While Bitcoin (BTC) and Ether (ETH) have chalked out moderate gains in the past 24 hours, prices remain well below levels that are likely to inflict "maximum pain" on buyers of August expiry option contracts.

On Friday, Deribit, the world's leading crypto options exchange by open interest and volume, will settle 72,000 BTC August options contracts worth $1.9 billion and 535,000 ETH options contracts valued at $893 million.

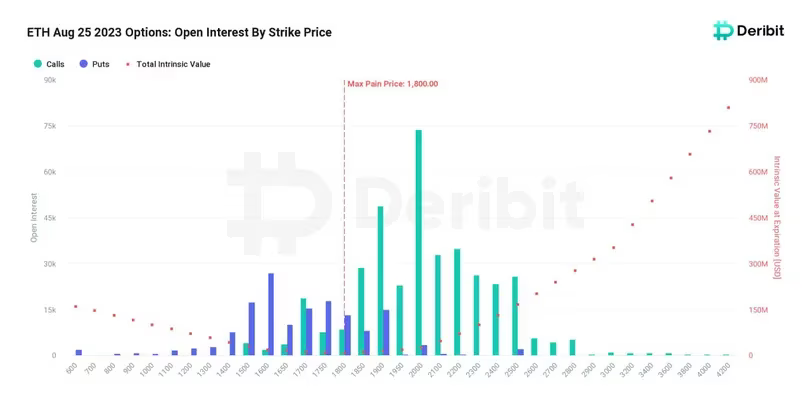

The max pain levels for BTC and ETH settlements are currently at $28,000 and $1,800.

The popular theory is that writers or sellers of call options and put options often look to push the underlying asset's spot price toward the max pain level to make their counterparties, the options buyers, suffer the most. They do so by buying/selling the cryptocurrency in the spot/futures markets.

So, assuming other factors remain constant, BTC and ETH could trade close to the respective max pain points in the next 24 hours. The max pain points will become invalid following the expiry. Deribit settles options on Friday at 08:00 UTC. On Deribit, one options contract represents 1 BTC and 1 ETH. The exchange controls nearly 90% of the global crypto options activity.

"Buyers of BTC and ETH put options are clear winners heading into the expiry," Deribit's Asia business development personnel Lin Chen told CoinDesk. "A lot of put options are in-the-money."

An in-the-money put is the one with a strike price higher than the going market rate of the underlying asset. It means the ITM put holder can sell the underlying asset at a price greater than the current market rate.

A put option gives the holder the right but not the obligation to sell the underlying asset at a predetermined price on a later date. A call gives the right to buy.

The chart shows open interest or number of active ether options contracts at each strike level and the the max pain point. (Deribit) (Deribit)

Most ether call options are set to expire out-of-the-money, thanks to last week's 8.3% slide. Bitcoin's open interest distribution paints a similar picture, as the feature image shows. The leading cryptocurrency by market value tanked over 10% last week, its biggest slide since the collapse of FTX in November.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.