Bitcoin, Ether slide as protective puts draw demand amid sell-off in FTXs token

Crypto market leaders Bitcoin (BTC) and ether (ETH) shed their relative calm and faced selling pressure early Tuesday as FTT, the native token of cryptocurrency exchange FTX, nosedived to 21-month lows on lingering concerns regarding trading firm Alameda's balance sheet.

At 4:30 UTC, bitcoin traded 4.3% lower on the day at $19,700, while ether changed hands at $1,480, representing a 5.5% decline, CoinDesk data show. FTX's FTT token tanked 20% to $17, the lowest since February 2021, extending the past week's 13% slide.

Options data showed renewed demand for bearish put options tied to bitcoin and ether. The bearish shift in sentiment perhaps reflects investor fears that the ongoing FTX-Alameda drama may lead to Terra-like crypto collapse.

"We have seen renewed demand for downside protection after the negative news flow related to FTT," Patrick Chu, director of institutional sales and trading at over-the-counter crypto derivatives tech platform Paradigm, told CoinDesk.

A call option gives the purchaser the right, but not the obligation, to buy the underlying asset at a predetermined price on or before a specific date. A put option gives the right to sell. Options skew measures prices for bullish calls relative to bearish puts.

"Short dated skew in particular has moved in favor of puts as we have seen downside protection in both BTC & ETH with strong demand for end Nov / Dec expiries," Chu added.

A call option gives the purchaser the right, but not the obligation, to buy the underlying asset at a predetermined price on or before a specific date. A put option gives the right to sell. Options skew measures prices for bullish calls relative to bearish puts.

The controversy surrounding Alameda's balance sheet began last week after CoinDesk reported that the trading firm holds large amounts locked or illiquid FTX tokens, painting the two entities unusually close to each other. (Alameda and FTX are sibling companies).

Since then, FTT has crashed by 40% and the exchange has seen large withdrawals at an alarming rate.

"Much of the anxiety comes from FTX’s app (formerly Blockfolio), which has a generous 'earn program' of about ~5% up to $100K. As expected, a lot of capital is being withdrawn, which some observers try to frame as a 'bank run'. So far, I have no indication that investors are having trouble withdrawing cash," Ilan Solot, co-head of digital assets at London-based financial services platform Marex said in an email.

"Moreover, a 5% rate (not far from U.S rates) is not as egregious as what Anchor or Celsius were doing. But we don’t have any visibility on the repurposing of funds or liquidity mismatches (which doesn’t mean they don’t exist)," Solot added.

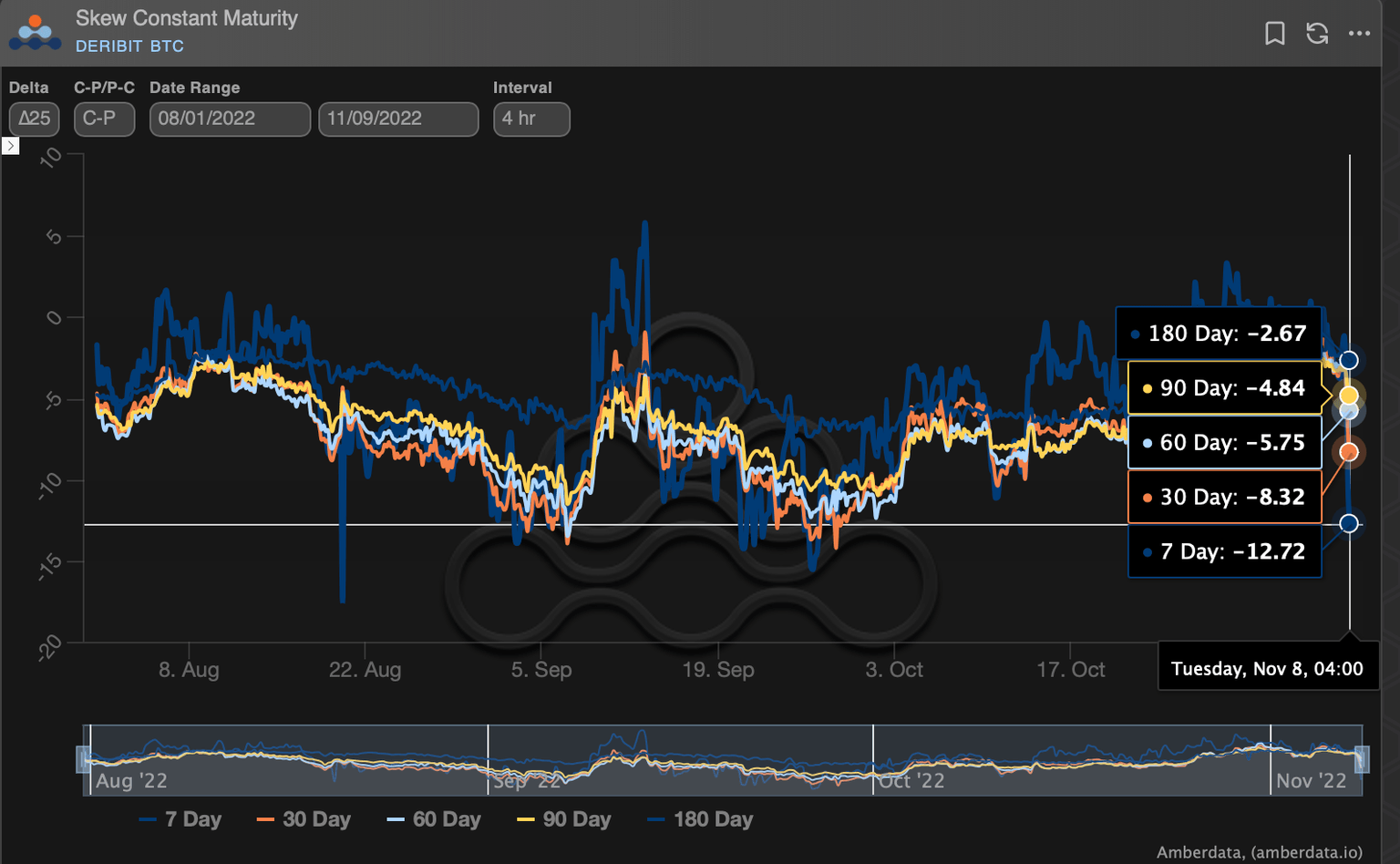

The chart shows a renewed demand for bearish put options. (Amberdata) (Amberdata)

Both short-term and long-term bitcoin call-put skews have turned lower from zero this week. The one-week skew has dropped from -1% to -12%, the lowest since late September, according to digital assets data provider Amberdata.

In other words, puts are back in demand.

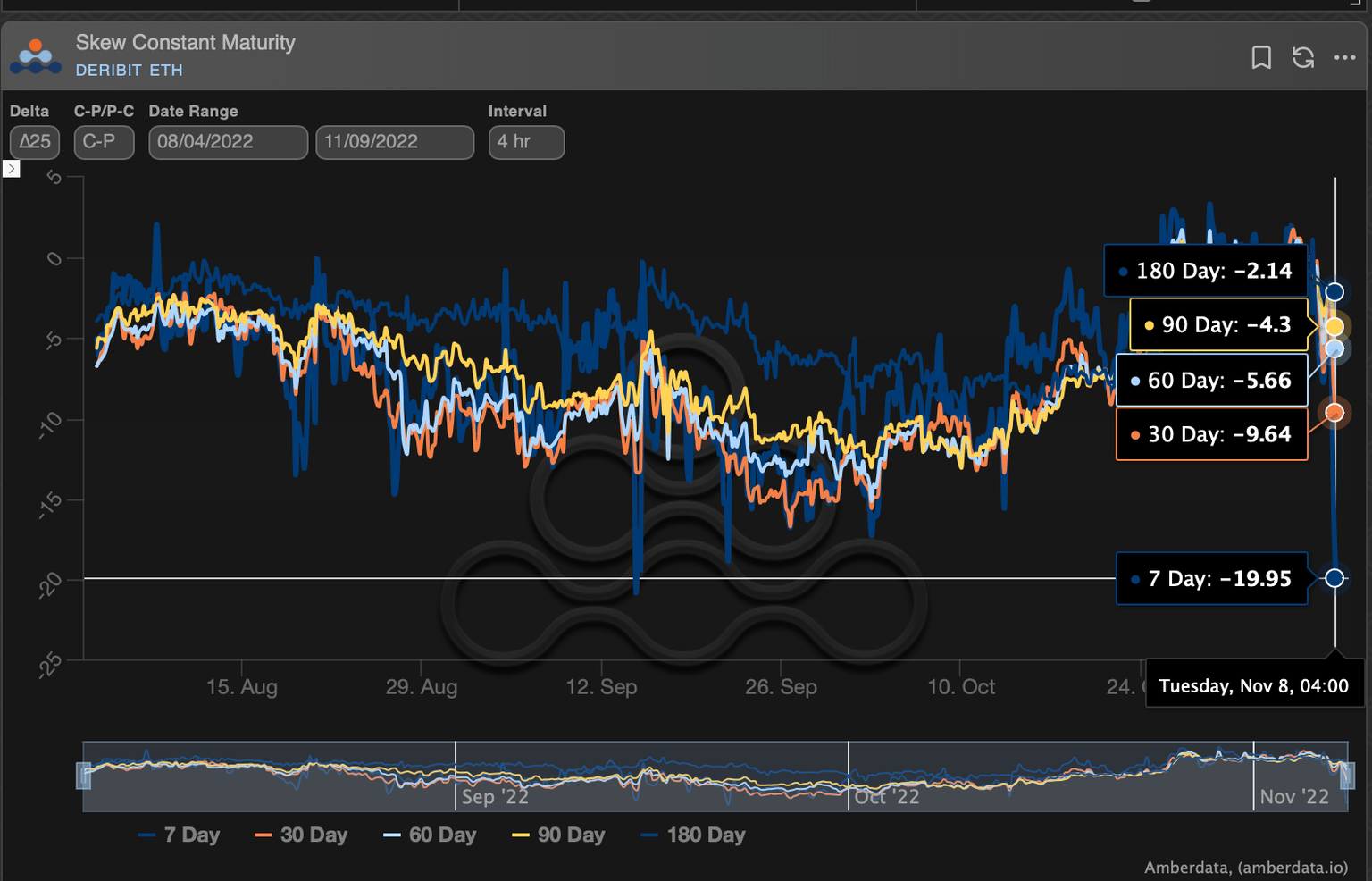

A similar pattern is observed in ether call-put skews.

The one-week skew has tanked to -20%, reflecting increased demand for short-term puts. (Amberdata) (Amberdata)

The one-week ether call-put skew has dropped to nearly -20%, indicating strongest bias for bearish puts since mid-September.

Options traders' expectations for price turbulence over the coming week and month have increased. Ether's seven-day implied volatility, or expectations for price volatility, jumped to an annualized 98%, the highest in two months. The one-month gauge ticked higher to a two-week high of 84%.

"The market seems to be panicking, given the fact that LUNA event wasn't that long ago," Martin Cheung, an options trader from Pulsar Trading Capital, said, referring the uptick in the implied volatility.

Terra's stablecoin UST and native token LUNA crashed in May, destroying billions of dollars in investor wealth. The crash brought down several lenders, including Celsius.

According to Solot, FTX and Alameda's issues are unlikely to crash the market.

"FTX is a systemically important player in the crypto ecosystem, so any trouble or loss of confidence – even if temporary – will have an outsized impact," Solot said.

"That said, there’s a lot less leverage in the system right now, so there’s a greater chance any trouble can be contained more easily – or at least that losses will be concentrated instead of widespread. Indeed, the spill over to other tokens has been very mild so far," Solot noted.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.