Bitcoin ETF launch: A turning point or a teething stage?

- The approval of several Bitcoin spot ETFs marked a watershed moment for the crypto industry, but price action does not agree.

- BTC crashed nearly 15% between January 11 and 12, casting doubts on whether the ETF launch is a sell-the-news event.

- History shows that major events have caused steep sell-offs, while some have marked cycle tops.

The first Bitcoin spot ETFs were available for trading in the US on January 11, which caused BTC to crash by double digits. This move sparked a debate about whether the ETF approval is a sell-the-news event or will be a turning point to the 2023 bull rally.

Read more: Dissecting the $4.6 billion Bitcoin ETF debut: New capital or clever shuffle?

Bitcoin price reaction to spot ETF approval

The optimism due to the spot ETF approval vanished on January 11 as ETFs were available for trading. The approval from the SEC pushed Bitcoin price up by 6% to $48,975 led to a roughly 15% crash after less than 48 hours.

The sudden decline in Bitcoin price has prompted investors to worry if this was a sell-the-news event that could trigger a deeper correction or a potential cycle top. Let’s break down some of the popular outlooks that crypto investors expect.

BTC/USDT 1-hour chart

BTC history of sell-the-news events

December 18, 2017 - Chicago Mercantile Exchange (CME) launches the first Bitcoin futures contract. Like Bitcoin spot ETF approval in 2024, this decision from CME was a watershed moment for the crypto industry when the news outlets tagged Bitcoin and the larger crypto market as the Wild West. Regardless, this event marked the cycle top for BTC at $19,785 (or roughly $20,000).

September 23, 2019 - Bakkt platform goes live. This event was considered a gateway for institutional investors. The Bakkt platform launched its digital asset marketplace offering physically settled Bitcoin futures contracts and warehousing. The launch of Bakkt was dubbed a turning point that would attract institutions into crypto, but Bitcoin price crashed 20% in under two days after the launch and continued its descent for nearly three months.

April 14, 2021 - Coinbase's direct listing on the Nasdaq Global Select Market, dubbed the Coinbase IPO, was a highly anticipated event. The market was euphoric with the massive success of NFTs, but the high retail interest coupled with the Coinbase IPO marked the bull market rally top at $64,898.

January 11, 2024 - Bitcoin spot ETF approval on January 10 pushed BTC up by roughly 5%, but the pioneer crypto crashed by 15% in the ETFs’ first trading day on January 11.

Is this a sell-the-news event? Let’s explore further.

To understand if the ETF launch is a sell-the-news event, investors need to know where the selling pressure is coming from. As outlined in a previous article, ETF trading has not attracted new capital as of yet, or at least not enough to overcome the selling pressure.

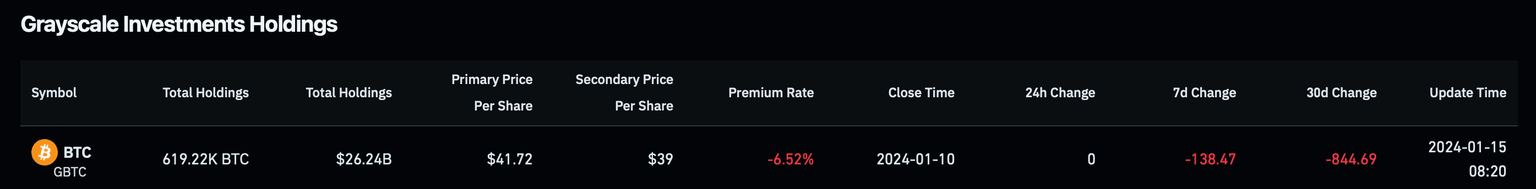

According to CoinGlass data, Grayscale Investment has seen redemption worth nearly $36 billion in the last month. In just the last week, nearly 138.47 BTC worth $5.88 billion of BTC has been redeemed.

Grayscale’s GBTC Holdings

Investors holding GBTC shares can redeem them by returning those shares to Grayscale in exchange for the underlying Bitcoin. While it might look like it, not all of the redeems amount to selling. Some of these investors could be switching to ETFs due to Grayscale’s high management fees of 1.5%.

Due to Grayscale’s large lock-up period and high fees, the first few days of trading were essentially rebalancing flows, which could have flipped ETF approval euphoria on its belly. But as the smoke clears, retail investors are likely to find that this was a buy-the-dip or rumor event.

Concluding thoughts

Now that the context of the recent crash is clear let’s explore some of the most talked about scenarios that investors are expecting.

BTC/USDT 1-day chart

Bitcoin price will crash to $12,000: This outlook is held by very few investors, who are expecting a sweep of the sell-side liquidity resting below $24,000 and $15,000. The chances of this happening now are highly unlikely without a major black swan event.

Bitcoin price will crash to $35,000: A sizeable group of market participants are expecting this logical outlook. This crash is not unheard of when looking at the previous bull rally corrections.

Bitcoin price will continue bull rally to new all-time highs: Unlike the first and the second scenarios, many investors believe this short-term correction could end soon and catalyze BTC to continue its bull rally.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.