Bitcoin (BTC $29,99) passed $29,500 on Oct. 20 after an eventful 24 hours boosted BTC price trajectory, while XRP’s (XRP $0.52) price jumped above $0.50 in response to Ripple’s big legal win.

BTC/USD 1-hour chart. Source: TradingView

Hawkish Fed’s Powell fails to dent BTC price

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it edged closer to two-month highs from the start of the week.

The largest cryptocurrency appeared to feed off events surrounding a speech from Jerome Powell, chair of the United States Federal Reserve, the day prior.

Amid a U.S. bond rout, Powell was under pressure to deliver appropriate wording, and analysis even predicted a “very dovish” tone would dominate. In the event, the speech, which was briefly interrupted by protesters, saw Powell as highly conservative on the outlook.

“The stance of policy is restrictive, meaning that tight policy is putting downward pressure on economic activity and inflation,” he said about interest rate hikes.

Given the fast pace of the tightening, there may still be meaningful tightening in the pipeline.

Powell said that the Fed acknowledged the potential problems of hiking rates too far.

“Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment. Doing too much could also do unnecessary harm to the economy,” he continued.

Given the uncertainties and risks, and how far we have come, the Committee is proceeding carefully.

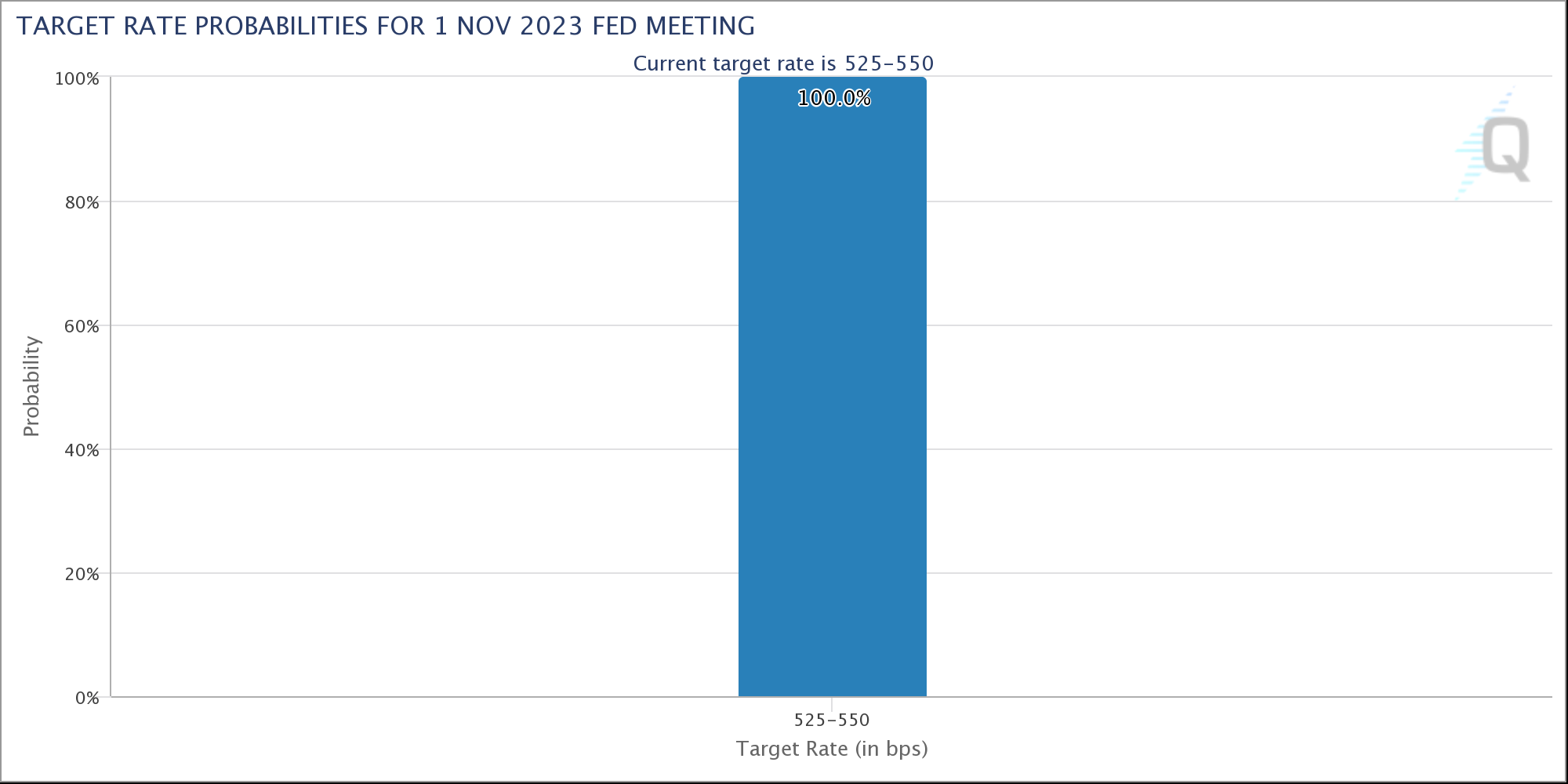

Data from CME Group’s FedWatch Tool showed changing tides among market expectations when it comes to future rate decisions.

At its next meeting on Nov. 1, the Federal Open Market Committee (FOMC) is now unanimously thought to hold rates at their current levels, per data from CME Group’s FedWatch Tool. Before Powell, the odds stood at 88%.

Fed target rate probabilities chart. Source: CME Group

Following the speech, news broke that U.S. regulators had dropped criminal charges against executives of blockchain firm Ripple.

XRP’s price responded immediately, trading up over 6% in 24 hours at the time of writing.

XRP/USD 1-hour chart. Source: TradingView

Trader suggests Bitcoin “impulse” is here

Amid a backdrop of increasing anticipation over the approval of a U.S. Bitcoin spot price exchange-traded fund (ETF), Bitcoin gained momentum overnight.

At the time of writing, the day’s highs stood at $29,689 — just $200 from the top of a snap volatility wick seen on Oct. 17.

$BTC has launched.

— CrediBULL Crypto (@CredibleCrypto) October 20, 2023

Keeping it as simple as it can get:

The same way 26.8k was the origin of our last impulse, 28.6k is now the origin of the current one. Above that, we are going A LOT higher, FAST.

Drop below 28.6k and the local uptrend will be violated and we may get a bit… https://t.co/odakQpZbTL pic.twitter.com/CbhLBo133G

“Bitcoin filling the wick, slowly but surely. Let’s go for that $30k tap,” popular trader Jelle wrote in part of an X analysis on the day, having previously argued that Bitcoin looked “eager to fill” the Oct. 17 wick.

“Today it’s going a very interesting day for trading... They have hit exactly $29400 where there were many liquidations,” fellow trader CrypNuevo continued.

In various X posts, CrypNuevo uploaded liquidation data from the past days, warning that long positions outnumbered shorts four to one. Bitcoin, he suggested, could retrace during the U.S. trading session.

$BTC

— CrypNuevo (@CrypNuevo) October 20, 2023

Liquidation levels and liquidation heatmaps.

Quick thoughts:

- All our liquidation levels to the upside from yesterday have been hit.

- Delta long liquidations at $15B (mid-high amount and enough to consider a retrace is coming soon).

- Current long-short open positions… pic.twitter.com/dAqbRbaimc

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.