Bitcoin, cryptocurrencies trying to create a bottom

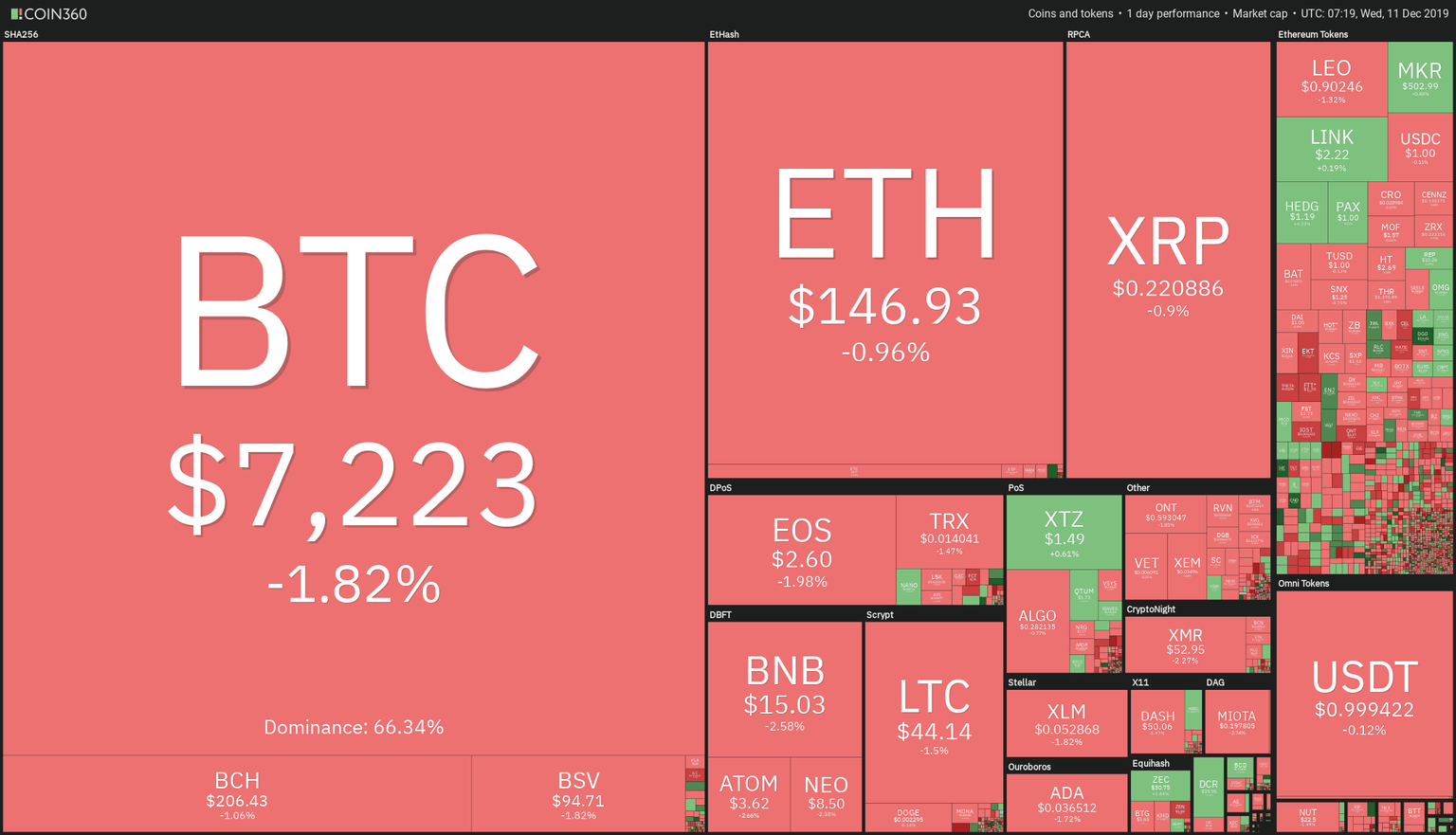

In the last 24 Hours, the selling pressure dove Bitcoin (-1.73%) to its former bottoming area. The cryptocurrency sector continues mostly in the red, although with modest drops in the vicinity of 1 percent. Also, Ethereum (-0.95%), Ripple (-0.79%), Litecoin (-1.52%), and others are creating bottoming figures. The Ethereum token sector, although with lots of red-tinted tokens, there are large movers as well, such as S4F (+29.8%), CND (+19.3%) and DGD (+15.26%).

Fig 1 -24H Crypto Sector Heat Map

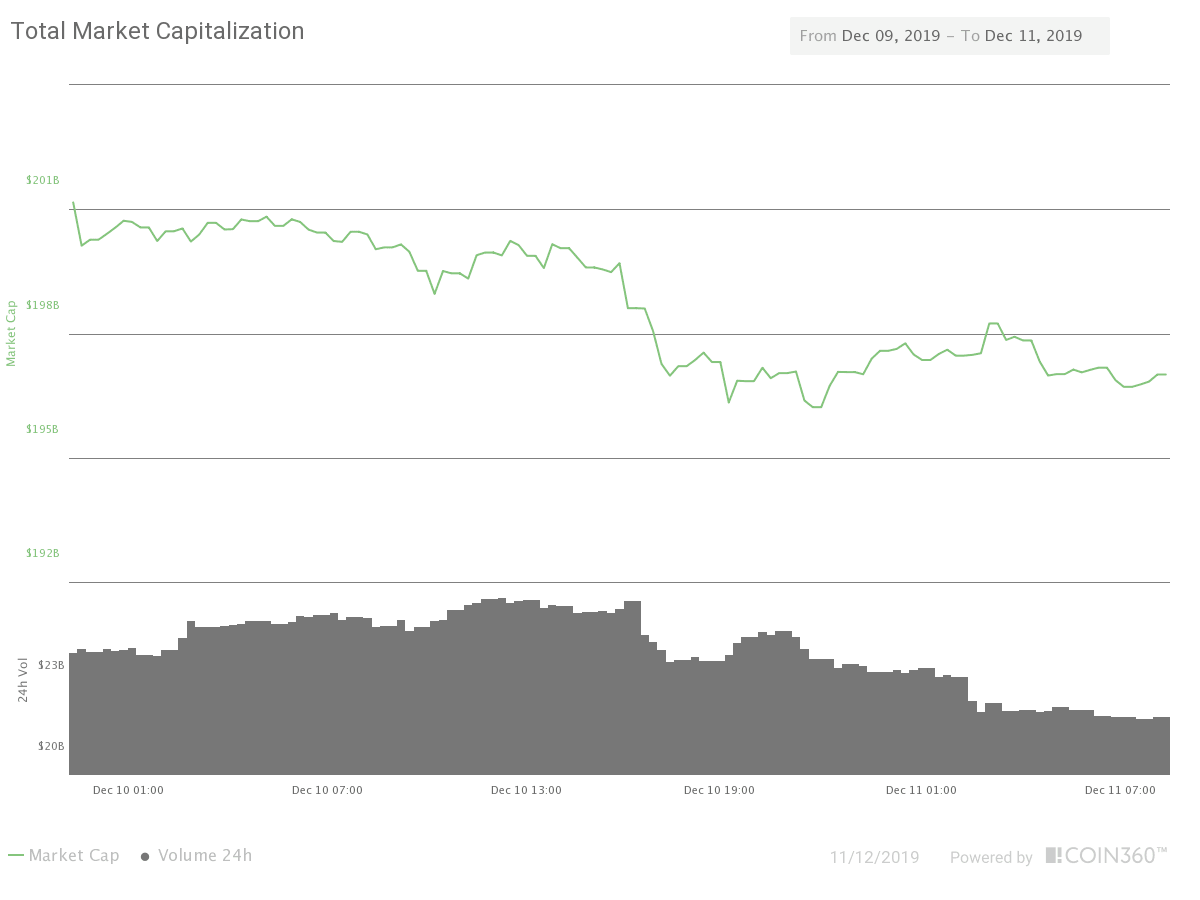

The market capitalization of the sector dropped to $197,01 billion (-1.85%) on a traded volume of $22.134 billion (-8.33%) in the last 24 hours. The dominance of the Bitcoin descended slightly to $66.37%.

Fig 2 - 24H Crypto Market Cap with Traded Volume

Hot News

SEC President Jay Clayton testified before the Senate Committee on several issues, among which were blockchain technology and cryptocurrencies.

"I am optimistic that developments in distributed ledger technology can help facilitate capital formation, providing promising investment opportunities for both institutional and Main Street investors" -Jay Clayton.

Clayton also mentioned that the Commission had amended the existing rules to update the regulations on ETFs. He said that this action will ease "greater competition and innovation in the ETF marketplace" and would facilitate to comply with the standard conditions to come to market quicker.

Over 80 banks will become part of JPMorgan's blockchain-based Interbank Information Network, according to a recent piece of news. The IIN has been created to share financial information among its members. Another use IIN has is to make possible instant remittance transfers.

Ripple's Spring launched a platform for XRP payments integration. The Xpring.io service is a revamped version of the Xpring SDK launched in October. The new version supports two new programming languages: Python and Go.

“That will be the central hub for developers to manage everything they need when it comes to integrating payments into their apps,” - Ethan Beard, Xpring's senior vice president.

Technical Analysis

Bitcoin

Chart 1 - Bitcoin 4H Chart

In the last 24 hours, Bitcoin is creating a series of small-bodied candles on top of a support area with $7.160 as its key level. The MACD seems to start curving to the upside, while the price still moves below its -1SD line, and also below its 50 and 200 SMA. The price still has a bearish bias, but we need to see if this support holds and attract new buyers to push the price upwards.

Chart 2 Bitcoin-longs weekly Chart

On the BTC-longs chart, we can see that the BTC long-interest is at its yearly peak, even near its historical maximum, at the same time BTC price stalls. This is an evident accumulation of the coins released by the weak hands.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

7,160 |

7,260 |

7,340 |

|

7,000 |

7,416 | |

|

6,880 |

7,580 |

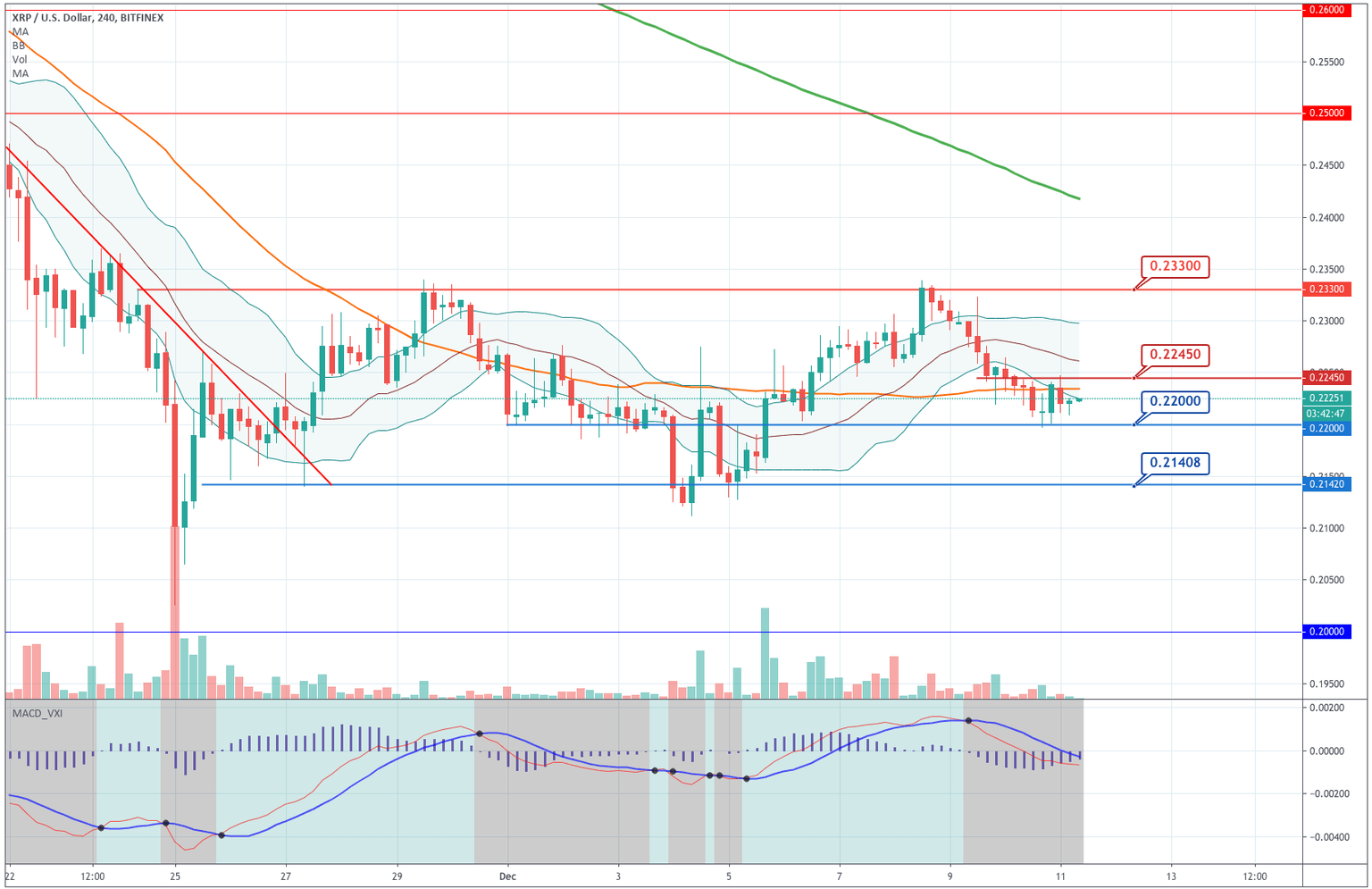

Ripple

Chart 3 - Ripple 4H Chart

Ripple's 0.22 support has held the price and created a Moring Star Formation that currently is partially faded. MACD histogram is moving towards the zero-line and curving up, while XRP's price moves sideways and close to its -1SD line. Although the bias is slightly negative, we see the potential for a reversal. The levels to keep are 0.22 and 0.2245.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

0.2200 |

0.2245 |

0.2260 |

|

0.2160 |

0.2300 | |

|

0.2140 |

0.2330 |

Ethereum

Chart 4 - Ethereum 4H Chart

Ethereum $144 support held yesterday's drops and made a reversal figure, although the followup is not great. The price is still moving below its -1SD line, and the MACD shows the downside momentum is fading. We should keep an eye in the $144 and $147.2 levels, and also in the volume.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

144.00 |

145.70 |

147.20 |

|

140.00 |

149.00 | |

|

138.40 |

152.00 |

Litecoin

Chart 5 - Litecoin 4H Chart

Litecoin bounced off of its $44 support and is making a mild correction that started yesterday when it made a Morning Star formation. The MACD is close to making a bullish crossover; at the same time, the price moves towards its Bollinger mean line. The bias is still negative, although it can turn bullish if the price closes above $44.8 on good volume.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

44.00 |

44.30 |

44.80 |

|

43.40 |

45.40 | |

|

42.00 |

46.00 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and