The hotly-debated legislation is no surprise to hard money supporters, as Cameron Winklevoss saying that it would "plunder" future generations.

The United States tax bill which could hurt Bitcoin (BTC) and crypto holders will “continue the plunder of future generations,” Cameron Winklevoss argues.

According to new estimates, the proposed Infrastructure Bill currently under discussion in Washington would pile on an extra quarter of a trillion dollars in debt.

Bill may add $256 billion in debt

As the contentious bill makes its way through government, crypto voices continue to warn about a potential tax nightmare that, they argue, can still be easily avoided.

As Cointelegraph reported, language in the Bill may place undue demands on holders and businesses alike.

An effort is currently underway from pro-Bitcoin senators and the crypto industry to change Bill’s phrasing to reduce the future burden.

Nonetheless, the Bill in and of itself is a cause for concern on an economic level, Winklevoss says.

“The infrastructure bill is estimated to add another $256B to the federal budget deficit,” the Gemini exchange co-founder tweeted Friday.

“It will not be fully paid for. The plunder of future generations continues. Bitcoin fixes this.”

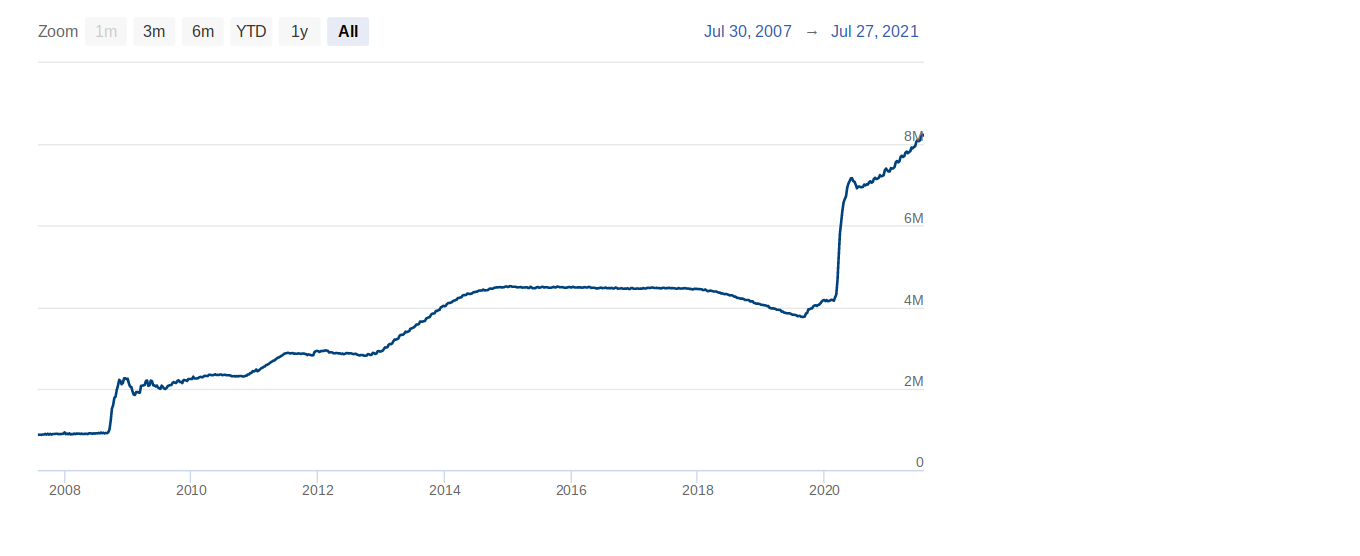

His words come the week after the Federal Reserve saw a new record on its balance sheet, which topped $8.24 trillion for the first time on July 26.

Federal Reserve balance sheet chart. Source: Federal Reserve

More broadly, central banks worldwide have favored the continuation of asset purchases regardless of future debt implications, flagging new variants of the Coronavirus as the impetus.

“The wrinkle, now, is Delta: if Delta causes the labor market to heal much more slowly, then that's going to cause me to step back,” Minneapolis Fed President Neel Kashkari said Thursday, quoted by Reuters.

Caution over BTC price reaction

Short-term headwinds for Bitcoin are thus skewed by progress on the Bill, something which was already forecast to be a major market force this week.

Traders were of mixed opinions on its market impact once passed, with popular Twitter account Pentoshi arguing that Bitcoin has already overcome more significant setbacks.

Other macro signals remain more muted, with the U.S. dollar currency index (DXY) treading water after recent volatility.

DXY 1-day candle chart. Source: TradingView

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Michael Saylor predicts Bitcoin to surge to $100K by year-end

MicroStrategy's executive chairman, Michael Saylor, predicts Bitcoin will hit $100,000 by the end of 2024, calling the United States (US) election outcome the most significant event for Bitcoin in the last four years.

Ripple surges to new 2024 high on XRP Robinhood listing, Gensler departure talk

Ripple price rallies almost 6% on Friday, extending the 12% increase seen on Thursday, following Robinhood’s listing of XRP on its exchange. XRP reacts positively to recent speculation about Chair Gary Gensler leaving the US Securities and Exchange Commission.

Bitcoin Weekly Forecast: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Bitcoin: Further upside likely after hitting new all-time high

Bitcoin hit a fresh high of $76,849 on Thursday as crypto-friendly candidate Donald Trump won the US presidential election. Institutional demand returned with the highest single-day inflow on Thursday since the ETFs’ launch in January.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.