Bitcoin aims for $65,000 as interest rate data and on-chain metrics fuel optimism

- Bitcoin recovers above $62,000 following the Federal Reserve’s dovish interest rate decision.

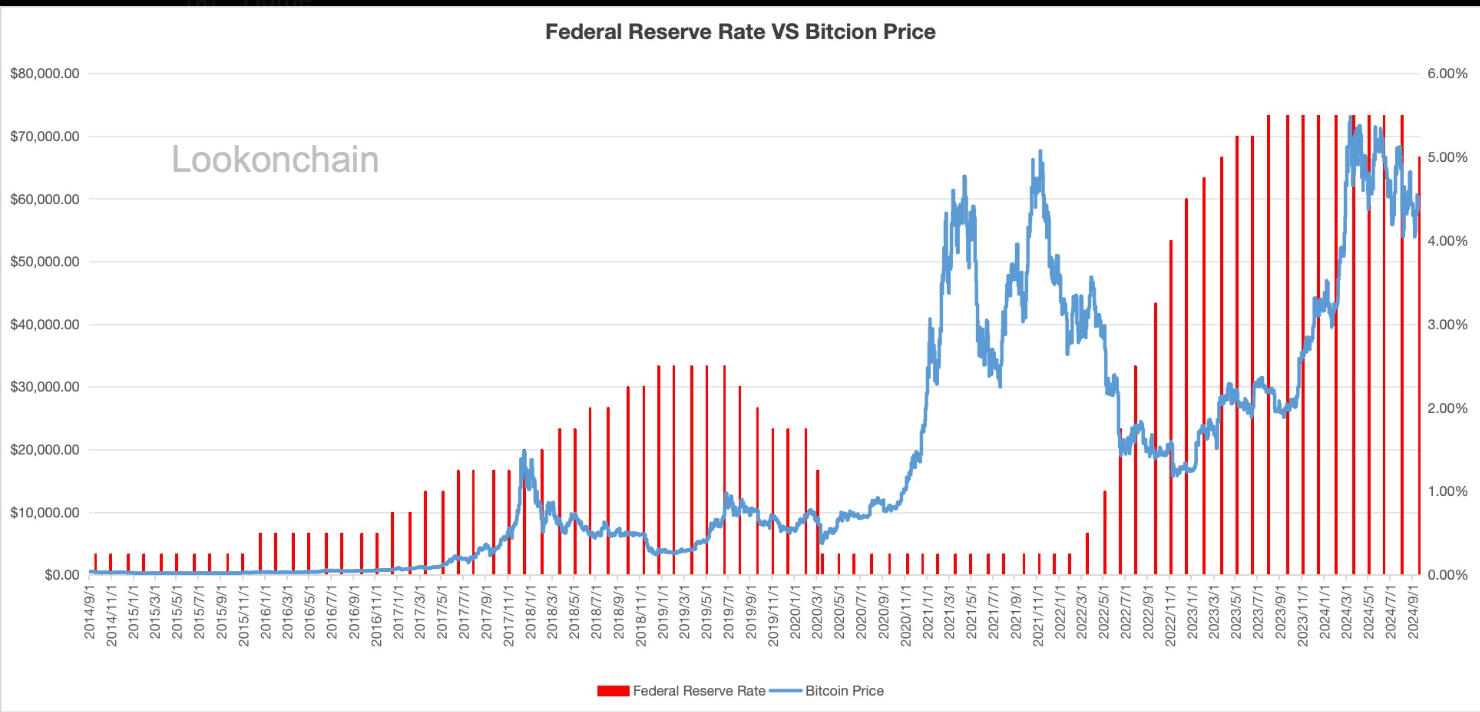

- Lookonchain chart shows how the Federal Reserve Rate has impacted Bitcoin's price.

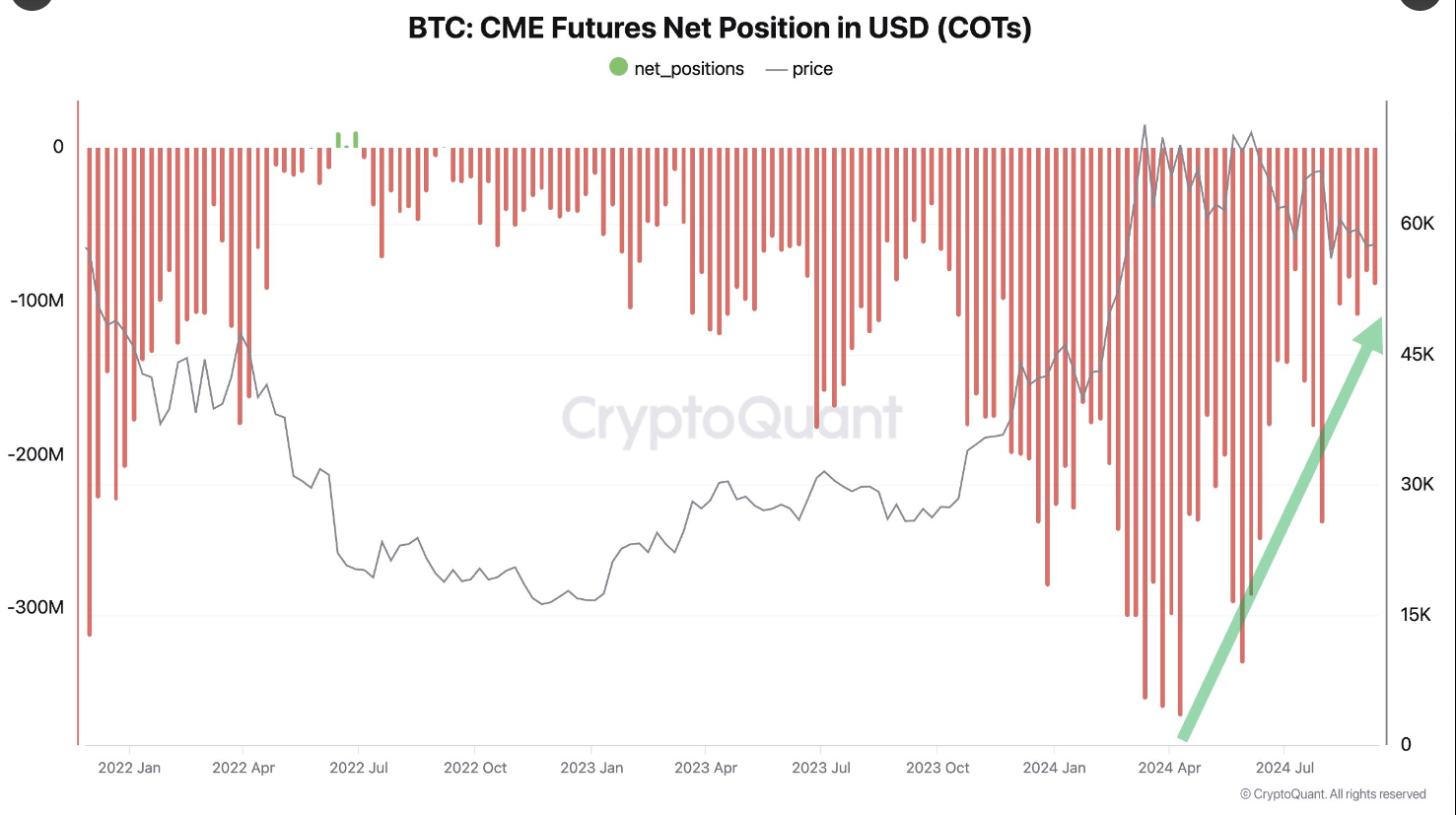

- Ki Young Ju, founder of CryptoQuant, posted on Twitter that institutions are no longer aggressively shorting Bitcoin.

Bitcoin (BTC) extends recent gains and trades above $62,000 at the time of writing on Thursday, following a 2.4% increase the previous day after the Federal Reserve’s (Fed) dovish decision to cut interest rates by 50 basis points. On-chain metrics shared by Ki Young Ju, founder of CryptoQuant, further indicate signs of BTC strength.

Bitcoin’s reaction to Fed rate cut

Bitcoin rose 2.4% to close above $61,700 on Wednesday after members of the US Federal Reserve decided a 50 basis points (bps) cut on interest rates.

The Lookonchain chart below shows how the Federal Reserve Rate has impacted Bitcoin’s Price.

At the start of the COVID crisis in 2020, the Federal Reserve aggressively cut interest rates, bringing them to the 0%-0.25% range. The low interest rate environment sparked a rally in Bitcoin’s price, which surged from around $5,000 to $60,000.

Conversely, the rate hikes between March 2022 and December 2022, increasing rates to the 4.25%-4.50% range, negatively impacted Bitcoin, causing its price to plummet from approximately $46,000 to $16,000.

Similarly, the current reduction of the interest rate by 50 basis points, to the 4.75%-5.00% range, could produce effects similar to those observed during the COVID crisis. However, while the 2020 rate cut significantly influenced Bitcoin’s price due to the global nature of the crisis, the anticipated 2024 reduction may have a positive but less pronounced impact.

Federal Reserve Rate VS Bitcoin Price Chart

However, economist and Gold advocate Peter Schiff warned about the Fed’s rate cut in a post on Twitter on Wednesday, following the Federal Reserve’s 50 basis point interest rate cut. “As expected, the Fed caved to the markets and cut interest rates by 50 basis points,” he wrote, elaborating: “Not only will this round of rate cuts not stop a cooling economy from entering a recession, but it will also turn up the heat on inflation, making the recession that much worse.”

Schiff also commented, “Not only did the Fed’s 50 basis point rate cut send gold to a record high above $2,595, but it also sent the US dollar sinking below 0.84 Swiss francs, a new 13-year low.” This indicates that the rate cut could shift investors from risky assets like Bitcoin to more safe-haven assets like Gold.

As expected, the #Fed caved to the markets and cut interest rates by 50 basis points. Not only will this round of rate cuts not stop a cooling economy from entering a #recession, but it will also turn up the heat on #inflation, making the recession that much worse. Buy #gold now.

— Peter Schiff (@PeterSchiff) September 18, 2024

Ki Young Ju, founder and CEO of CryptoQuant, an on-chain Data and Analytics company, posted on Twitter, “Institutions are no longer aggressively shorting Bitcoin. CME futures net positions have declined by 75% over the past five months,” which suggests a positive move for Bitcoin.

Bitcoin CME Futures Net Position chart

Louisiana State Treasurer John Fleming, MD, announced on Twitter that the state government will now accept Bitcoin, Bitcoin Lightning, and USD Coin as valid forms of payment.

“In today’s digital age, government systems must evolve and embrace new technologies. By introducing cryptocurrency as a payment option, we’re not just innovating; we’re providing our citizens with flexibility and freedom in interacting with state services. Additionally, this unique innovation protects our state from any volatility associated with cryptocurrency,” Dr. Fleming said.

The Louisiana Department of Wildlife and Fisheries was the first state agency to implement the new payment system, paving the way for other departments to follow. This could positively impact Bitcoin and the broader crypto markets by promoting greater acceptance of cryptocurrencies.

LOUISIANA STATE GOVERNMENT ACCEPTS FIRST CRYPTOCURRENCY PAYMENThttps://t.co/C9NqQbpEyo

— John Fleming, MD Louisiana State Treasurer (@LATreasury) September 18, 2024

Louisiana State Treasurer, John Fleming, M.D. announces an innovative transition with state government's plan to accept cryptocurrency as a valid form of payment. pic.twitter.com/b9B0OK7Al9

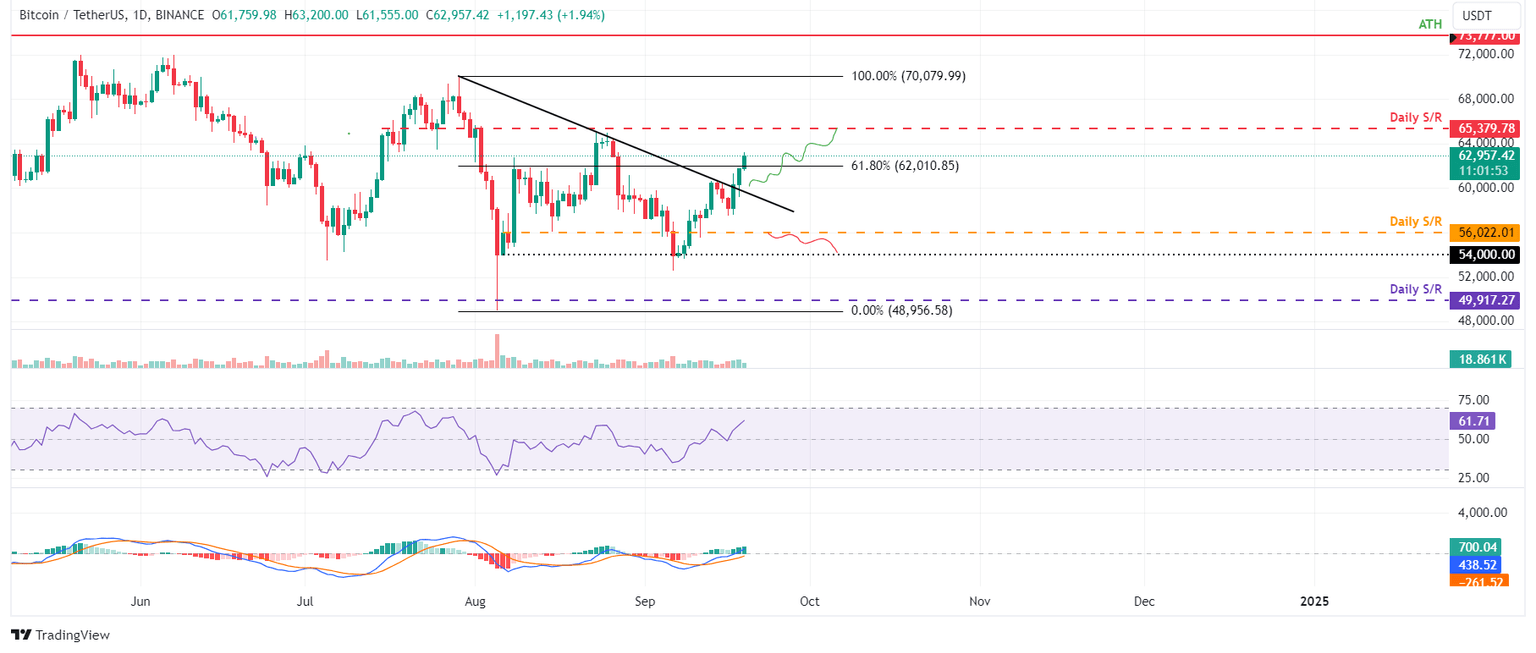

Technical analysis: Bitcoin above the $62,000 barrier

Bitcoin price broke above the descending trendline (drawn from multiple high levels from the end of July) earlier in the week and closed above the 100-day Exponential Moving Average (EMA) at $60,781 on Wednesday. At the time of writing, BTC extends gains near its 61.8% Fibonacci retracement level of around $62,000.

If BTC closes above the 61.8% Fibonacci retracement level, it could rally 5.6% to retest its daily resistance at $65,379.

The Moving Average Convergence Divergence (MACD) indicator further supports Bitcoin’s rise, signaling a bullish crossover on the daily chart. The MACD line (blue line) moved above the signal line (yellow line), giving a buy signal. It shows rising green histogram bars above the neutral line zero, also suggesting that Bitcoin’s price could experience upward momentum.

Furthermore, the Relative Strength Index (RSI) trades above its neutral level of 50, indicating bullish momentum.

BTC/USDT daily chart

However, the bullish thesis will be invalidated if BTC breaks below the descending trendline and closes below the $56,022 daily support level. In that case, Bitcoin’s price could extend the decline by 3.6% to retest its psychologically important level at $54,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.