However, this theory has little evidence so far. Thus, the US Federal Reserve lower rates earlier this week, though Bitcoin traders have barely noticed it.

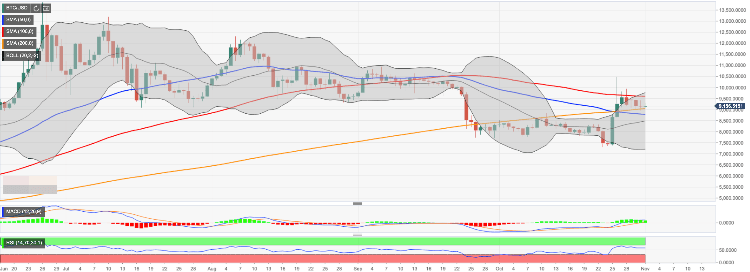

BTC/USD, daily chart

Bitcoin has been drifting down since the beginning of the week. The first digital coin topped at $10,484 on October 26; however, the spike above SMA100 (Simple Moving Average) on a daily chart proved to be unsustainable as the price retreated to the range below $10,000 and spend the best part of the week close to $9,000 handle. While BTC is still about 25% higher on a week-to-week basis, traders are anxious that the downside correction may gain traction once the support of $9,000 gives way.

Let's have a closer look at the technical picture to see if these predictions are valid.

On a daily chart, BTC/USD is capped by SMA100 (currently at $9,600). Thus we will need to see a sustainable move above this handle for the upside to gain traction. Once this happens, the next critical barrier $10,000 will come back into focus, followed by the recent high of $10,484.

However, waning momentum and downward-looking RSI makes this scenario less possible at this stage.

On the downside, $9,000 is strong support with SMA200 daily located on approach. This technical indicator served as a strong resistance since the end of September, now it has a potential to tame the bears and become the jumping-off ground for the next bullish run.

A sustainable move below $9,000 will take us to SMA50 daily at $8,7700 and the middle line of the daily Bollinger Band at $8,450. This is a pivotal area that needs to be defended if we want to retain the upside bias in the long run.

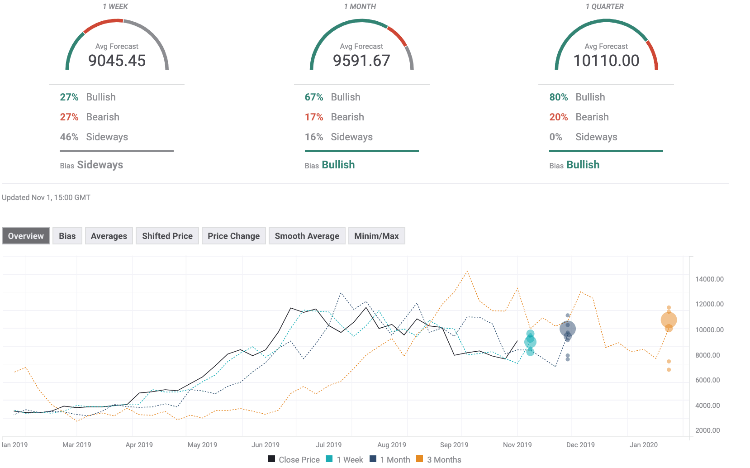

The Forecast Poll of experts improved significantly since the previous week. Expectations on all timeframes are mostly bullish. The average price forecasts are above 9,000.

Author

Tanya Abrosimova

Independent Analyst