United States-based Bitcoin (BTC $29,369) ATM operator Bitcoin Depot said it posted its best-ever revenue numbers in the second quarter of 2023 as the company looks to expand its footprint after its recent listing on the Nasdaq.

Bitcoin Depot released its Q2 results along with several cryptocurrency ecosystem firms, recording $197.5 million in quarterly revenue. The company noted that this is a record figure and an 18% increase from its revenue for the same period in 2022.

The company also reported that its net loss of $6.1 million was down by 249% year-over-year. Its Q2 profit stood at $25.9 million, while its gross profit margin was 13%, up from 8% during the same period in 2022.

Bitcoin Depot founder and CEO Brandon Mintz said the company would be looking to continue growing through 2023 following its public listing on the Nasdaq. The listing occurred on July 3 following the closing of a business merger with GSR II Meteora Acquisition Corp.

Bitcoin Depot has also announced a number of partnerships with convenience stores across the U.S. as it aims to increase the number of Bitcoin access points across the country. The company also carried out a software conversion of its ATMs in February 2023 to BitAccess. The conversion reportedly cut out previous annual licensing fees, which were incurring extra costs.

Bitcoin Depot is also building out its BDCheckout service, as well as other software and operational services, which has allowed the company to tap into revenue streams from kiosk management software.

The company is forecasting total revenue of up to $730 million in 2023, which it says is a 13% improvement on its 2022 total of $647 million.

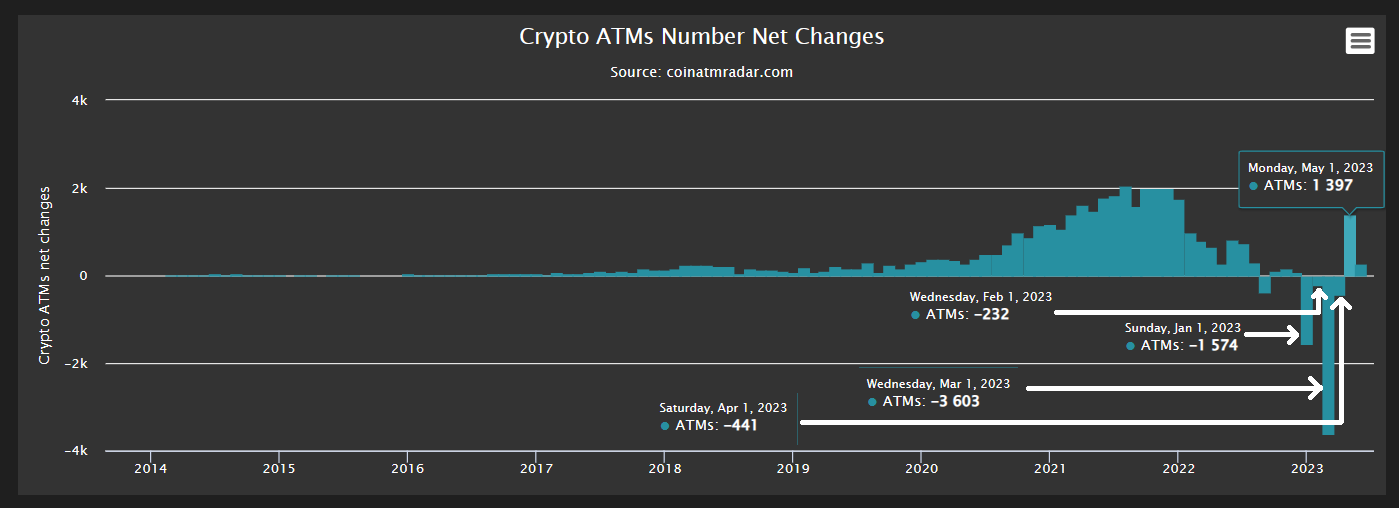

Data reflecting the net number of crypto ATMs globally. Source: Coin ATM Radar.

As Cointelegraph previously reported, the Bitcoin ATM market experienced a downturn regarding the number of operational machines across the U.S. in the first half of 2023. This trend took a positive turn in May 2023, with over 1,000 BTC ATM installations reportedly taking place, according to data from Coin ATM Radar.

Bitcoin ATM growth began a downward turn in late 2022, with the BTC ATM ecosystem recording negative growth in global net installations for the first time ever.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

XRP eyes $0.6640 as Ripple CEO tips Trump to fire Gensler on first day in office

Ripple's XRP is up over 5% on Wednesday and could extend its rally to $0.6640 as the Securities & Exchange Commission may not file its appeal brief against the company due to Donald Trump's presidential election victory.

What's next for Bitcoin and Crypto industry following Trump's victory in US Presidential election

The 2024 US presidential election ended with pro-crypto advocates leading the House of Representatives, the Senate, and Donald Trump as the president-elect. The results stirred massive celebration across the crypto industry, with Bitcoin and the crypto market rallying following Trump's win.

Crypto Today: All Bitcoin holders in profit, TRON partners with Chainlink, DOGE miners in $145M buying spree

Bitcoin price reached a new all-time high of $75,120 on November 6 as markets reacted to Donald Trump’s victory in the 2024 US presidential election. The global cryptocurrency sector valuation grew by $190 billion within the daily time frame as bullish momentum spilled over into the altcoin market.

Coinbase’s Paul Grewal urges SEC to embrace change on crypto after Trump's victory

Paul Grewal, Coinbase's Chief Legal Officer, has asked the US Securities & Exchange Commission to reconsider how it regulates cryptocurrencies now that Donald Trump has been elected to a second term as president.

Bitcoin: New all-time high at $78,900 looks feasible

Bitcoin price declines over 2% this week, but the bounce from a key technical level on the weekly chart signals chances of hitting a new all-time high in the short term. US spot Bitcoin ETFs posted $596 million in inflows until Thursday despite the increased profit-taking activity.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.