Bitcoin eyes liquidity above $30K as Gold hits new all-time high

Bitcoin (BTC $29,098) reclaimed $29,000 overnight into May 4 as the United States banking crisis risked spawning new victims.

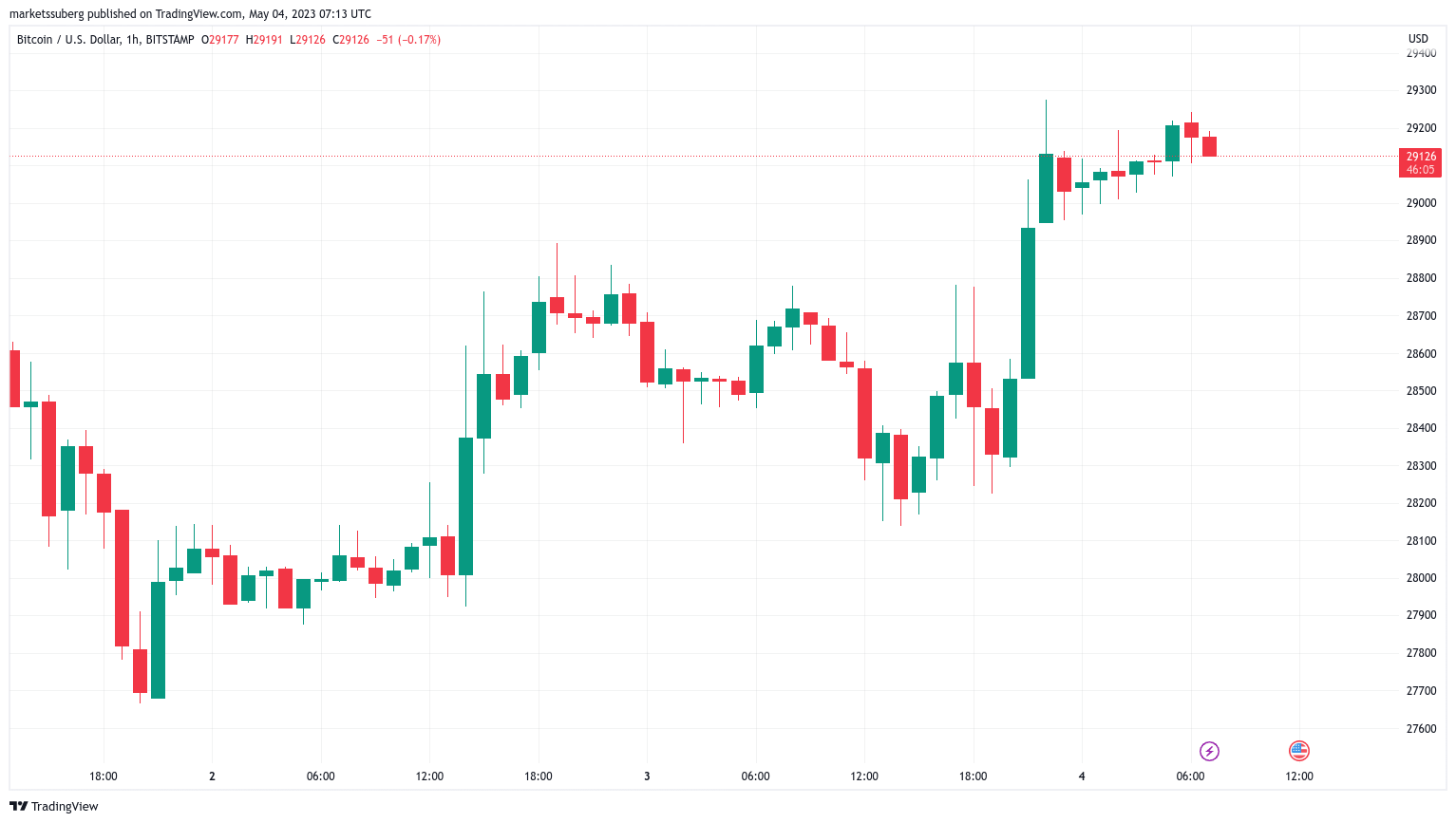

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

Gold, Bitcoin benefit from U.S. banking mayhem

Data from Cointelegraph Markets Pro and TradingView tracked a swift mood change for BTC/USD, which hit $29,242 on Bitstamp.

The pair had sunk to daily lows at the previous day’s Wall Street open as markets awaited the Federal Reserve’s decision on interest rates.

At the same time, more U.S. regional bank stocks were suffering, with the trend remaining as the Fed confirmed its much-anticipated 0.25% hike.

One lender, PacWest Bancorp, reportedly announced that it was considering a buyout, pressuring the regional bank sector even further while boosting havens, including Bitcoin.

Gold even hit new all-time highs as market commentators criticized the Fed’s approach and predicted the end of rate hikes altogether.

XAU/USD 1-month candle chart. Source: TradingView

“The biggest joke is the fact that Jerome Powell says that the banking system has improved and is healthy, sound and resilient. It’s the weakest it has ever been and another few banks have been falling apart after market,” Michaël van de Poppe, founder and CEO of trading firm Eight, reacted.

This was the last hike.

Van de Poppe referenced comments on the regional banking sector by Fed Chair Jerome Powell, which accompanied the rate decision.

“Conditions in that sector have broadly improved since early March, and the U.S banking system is sound and resilient,” he said in a statement prior to a subsequent press conference.

We will continue to monitor conditions in this sector. We are committed to learning the right lessons from this episode and will work to prevent events like these from happening again.

Others were far from convinced, however.

Arthur Hayes, the former CEO of derivatives exchange BitMEX, revealed that he was already hunting for failing regional banks. Markets, he argued, could depend on the next move by either Powell or Treasury Secretary Janet Yellen.

“You never know what is the trigger that causes Yellen or Powell to cave and bail everyone out. It’s all politics now and politics is more about power than rational decisions,” part of a tweet read.

Financial commentator Tedtalksmacro additionally noted that the Fed funds rate was now at its members’ own expected peak.

Back in March, the majority of FOMC participants said that the terminal rate for this tightening cycle would be 5-5.25% —> that’s where we are now. pic.twitter.com/50d4EMG7Fg

— tedtalksmacro (@tedtalksmacro) May 3, 2023

An “important signal”

Turning to Bitcoin: reclaiming $29,000 provided a much-needed bullish counterpoint to recent price action.

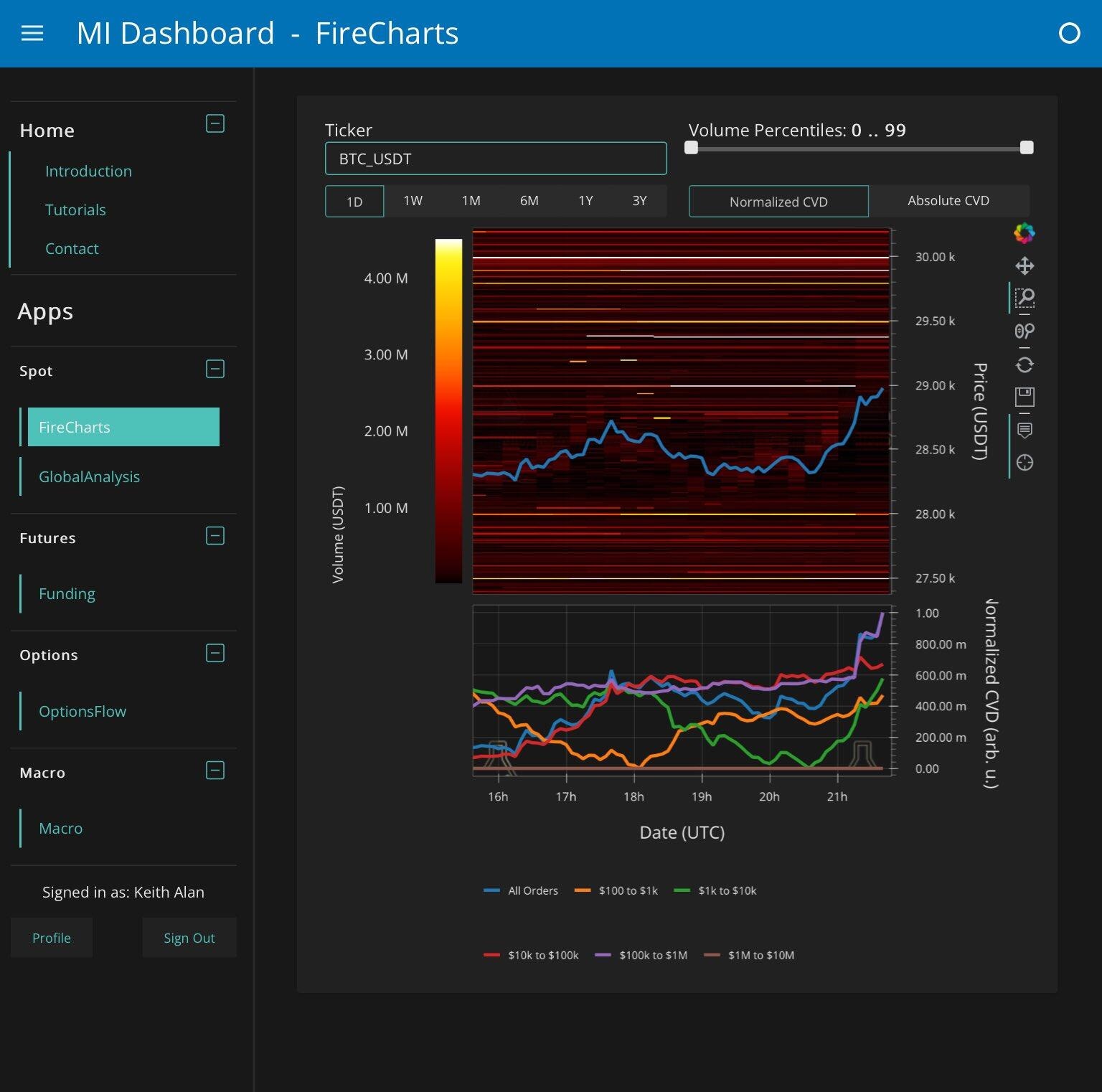

Eyeing changes in the Binance order book, monitoring resource Material Indicators showed that whale buying power had gained the upper hand through the news events.

“After clearing out most of liquidity in the range before the FOMC FED rate hike announcement, BTC whales had no problem eating through the remaining liquidity and reclaimed $29k,” it summarized.

BTC/USD order book data (Binance). Source: Material Indicators/ Twitter

Market participants thus hoped that further liquidity squeezes could come next, fueling a trip above the $30,000 barrier.

“Even though Gold is attacking ATHs, Bitcoin continues to outperform it,“ Checkmate, lead on-chain analyst at Glassnode, noted, having called gold’s new highs an “important signal.“

A tweet including Glassnode data showed the increase in BTC/XAU since the start of 2020.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.