Bitcoin falls below $27,600, erasing CPI-related gains

- Sentiment among traders across social media platforms has turned negative with a rise in Fear, Uncertainty and Doubt.

- Crypto intelligence trackers are monitoring whale activity and on-chain metrics to determine what’s next for Bitcoin after sentiment turns bearish.

- Bitcoin price has typically rallied in periods that followed skepticism from market participants.

Bitcoin price has fallen sharply, staying below $27,600, as a rise in negative sentiment among crypto market participants weighs on the cryptocurrency. The decline came after a short rally driven by U.S. inflation data, confirming a downward trend that has been running for around one month, since the BTC price topped above $30,600 in mid-April.

Technical experts at crypto intelligence tracker Santiment say that Bitcoin price typically rallies when sentiment among traders turns negative on social media platforms.

Also read: Bitcoin, Ethereum prices rally as US CPI inflation falls to 4.9%

Bitcoin traders bow out as sentiment across social media turns negative

Brian Quinlivan, on-chain analyst and marketing director at Santiment, said that the current decline in Bitcoin price could represent a “buy the dip” opportunity for traders.

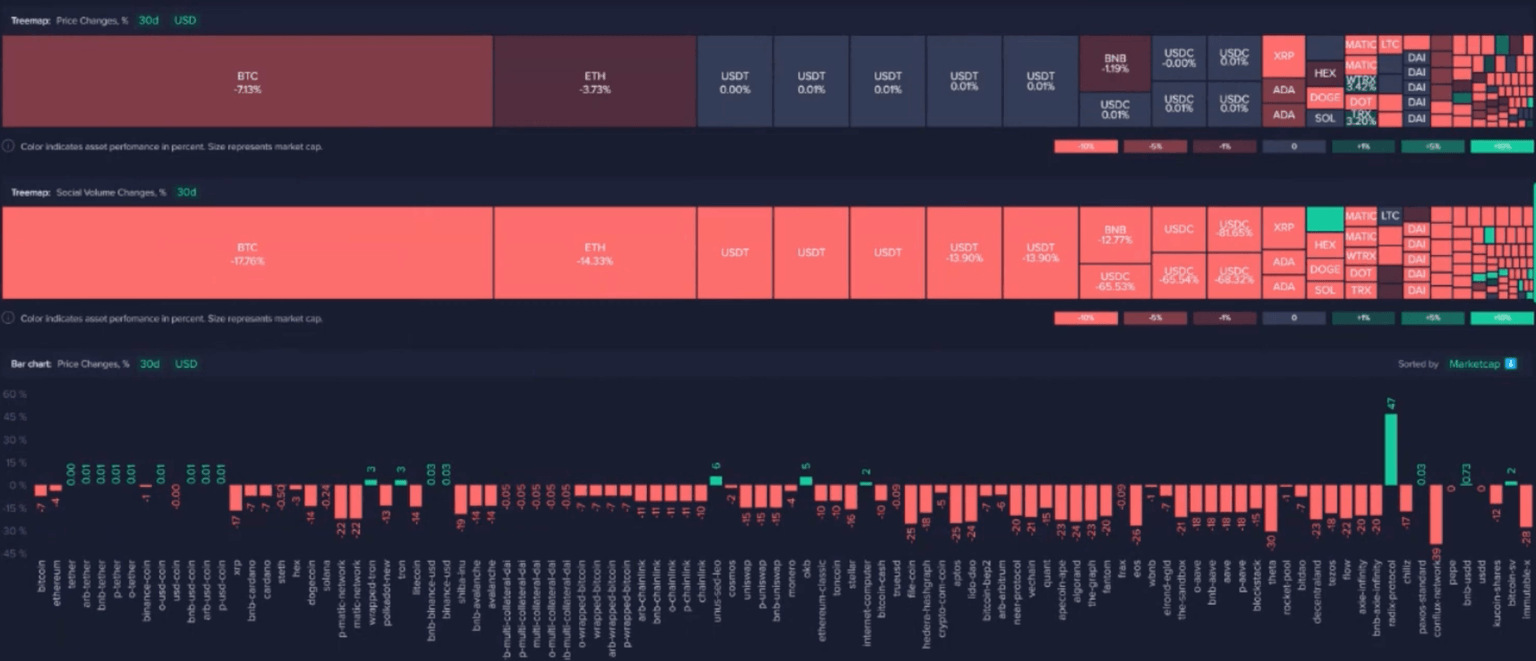

Santiment data shows that discussions on social media about crypto assets in the top 100 market capitalization list are falling compared with the previous thirty-day period. More specifically, discussions surrounding Bitcoin and other assets with large market capitalization declined 18%.

Treemap of asset-related discussions on social media

Interestingly, over the past thirty days Bitcoin price is down 7%, Ether price fell 4% and similar drawdowns are noted in assets in the top 10 on CoinGecko. This is one of the largest declines in a thirty-day period since June 2022, amidst shifting macroeconomic conditions and interest-rate hikes by the US Federal Reserve.

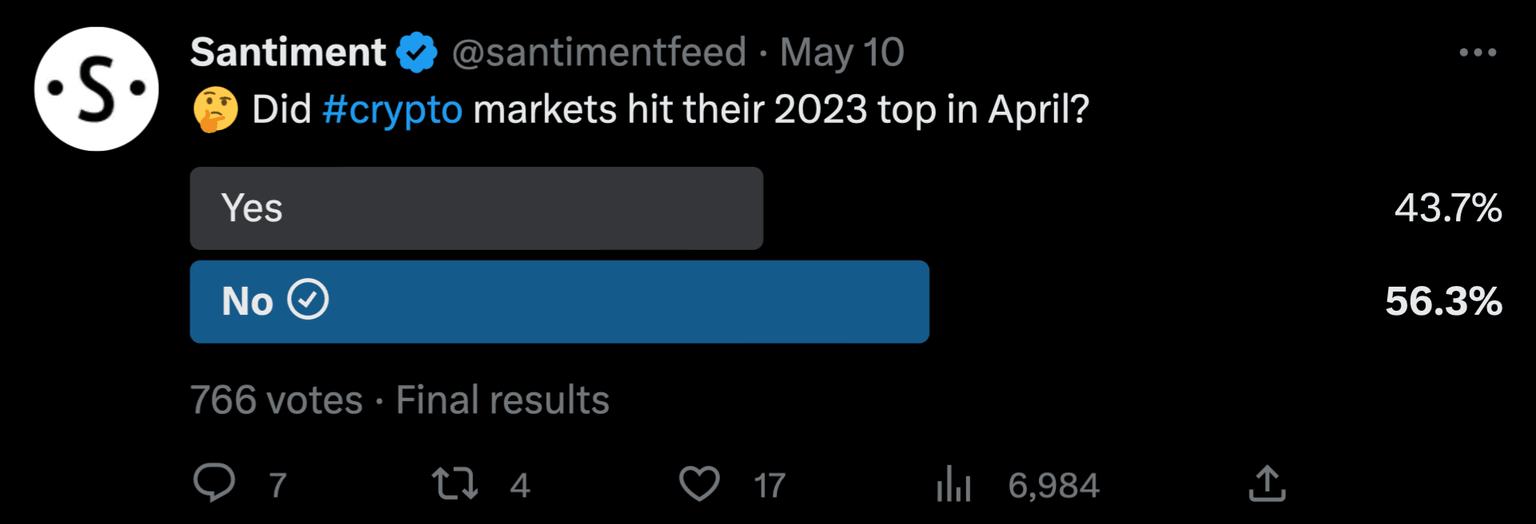

To assess market sentiment, Santiment asked traders if crypto markets have hit their tops in April and 43.7% of the voters agreed, suggesting that almost half of those polled don’t expect prices to increase further.

Santiment’s poll to assess market sentiment

Bullish divergence in whale accumulation chart

Bitcoin’s large wallet holders, popularly known as whales, bought 0.29% of the BTC supply between April 10 and May 10, a massive accumulation of the asset despite the decline in prices. There is a consistent increase in supply from addresses holding between 10 to 10,000 BTC, according to the whale accumulation chart.

The fact that prices fell and BTC holdings of whale wallets climbed signals a bullish divergence.

BTC whale accumulation chart

Experts consider this an interesting development since US Consumer Price Index (CPI) data for April showed that inflation fell to 4.9%, slightly below the 5% anticipated by markets. CPI data prompted a knee-jerk reaction of BTC traders which pushed Bitcoin higher.

Since then, however, Bitcoin price erased its gains and nosedived to the $27,000 level. It traded at around $27,400 at the time of writing, nearly 50 weeks away from its next halving. BTC price typically climbs closer to its halving, therefore long-term investors can expect a recovery in the asset within the next few months.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.