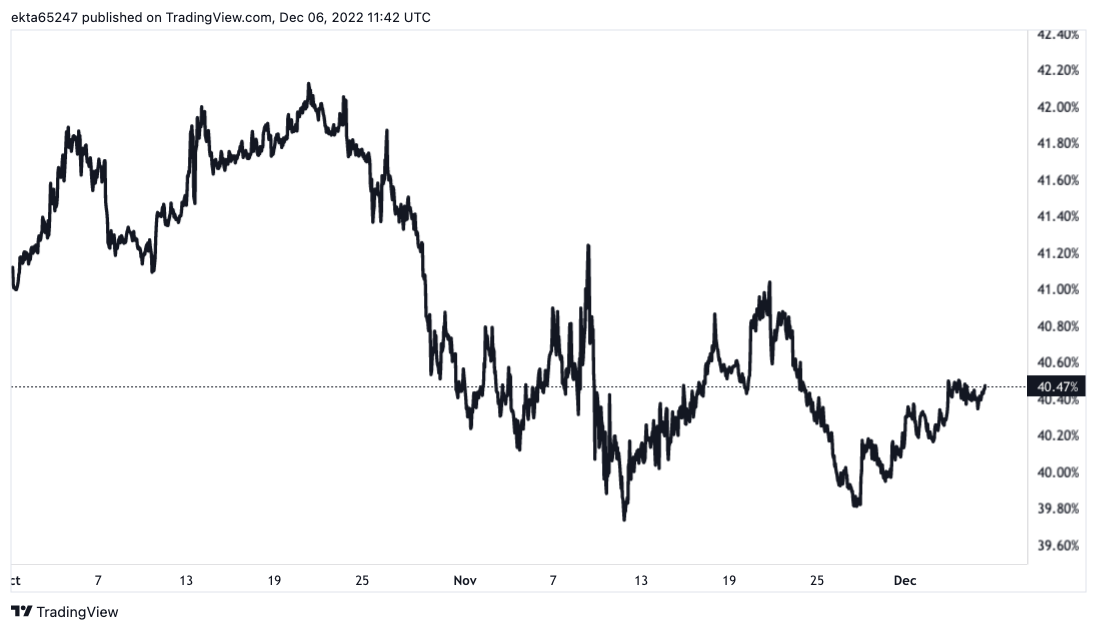

- Bitcoin dominance rate is steady at 40% in contrast to its record of sharp rises during times of stress in markets.

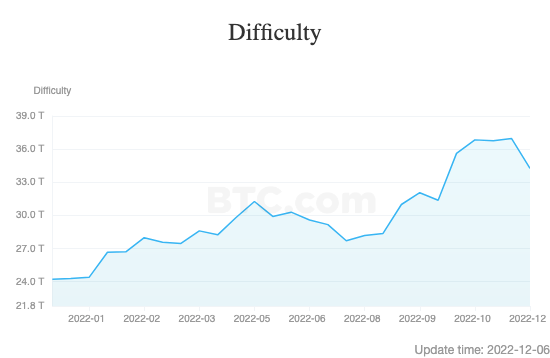

- On December 5, Bitcoin’s mining difficulty adjustment dropped 7.32% lower, making it the largest difficulty reduction in 2022.

- Bitcoin price yielded nearly 5% gains over the last week as traders pulled BTC off exchanges.

Bitcoin (BTC) dominance has stagnated lately as investors pull capital out of the crypto market. In previous cycles, Bitcoin’s dominance increased sharply during times of stress. However, several developments in November 2022 resulted in an exodus of investors from the market. Interestingly, the largest asset by market capitalization witnessed its highest mining difficulty reduction, 7.32%, on December 5.

Also read: Goldman Sachs to increase crypto stake at deep discount, after FTX exchange collapse

Bitcoin mining difficulty drops 7.32%: here is what it means

Bitcoin, the largest crypto asset by market capitalization and popular as a safe haven for investors during times of geopolitical crisis, witnessed a large difficulty reduction. On December 5, at block height 766,080, Bitcoin’s mining difficulty adjustment dropped 7.32%. This marks the largest mining difficulty reduction in 2022.

The current difficulty is approximately 34.24 trillion. It will remain at this point for the next two weeks or 2,016 blocks. Miners are powering off machines to survive the bear market as it eats into the profitability of mining Bitcoin.

Bitcoin mining difficulty

The recent adjustment is the biggest downward shift in mining difficulty since July 2021 when several miners went offline and migrated from China to the West. Prior to its mining ban, China was the world’s largest Bitcoin mining hub.

Bitcoin’s mining difficulty self-adjusts according to the hashrate, or computing power that is online, in order to keep the time it takes to mine a BTC block roughly stable. When there are a large number of miners online, difficulty climbs and vice versa.

In the second half of 2022, Bitcoin miners have witnessed a decline in their revenue with BTC’s price collapse. Electricity prices have increased, adding to the cost of mining Bitcoin, and thus profitability has been greatly reduced.

Major producers like Core Scientific (CORZ) and Argo Blockchain (ARBK) have been hit by liquidity crunches, while Compute North filed for Chapter 11 bankruptcy. According to Luxor’s hashprice indicator, the profitability of mining has dropped by about 20% in the past month.

Bitcoin dominance stagnates at 40%, many investors quit crypto

FTX exchange’s collapse and subsequent bankruptcy induced a bloodbath in crypto in November. Samuel Bankman-Fried’s Alameda Research, a trading firm, and 190 related entities along with FTX exchange filed for Chapter 11 bankruptcy.

The exchange owes $3.1 billion to its creditors and currently remains insolvent. As the contagion spread to crypto lenders, other exchanges and crypto trading firms, many hedge funds are either on the verge of bankruptcy or already filed in November.

The FTX exchange collapse is similar to a bank run in crypto, inducing fear among market participants and driving several investors out of the cryptocurrency ecosystem entirely. During black swan events and times of geopolitical crisis, investors would turn to Bitcoin as a safe haven, and this resulted in an increase in BTC dominance.

However, this cycle the trend has changed, and Bitcoin dominance remained stagnant at 40%. In the past month, nearly $1.8 billion worth of Bitcoin left exchanges. Investors are turning to self-custody and pulling BTC off exchanges, while several others have turned their holdings to cash and exited their positions while incurring heavy losses.

Bitcoin dominance

Wes Hansen, director of trading and operations at crypto fund Arca, told Coindesk,

BTC has not outperformed the downside in recent months, so investors no longer view it as a safe haven. More broadly, the events of November 2022 have shaken the confidence of a lot of investors in this space. In prior cycles, investors would move into BTC to protect the downside when the market fell off. But because of the size of this year's scandals and their far-reaching impacts, a lot of investors aren't moving to BTC because they're just leaving the space entirely.

Bitcoin price prepares for upcoming reversal

Bitcoin price yielded 20.3% losses for holders over the past month. An evaluation of the BTC price chart indicates that the asset cannot stay oversold for long. A reversal in Bitcoin price trend is around the corner.

As seen in the Bitcoin price chart below, there have been trend reversals in 2016 and 2019. A similar pattern has emerged in the last few months of 2022.

BTC/USD price index

Gert van Lagen, a crypto analyst, is bullish on Bitcoin. The expert believes a breakout past $18,100 would validate the Wyckoff accumulation thesis. Wyckoff’s theory outlines key elements in price trend development that are marked by periods of accumulation and distribution. The technical analyst predicts an extended rally in Bitcoin.

$BTC [4h] update on #Wcykoff accumulation.

— Gert van Lagen (@GertvanLagen) December 5, 2022

Currently printing a higher low at the lower resistance line (AR), i.e. resistance being flipped to support.

Ultimate validation of scheme: break above 18.1k

Invalidation: break below support. https://t.co/raSRluCG1q pic.twitter.com/SLa4tGhDi7

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum ETFs recorded net inflows of $104.1 million on Friday — their highest daily inflow since February 4, per SoSoValue data. As a result, the products saw a weekly net inflow of $157.1 million, which also marks their highest net buying activity since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation filed a registration statement with the Securities & Exchange Commission on Friday, signaling its intent to offer and sell a wide range of securities.

Bitwise hints at NEAR ETF following Delaware registration

The filing marks a crucial step before a firm submits an application for an ETF with the SEC. While Bitwise has not yet applied for a NEAR ETF with the SEC, similar actions preceded its previous XRP and Aptos ETF filings.

Bitcoin price could reach $285K by 2030 as Citigroup forecasts $1.6 trillion stablecoin inflows

Bitcoin price outlook strengthens as Citigroup projects $1.6 trillion stablecoin growth, calling them critical bridges between banks and blockchain.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.