Bitcoin dives below $60K as crypto market liquidations charge above $300 million

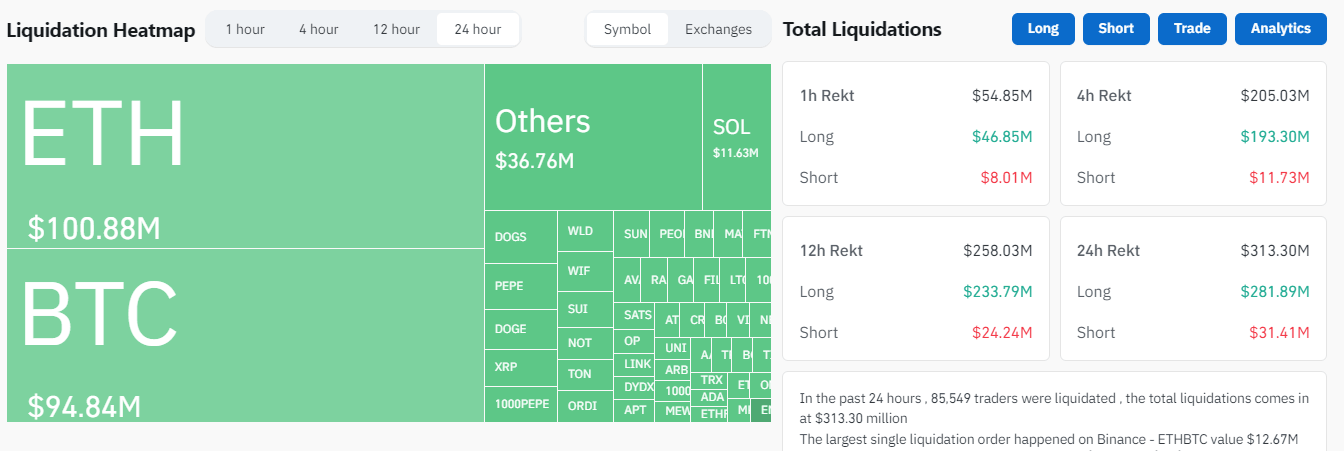

- Crypto assets have sustained more than $313 million in liquidations on Tuesday.

- Ethereum liquidations ranked highest after crossing $100 million.

- Bitcoin's open interest dropped by $2.4 billion following the price correction.

The crypto market experienced over $313 million in liquidations on Tuesday after Bitcoin plunged below $60K, per Coinglass data. Long traders have sustained 90% of the total liquidations worth $282 million, a magnitude above $31.36 million in short liquidations.

Bitcoin and Ethereum lead crypto liquidations

Ethereum led the liquidations rank, with over $100 million, of which $93.52 million were liquidated long positions. Ethereum has plunged by nearly 9% in the past 24 hours.

Crypto market liquidations

Bitcoin follows closely with over $94 million in liquidations, with long and short liquidations accounting for $85.97 million and $8.87 million, respectively. Notably, Bitcoin's open interest (OI) has dropped by more than $2.4 billion in the past few hours.

Open interest is the total number of unsettled open long and short positions in the market. A drop in open interest signifies increased liquidations or caution from traders, often due to declining prices.

The correction follows a spike in Bitcoin's funding rate on August 25, which reached its highest level on the DyDx exchange since BTC's all-time high in March, according to Santiment data.

Funding rates are periodic payments exchanged between buyers and sellers of crypto perpetual contracts based on the difference between the futures contracts and its index price.

Bitcoin DyDx Funding rates

Several traders increasingly opened long Bitcoin and Ethereum positions after the Federal Reserve (Fed) Chair Jerome Powell's keynote indicated a potential interest rate cut in September. However, the recent liquidation shows the market moved in the opposite direction.

"When funding rates get extreme in either direction, they are always prone to get liquidated and shoot markets in the opposite direction," noted Santiment analysts.

Solana was also heavily hit, down more than 7% on the day. In the past 24 hours, SOL has seen over $11 million in liquidations, with long and short liquidations accounting for $10.17 million and $1.01 million, respectively.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi