Bitcoin, Cryptocurrency Prices Down while Accumulation Continues

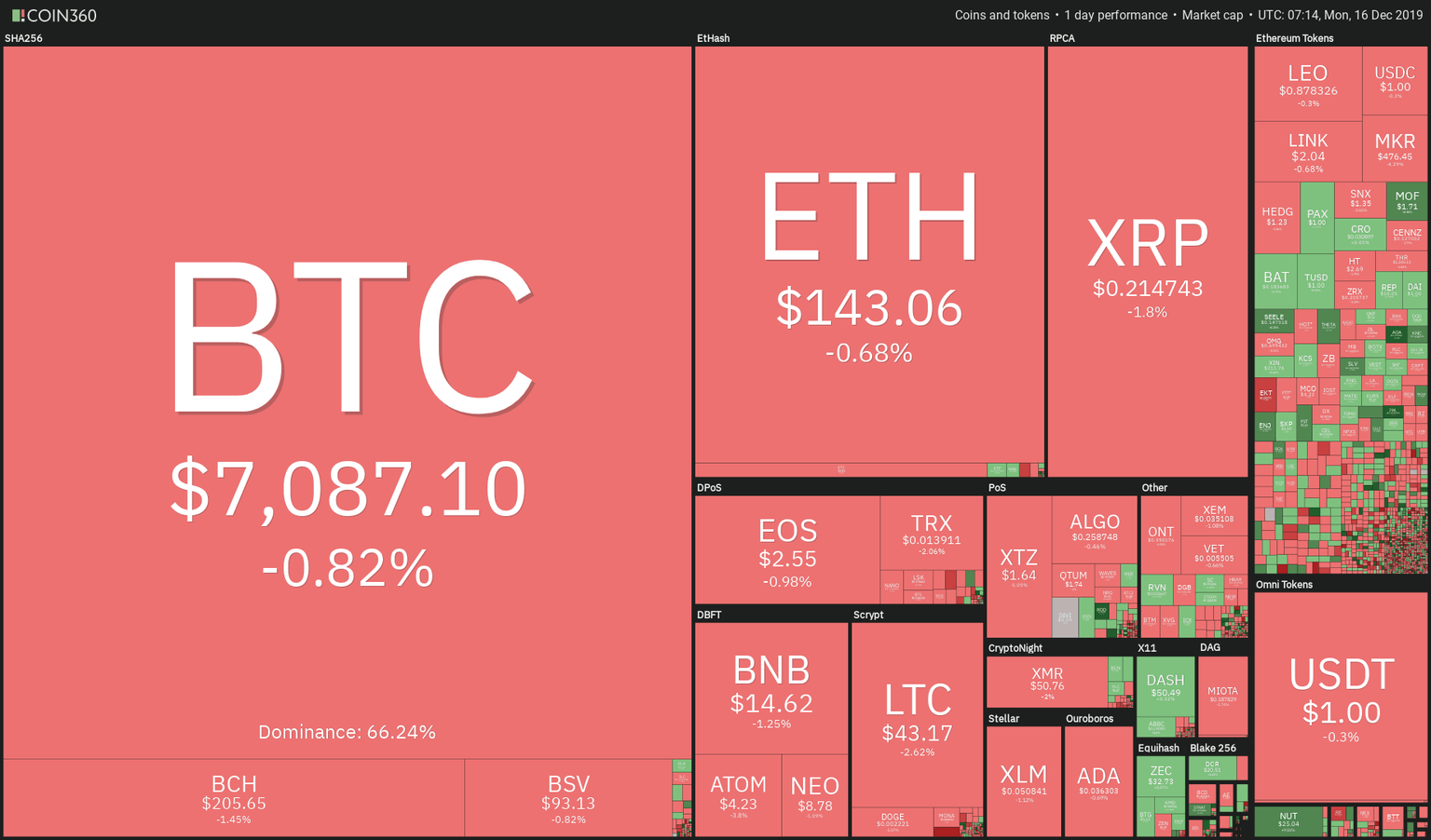

Yet another poor weekend for Bitcoin and cryptocurrencies, that continued the descent initiated last Monday. There wasn't really a steep descent, but Sunday and early Monday's action wiped out the bullish impulse made on Saturday. Litecoin (-2.42%) and ATOM (-3%) are the most harmed in the last 24hours, whereas Bitcoin (-0.8%) and Ethereum (-0.7%) are recovering slightly from early losses. In the Ethereum token sector, there were several good moves, among which were MOF(+10.1%), ENJ (+11.6%), THETA (+11%) and, especially Aurora ( +33.6%), and JEWEL (+156%).

The market Capitalization descended to $193.7 billion, on a $20.85 billion of volume traded during the last 24H, and the dominance of Bitcoin dropped to 66.25%.

Hot News

Yan, Zuoxing, Founder of bitcoin-miner microBT, was arrested under a $15,000 fraud charge. The Shenzen district prosecutor announced last Thursday on his website that he ordered the arrest of the microBT CEO, a company that manufactured about 40% of the mining equipment worldwide for the alleged misappropriation of 100,000 yuan (about $15,000).

Chinese courts are using Blockchain technology to speed up the decisions of millions of legal cases. On Dec 5, Xinhua, the official news agency, reported that over 3.1 million litigation cases were settled using blockchain and AI-powered internet courts.

The legal team, representing the customers hit by QuadricaCX's bankruptcy, demand Candian authorities the exhumation of the body of the founder. Gerald Cotten supposedly passed away in 2018 in India from health problems. After his death, QuadricaCX's directors claimed they could not access the digital cold storage, as they said only Cotten had access to these wallets holding $137 million in cryptocurrencies. The lawyers representing QuadricaCX customers wand to confirm Cotten's death, alleging Cotten's death is a hoax to run off with the funds.

Technical Analysis

Bitcoin

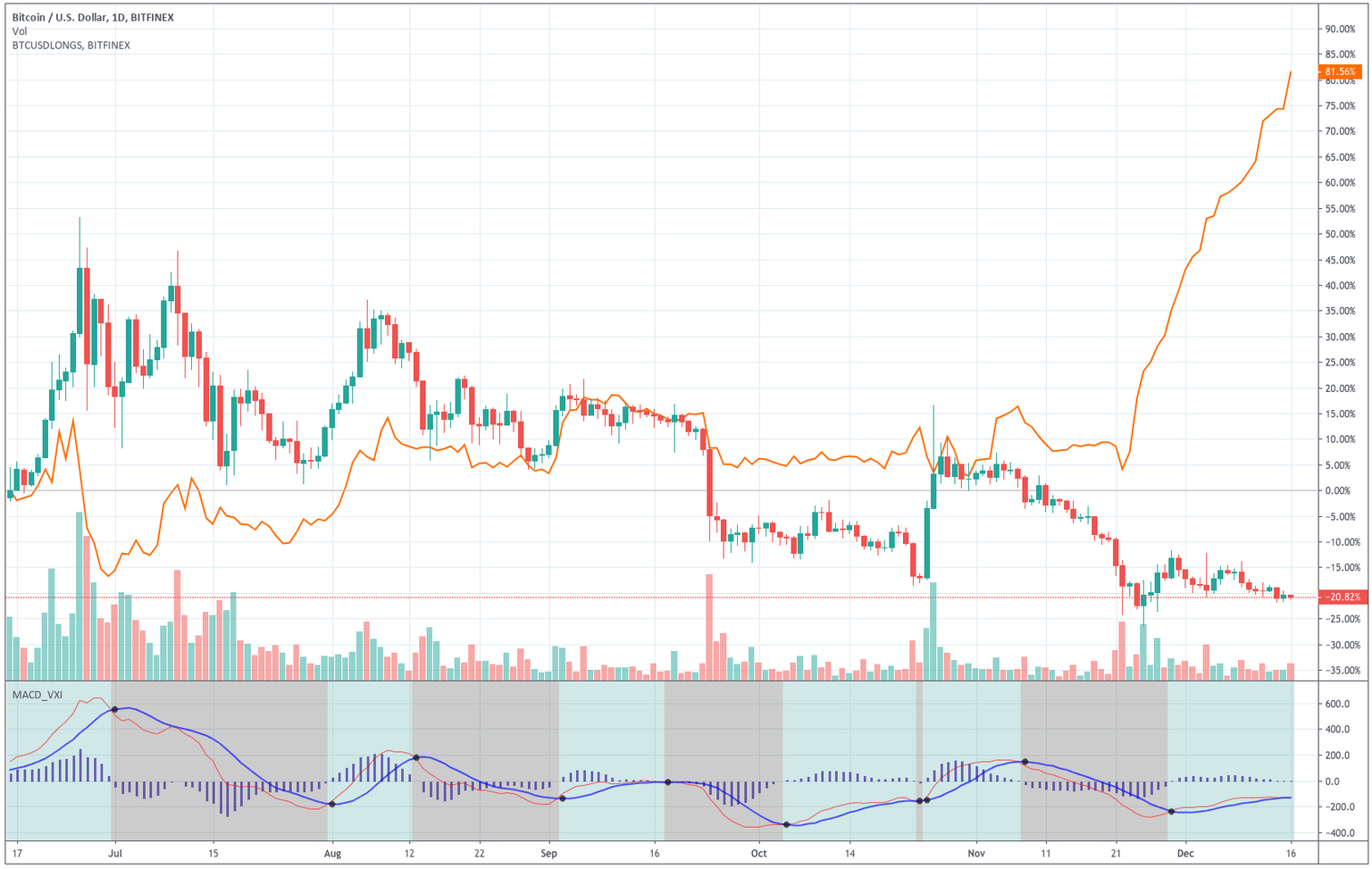

Bitcoin seems to move in a descending channel, although the last leg down did not manage to cut through the $7,000 support level. Still, the price moves under the -1SD line guidance, and the MACD is in the negative territory.

The asset continues moving weak even though the long positions has kept moving up all this time. The last jump up in the long positions added 4% longs to it. This divergence between price and long positions started to occur very recently. Before that, there was a good positive correlation between the price and long positions.

This fact makes us believe a break of the Bitcoin's descending channel to the upside and a new bullish cycle may happen soon.

Ripple

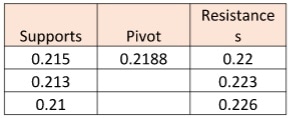

Ripple has completed its path to our target level and now moves just above the 0.214 support level. XRP's price moves still below the -1SD Bollinger line, and its MACD is bearish. Therefore, we think the price, although touching supports, it may need to test its $0.21 level. The other scenario is of a horizontal channel between 0.214 and 0.23. That would depend on a sentiment shift in the sector. For the moment, the bias is bearish.

Ethereum

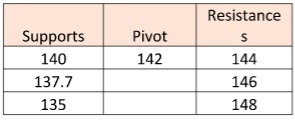

Ether moved down to test the $140 again. The support held, and now the price is bouncing off of it, although still moving below its -1SD line. The action of the price is making a triangular structure at the moment. Thus, we have to wait for the resolution of it. The most probable path is still down. The level to break would be $140. Buyers would love to see a break above $144, a not so easy to accomplish fact given the lack of buyers.

Litecoin

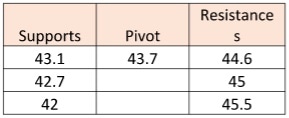

Litecoin is also touching its $43.2 support, and its price is below its -1SD line, which, as we already know, is bearish. The next step is the test of the $42.7 lows made on Nov 25 and potentially move to $41.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and