Bitcoin exchange reserves dropped by $5 billion in the past year, showing signs of accumulation.

The Bitcoin (BTC) reserves of exchanges are continuing to drop, which suggests retail investors and whales might be accumulating.

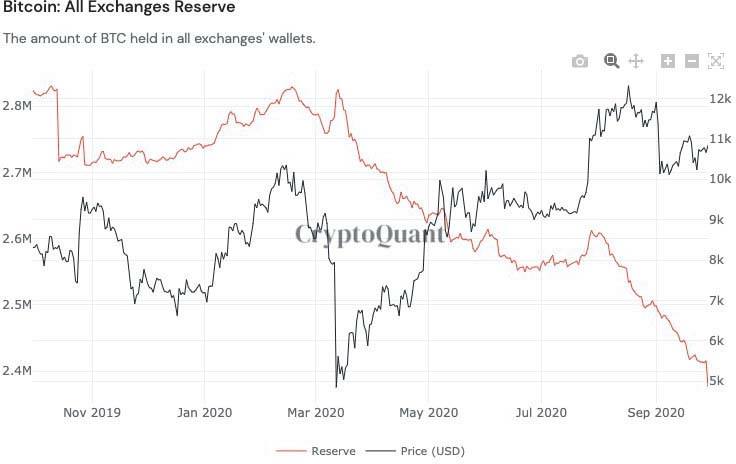

According to data from CryptoQuant, all exchanges’ reserves dropped to 2.4 million BTC, which is equivalent to $25 billion. In contrast, in October 2019, exchanges had around 2.8 million BTC, currently worth $30 billion.

Bitcoin reserves on all exchanges throughout the past year. Source: CryptoQuant

There is a clear decrease in selling pressure from whales and retail investors

The reserves of exchanges increase when investors deposit Bitcoin. Typically, deposits or inflows are considered selling pressure, because traders have to send BTC to exchanges in order to sell.

Hence, when exchange inflows decline, it often signifies that the appetite to sell BTC by investors is declining.

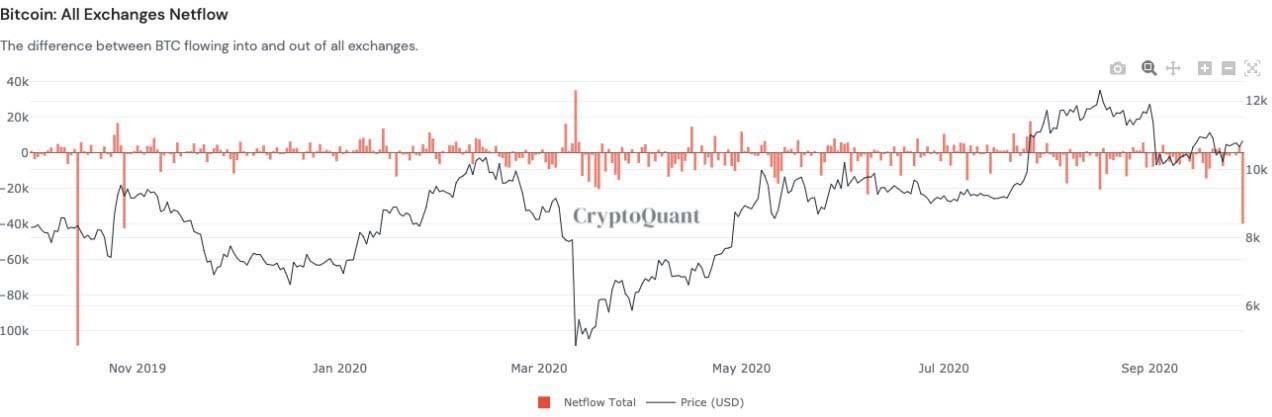

Another chart from CryptoQuant depicts the trend of net inflows of Bitcoin into exchanges in the same timeframe.

Throughout the past two months, net inflows have generally remained in the negative 20,000 BTC level. Net inflows sharply dropped in recent weeks, specifically as BTC sharply rebounded from $10,300 to above $10,700.

On Sep. 26, Cointelegraph reported that large whale clusters emerged at $10,407. Whale clusters form when whales accumulate new BTC and do not touch the new holdings. Clusters usually indicate that whales are beginning to accumulate in a new area.

Considering the accumulation trend and the resilience of BTC above $10,000, investors likely have little appetite to sell.

All exchange Bitcoin net inflow. Source: CryptoQuant

Due to the confluence of the lacking willingness to sell BTC at current prices and consistent accumulation, BTC is on track for a strong quarterly close.

Another possible reason behind the steep fall in exchange net flows might have been large-scale hacks. Most recently, KuCoin was reportedly hacked for $150 million after the private keys of hot wallets were compromised.

BTC on track for its second-best quarterly close

According to Skew, Bitcoin is en route to see its second-best quarterly close. BTC closed the second quarter at around $9,140. It would have to stay above $10,600 to secure the second-best quarterly close.

The quarterly closing prices of Bitcoin since 2014. Source: Skew

There are several reasons behind the strong performance of Bitcoin throughout the third quarter. Most notably, BTC rallied in tandem with gold and stocks after the U.S. approved a stimulus bill.

The initial kick start of a market-wide recovery from the stimulus, combined with a low-interest-rate environment, created a favorable macro backdrop. The analysts at Skew said:

“One more day to go and still looking like second best quarterly close for #bitcoin but it's a close call with Q2 2020.”

Throughout the year’s end, there are three key fundamental and macro factors that could buoy Bitcoin’s sentiment, namely the weakening U.S. dollar, the prospect of a stimulus package and vaccines.

Meanwhile, the U.S. dollar is continuing to show weakness against reserve currencies, in the likes of the yen, yuan and franc as the Fed has doubled down on its average inflation targeting strategy.

But while the prolonged weakness of the dollar might put the U.S. stock market at risk of underperforming against other markets, it should directly benefit Bitcoin and gold, which are priced against the USD.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.