- Based on a survey conducted by Huobi, Bitcoin, Ethereum, Shiba Inu, and Dogecoin are the top cryptocurrencies.

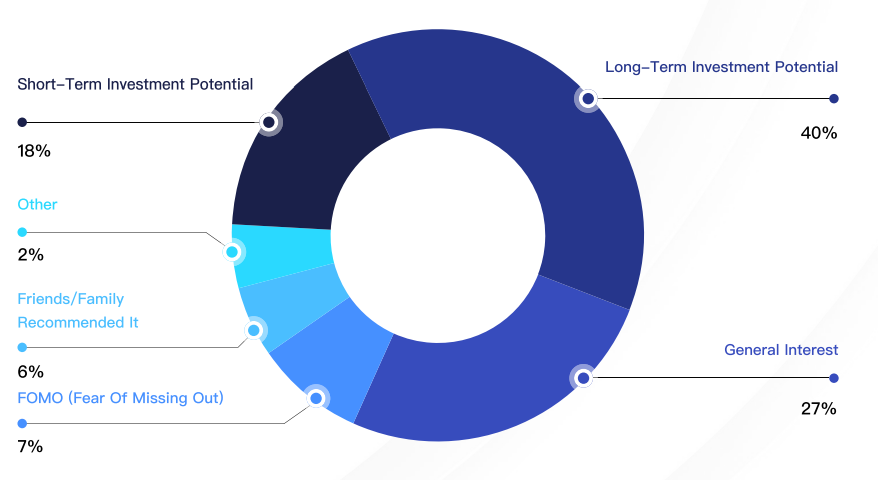

- According to survey findings, Investors turn to cryptocurrencies for long-term investment potential.

- Meme coins Shiba Inu and Dogecoin are among the socially dominant cryptocurrencies among US investors.

Meme coins became mainstream among US investors in 2021 based on survey findings from Seychelles-based cryptocurrency exchange Huobi. The largest cryptocurrencies by market capitalization continued dominating conversations on social media.

Bitcoin, Ethereum, Shiba-Inu-themed cryptos enjoy social dominance

Seychelles-based cryptocurrency exchange, Huobi recently published its “Crypto Perception Report.” The exchange was first founded in China, and since then, it has amassed investors worldwide.

Huobi surveyed over 3000 participants (18 years old or over) from the US to identify the top cryptocurrencies and their perceptions among investors.

The report reveals that Bitcoin, Ethereum, Shiba Inu and Dogecoin rank among the top cryptocurrencies. The social dominance of meme coins like Shiba Inu and Dogecoin made cryptocurrency mainstream in 2021. Institutional and retail investors have continued to pour capital into Bitcoin, Ethereum, Shiba Inu and Dogecoin throughout the past year.

Shiba Inu witnessed a spike in users as Ethereum whales continued accumulating the meme coin. 40% of surveyed participants turned to cryptocurrencies for their long-term investment potential.

Reasons why people invest in crypto.

Interestingly, a recent report by Fidelity researchers revealed that there is competition between countries (early adopters) of Bitcoin and others on an international level. According to analysts, countries that are early Bitcoin adopters could be better off in the long run.

The report reads:

If Bitcoin adoption increases, the countries that secure some Bitcoin today will be better off competitively than their peers.

@Hayess5178, a crypto analyst and trader, explained why Bitcoin dominance is key to price trends across altcoins and layer-1 scaling solutions in a recent tweet. @Hayess5178 shows that as the dominance of the top cryptocurrency increases, historically, altcoins lose value.

#Bitcoin Dominance $BTC.d

— Simon Hayes (@Hayess5178) January 17, 2022

Take note that #Bitcoin #Dominance is bouncing from trend line support on the daily chart.

It's possible #AltCoin's will struggle if dominance continues to rise.

Be vigilant with #Alts ♥️#ethereum #doge #crypto #cryptocurrency $dot $link#dogecoin https://t.co/bDUp96Yffg pic.twitter.com/ZPCFY5bOmi

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum ETFs recorded net inflows of $104.1 million on Friday — their highest daily inflow since February 4, per SoSoValue data. As a result, the products saw a weekly net inflow of $157.1 million, which also marks their highest net buying activity since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation filed a registration statement with the Securities & Exchange Commission on Friday, signaling its intent to offer and sell a wide range of securities.

Bitwise hints at NEAR ETF following Delaware registration

The filing marks a crucial step before a firm submits an application for an ETF with the SEC. While Bitwise has not yet applied for a NEAR ETF with the SEC, similar actions preceded its previous XRP and Aptos ETF filings.

Bitcoin price could reach $285K by 2030 as Citigroup forecasts $1.6 trillion stablecoin inflows

Bitcoin price outlook strengthens as Citigroup projects $1.6 trillion stablecoin growth, calling them critical bridges between banks and blockchain.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.